NOTE: Read on only if you mean Credit Card. If it’s a Debit Card, I don’t know the answer to your question and you should stop reading right now.

Worry not. Your experience is fairly common worldwide.

Credit Card Issuers (HDFC Bank in this case) use Fraud Detection & Prevention software to, well, detect and prevent fraud in credit card transactions. It’s beyond the purview of this answer to go into the details of these systems but suffice to say that, there are serious technology and UX challenges w.r.t. preventing a fraud before it happens.

Interesting case of “false positive” credit card fraud check. tl:dr: LAX means LA but BA LONDON doesn’t have to mean London. #AMEXhttps://www.quora.com/Have-you-ever-accidentally-reported-something-as-credit-card-fraud-because-you-forgot-you-used-it-and-the-name-of-the-company-didnt-match-the-charge-What-do-you-do/answer/Keith-Appleyard-1?ch=2&srid=XAE …

Have you ever accidentally reported something as credit card fraud because you forgot you used it…

Keith Appleyard’s answer: Well you report it, and if you’ve realised your own mistake, either ring them back to cancel the query, or wait for resolution. It happens often. I once had a transaction…

quora.com

I’m not saying that never happens but it needs huge investments. In actual practice, transactions are authorized even if they were suspected to be fraudulent before-the-fact and confirmed to be fraudulent after-the-fact. In your case, the very fact that you came to know about the transaction and raised a dispute means the said transaction was authorized i.e. not prevented before the fact.

Once a transaction is authorized, it must be posted to your account, which means it will appear on your statement that you get typically after a month. So, even after-the-fact fraudulent transactions will appear on the statement. This is a fundamental fact of the credit card industry. Ergo, I said worry not in the beginning.

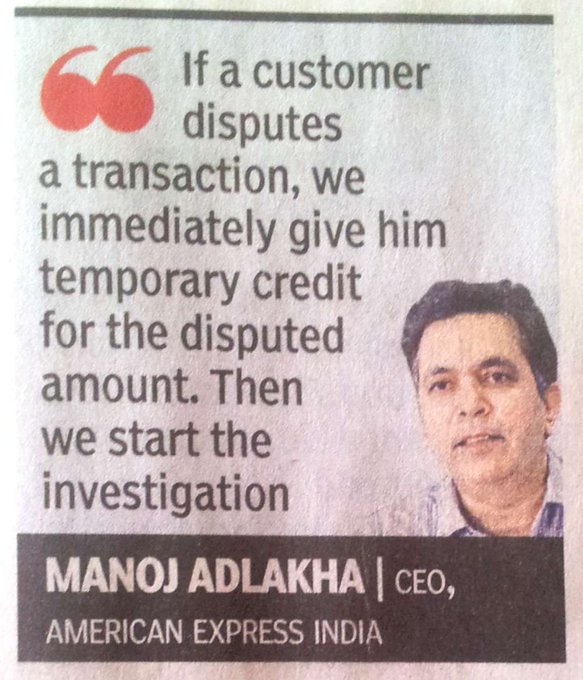

With some banks, once you dispute a transaction, the bank immediately reverses the transaction. The reversal entry will appear along side the original transaction in the same statement.

This is a standard feature of credit cards. Amex is able to tout it as a USP b/c banks have kept it under wraps in India.

With some other banks, once you dispute, only the original transaction will appear on the statement. The Bank may (a) reverse the transaction automatically on the next statement cycle or (b) wait for you to contact it again and repeat your dispute i.e. happily charge the amount if the cardholder does not read the statement and reiterate the dispute.

In many industries, (a) and (b) would be called shady practices or dark patterns but this is how banks operate worldwide, going by my experience of dealing with dozens of banks in half a dozen countries. And, sadly, fintechs have not been able to change the reality.

So, my recommendation is just chill and repeat your dispute to your bank.