The purpose of a Company in Capitalism is to maximize shareholder value aka generate wealth for its shareholders. The two most common ways for a company to MSV are as follows:

- PLBS: Company generates wealth via revenues, profits and dividends distributed to shareholders. The focus is on product, sales, marketing, and customer. Profit is a key metric. Example: Traditional companies like Banks.

- MSV / VC: Company generates wealth via “capital gains” route i.e. by growing valuation over time, which will increase the value of shares held by shareholders. The focus is on valuation and shareholder. Profit is not a key metric. While this model is applicable to virtually all venture capital funded private market companies, it can also be followed by companies listed in public markets. Example: New age companies like Fintech, Non Fungible Token (NFT), Dogecoin.

In both models, shareholders include promoters, investors and the public shareholder. If the company subscribes to the “everyone has a share” principle followed by Milo Minderbinder in Catch-22, shareholders could also include employees, customers and suppliers.

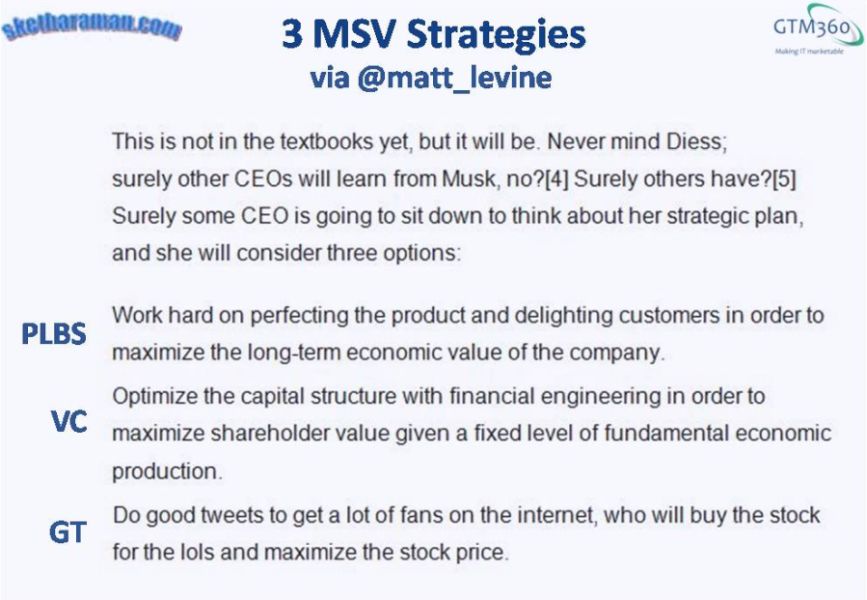

PS: I’d be remiss if I didn’t mention the following rapidly emerging third model proposed by Matt Levine / Money Stuff:

GT: Do good tweets and get a lot of fans on the Internet, who will buy the stock for the LOLs and maximize the share price. Example: Meme companies like Tesla, GameStop, and maybe RPG Enterprises.

—–

“Maximize Shareholder Value”. The paradigm is at least 25-30 years old.

Before MSV, the CEO’s strategic plan revolved around “work hard on perfecting the product and delighting customers in order to maximize the long term economic value of the company”.

After MSV, which emerged in the early 1990s in USA, and 5-10 years later everywhere in the world, the strategic plan of CEO has changed to “optimize the capital structure with financial engineering in order to maximize shareholder value given a fixed level of fundamental economic production”.

Source: Matt Levine.

Today, of course, virtually every CEO – at least the ones of publicly listed companies – has to practise MSV or s/he will risk getting fired by the Board, Activist Investor, Proxy Fight, etc. The role of Customer has drastically diminished. You won’t find too many CEOs saying this in public but, when given the shield of confidentiality by the Gartners of the world, they tend to share the truth.