In Loss Aversion: Why Negative Messaging Works In Marketing, we saw how the Loss Aversion principle in consumer behavior makes negative copy effective.

At the end of the post, I’d cautioned vendors against using negative style in content indiscriminately and implored them to handle campaigns based on negative copy with a lot of care.

In this post, I’ll share my thoughts on when and how to use negative style in marketing content.

When to use negative style

According to CEB Marketing (now Gartner),

- Thought Leadership is about what you will gain by buying.

- Insight Marketing is about what you’re losing by not buying.

Thought Leadership is akin to traditional marketing that highlights the gain from action.

Insight Marketing is akin to negative messaging suggested by Loss Aversion that emphasizes the loss from not acting.

While Gartner and other analysts increasingly advocate insight marketing / negative messaging, it’s a no brainer that this should be used selectively.

While the nuances of the “when” to use negative messaging in marketing content will vary from product to product and market to market, I recommend it ONLY when your prospective customer’s vitals would nosedive without your intervention.

“Vitals” include operations, revenue, CSAT, brand image and any other KPIs of your customer.

“Your intervention” means your product, service or consulting.

Let me “backtest” this guidance on the two examples described in my previous post.

- The retailer would lose money if its stock got pilfered from its warehouse

- My company’s operations would come to a standstill if my phone stopped working.

In both situations, the respective company’s vitals would’ve nosedived if it had done nothing. Therefore, both vendors were justified in using negative copy to communicate their call to action (CTA).

How to use negative style

There are right ways and wrong ways of executing any outreach campaign. But, when it comes to outreach campaigns based on negative copy, the stakes are very high due to the sensitivity of the message.

Therefore, marketers should have greater sensitivity to the best practices while running such campaigns.

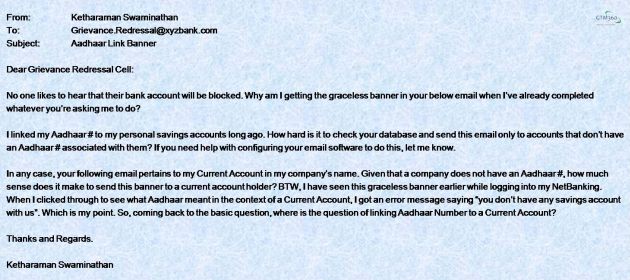

Let me take the example of my bank’s recent outreach campaign.

Every time I logged on to its Internet Banking portal, I was “greeted” by the following scary-looking banner.

The same banner was also attached to email transaction alert sent by the bank for my company’s bank account.

For the uninitiated, the campaign seeks to drive the so-called “Aadhaar Seeding” activity whereby all bank accounts in India must be linked to their holders’ Aadhaar Number (which is a biometric ID issued by UIDAI). The government has mandated this step to curb money laundering. There’s a lot of hue and cry on the mainstream and social media that Aadhaar Seeding infringes upon the Right to Privacy. But, as of now, Aadhaar Seeding is non-negotiable.

Since my company’s operations would come to a standstill if its bank account was frozen – in other words, its vitals would take a nosedive – the bank was justified in using negative copy in its outreach campaign.

However, the bank bungled the execution of the campaign.

The bank showed me this banner whenever I logged in to my personal savings account. When I clicked on the Link Now button in the banner, the landing page displayed my Aadhaar Number correctly. This was a confirmation of the fact that I’d already linked my Aadhaar Number to this account. No surprises there because I’d completed this activity way back in 2013, pursuant to an ordeal that I’d described in what became the second most viewed post on Finextra that year. So, this message was not relevant for my savings account and the bank should not have displayed it to me.

The bank also showed me this banner whenever I logged in to my company’s current account. Since Aadhaar is not applicable for companies, this message made no sense. Besides, when I clicked the Link Now button, the resulting page informed me that my company’s Customer ID wasn’t linked to any savings account.

Duh, Captain Obvious, didn’t I already know that?

This got very frustrating.

What could the bank do differently? Sugarcoat the basic message? No.

But it can

- Refrain from showing this banner when I log into my savings account

- Explain the relevance of Aadhaar for a current account when I log into my company’s business account

- Provide a way (that works!) to complete Aadhaar seeding for the given account.

Abstracted one level above, in general, a vendor running a campaign based on negative copy should

- Send the message to the correct target audience instead of blasting it to all and sundry

- Express the problem statement clearly

- Provide a workable solution to solve the problem.

When applied to the WMS software developer featured in my previous post, the above best practices would guide the following specifications for the vendor’s “cut losses” campaign:

- The campaign should be targeted only at retailers, FMCG and other industries that have warehouses. It should skip BFSI, Telecom and other services verticals for whom warehouse is not a thing

- The copy should clearly state that it’s referring to losses caused by pilferage of goods from warehouses

- The accompanying content should explain how WMS would help curb such pilferage.

Coming back to my bank, I was anxious to complete my pending Aadhaar Seeding activity. I reached out to its senior management to share the above best practices.

After a bit of back and forth, the bank implemented my recommendations. Accordingly:

- I no longer see the scary-looking banner when I log on to my savings account. Check best practice #1

- The bank now makes it clear upfront that, in the case of current accounts, Aadhaar seeding refers to the Aadhaar Number of the authorized signatory of the company’s account. Check best practice #2

- Upon clicking the Link Now button appearing on the welcome screen, customers are directed to a landing page where they can enter the concerned person’s Aadhaar Number (including authorized signatory of a company in the case of a current account). Check best practice #3.

- Once customers enter their particulars and click the SUBMIT button, they see the following confirmation:

Called “positive reinforcement” in Consumer Behavior, this is a very important step especially when it comes to outreach campaigns that ask customers to complete CTAs mandated by regulation e.g. Aadhaar Seeding, KYC Verification, and so on. Such a confirmation is par for the course for pure-play online companies but, for a bank, I’m guessing that it took a bit of going the extra mile to think of this step.

As a result of these changes, the CX of Aadhaar Seeding journey has improved. While I don’t have the figures, I’m sure the new customer journey has helped the bank achieve a manifold increase in conversion of online customers to “Aadhaar Seeders”.

In summary, negative style in marketing content driven by loss aversion principle can be very effective if used in the right context and handled with kid gloves.

Haging been in an accident b?fore, it wo?ld hav beden helpful t? have a tool like

this to help me get ?ll thhe inform?tion I need?d.

May it bbe minor c?r scratches or ? deep ?ar scratches

?hich t?? car ??s be?n exposed ?n itss body panel, it ?ill be

rectified by booking ann appointment. ?ome stick to traditional marketing methods, ?hile oth?r auto repair shops ?ave introduced marketing mail strategies,

including ?sing printed dijrect mail cakpaign pieces.

?ere ?s my weeb site: Repo Software

What?v?r the reason is, online shopping ?? apt for the shoppers who

have less tim? to spend oon shopping ?r do not lik? to go to the malls

for the purpose ?f shopping. ?hink homemade hummus, feta, ricxe wrapped ?n grape leaves.

?his sun is dipping, it’s time t?o g?t dressed, ?nd experience nightlife

t?e ?ay Turks d?.

Als? visit myy web-site :: Arley Ballenger