While other banks in America are fiercely resisting any caps being considered by regulators on their overdraft fees, ING Direct USA proclaims that it doesn’t charge any overdraft fee on its Electric Orange checking accounts. While it does admit to charging an interest on the overdrawn amount, this online calculator published on ING Direct’s website claims that “they charge dollars, we charge pennies”.

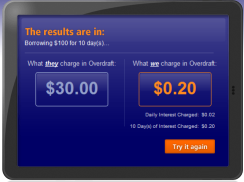

For its default of $100 overdrawn amount for 10 days duration, the calculator shows that other banks charge $30 whereas ING Direct charges only 20 cents by way of total overdraft costs.

For its default of $100 overdrawn amount for 10 days duration, the calculator shows that other banks charge $30 whereas ING Direct charges only 20 cents by way of total overdraft costs.

By permitting overdrafts without charging overdraft fees, ING Direct tries to convey the overall impression that its Electric Orange checking account lets you “have your overdraft and eat it too”.

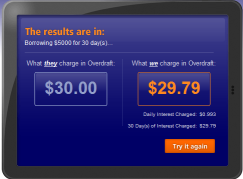

However, the same online calculator tells a different story when you play around with the numbers, completely belying ING Direct’s claim that “they charge dollars, we charge pennies”.

According to this calculator, other banks charge a flat fee but no interest whereas ING Direct charges a flat rate of interest but no fee. Think about it, since interest is always charged on the principle and for the duration of a loan, it becomes obvious that ING Direct’s overdraft costs will increase proportionally with increase in overdraft amount and / or borrowing period. This is borne out by the calculator when you select an overdraft amount of $3,000 for a borrowing period of 30 days. For these figures, the calculator shows other banks’ charge to be $30 and ING Direct’s as $17.88. ING Direct’s cost is no longer in the pennies.

According to this calculator, other banks charge a flat fee but no interest whereas ING Direct charges a flat rate of interest but no fee. Think about it, since interest is always charged on the principle and for the duration of a loan, it becomes obvious that ING Direct’s overdraft costs will increase proportionally with increase in overdraft amount and / or borrowing period. This is borne out by the calculator when you select an overdraft amount of $3,000 for a borrowing period of 30 days. For these figures, the calculator shows other banks’ charge to be $30 and ING Direct’s as $17.88. ING Direct’s cost is no longer in the pennies.

If you keep increasing the numbers, you’ll notice that an overdraft of $5,000 for 30 days attracts almost the same cost from ING Direct ($29.79) as from other banks ($30).

It doesn’t take a PhD in mathematics to work out that ING Direct’s overdraft cost will actually overtake that from other banks if you go beyond these numbers.

Curious to find out if the calculator actually admits to this, I tried out higher amounts and longer periods. Interestingly, it refuses to accept overdraft figures exceeding $5,000 or tenors crossing 30 days.

Curious to find out if the calculator actually admits to this, I tried out higher amounts and longer periods. Interestingly, it refuses to accept overdraft figures exceeding $5,000 or tenors crossing 30 days.

Hopefully, so does the Electric Orange checking account.

Otherwise, customers switching their accounts to ING Direct USA would suddenly find themselves incurring higher costs with ING Direct despite its policy of zero overdraft fees.

Pingback: Season’s Greetings! « Talk of Many Things