This is a random collection of my observations about GST based on discussions with a bunch of small business owners and a couple of Chartered Accountant firms.

The objective of this post is to throw light on how GST works for a company in actual practice. While it’s impossible – even inadvisable – to avoid jargon when discussing any specialized topic, I’ve recast some of the GST lingo into terms that make more sense to a businessman (as against accountant or compliance officer).

In the context of this post,

- “You” and “your company” refer to a GST-registered company that’s based out of India and is engaged in the IT products and services business

- “Normies” is used as a catch-all for founders / directors / owners of IT companies who don’t necessarily come from finance or law background.

- Unless otherwise specified, “sale” and “purchase” are domestic transactions i.e. not exports or imports

- Like in the case of common law, “man” includes woman, “businessman” includes women entrepreneurs, and so on.

I’m neither a CA nor your CA, so please take whatever I say with a pinch of salt. Needless to say, this is not taxation, accounting or legal advice.

With that preamble out of the way, here are my random ramblings about the Goods and Services Tax that came into effect on 1 July 2017 and underwent significant amendments on 6 October 2017.

APPLICABILITY

There’s a general feeling that GST is only applicable for private and public limited companies. That’s not true. All kinds of businesses – proprietorships, partnerships, LLPs, pre-revenue startups, freelancers, etc. – are prima facie required to be registered under GST.

If you were registered under Service Tax, you must get registered under GST even if you otherwise are exempted. The way it works, you need to first carry out the so-called “GST Migration” procedure. Only then can you exit GST (if you’re exempted).

If you carry out exports, you must be registered under GST, regardless of turnover. This statement applies even to freelancers doing business on Upwork and other export-oriented portals.

The technical name for a company registered under GST is “Registered Dealer” and that for a company not registered under GST is “Unregistered Dealer”. Maybe it’s only me but I find the term “dealer” misleading in the context of a typical IT company. Therefore, I’m substituting the two terms by “GST Co” and “Non-GST Co” respectively.

GST INVOICE

Invoices are of two types: Sales Invoice and Purchase Invoice. Sales Invoice is what you issue to your customers against a sale. Purchase Invoice is what you receive from your suppliers against a purchase.

GST mandates a template for invoices and other artefacts like debit and credit notes.

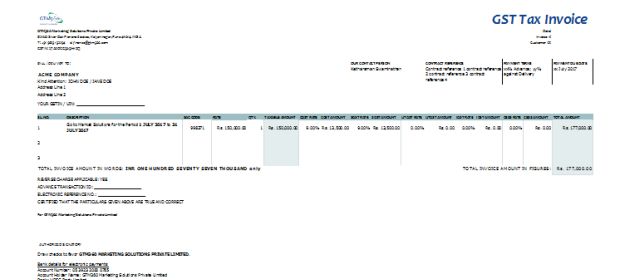

Even one look at a GST-compliant invoice would make it amply clear that it contains a lot more detail – e.g. HSN / SAC, Customer’s GSTIN, Freight – than the former VAT and Service Tax invoices. To fit my company’s GST invoice into one page, I had to reduce the font size from 12 to 10 points and change the page orientation from portrait to landscape.

Like VAT and Service Tax, you add the applicable GST on your Sales Invoice and collect the billed GST from your customer. Fairly straightforward.

Where things get a bit tricky is (a) the stage at which you pay GST to the government, and (b) purchase invoices.

GST IS NOT PRE-REVENUE

Like VAT and Service Tax that came before it, GST is payable to the government upon invoicing, whether or not you’ve collected your money from your customer.

This has caused the feeling that GST is payable pre-revenue.

Tax pre revenue is like taxing my ability to work! What kind of a govt does that ? It's like paying for permission to work ! License raj?

— Vishal Chandra ? (@vishalchandra) September 27, 2017

Some have even insinuated that GST is being charged on estimated revenues.

Were being asked to pay tax on estimated revenue, not on billing.

— Nikhil Pahwa (@nixxin) September 27, 2017

None of these beliefs is true.

Invoice implies Revenue. You can – and very often do – book revenues whether or not you’ve collected your payment (with the invoiced amount being reflected as Accounts Receivables until you receive the payment). Since GST is payable only after invoicing, it’s not pre-revenue.

GST would be pre-collection if you don’t receive your payment from your customer by the time you need to remit the GST to the government. To that extent, GST does pose a strain on your working capital. However, that strain has reduced now: Formerly, you had to remit Service Tax by the 5th of the month following the date of your invoice. Under GST, the deadline has been extended by 15 days to the 20th of the following month.

I think the angst about GST being applicable pre-revenue or on estimated revenue is caused by the failure to distinguish between Booking, Billing and Collection. Although the common man thinks of these three terms interchangeably, they’re three distinct milestones in accounting and taxation.

For the uninitiated, Booking happens when you collect a purchase order from your customer. Billing happens when you fulfill the order (in part or whole) and raise your sales invoice (for the completed portion of the order). You book revenues at this stage. This is also the stage at which GST is payable to the government. Collection happens when you get paid by your customer. If you’re unable to collect on an invoice beyond a certain number of days, you write off the revenue by issuing a credit note. AFAIK, at that point, you can claim refund of the GST you’ve paid before.

GST RETURNS

Under the previous Service Tax regime, you had to file only two returns a year. Under GST, the number of returns has shot up to 13 per year for companies with annual turnover below INR 1.5 crores (@ 3 returns per quarter, 1 annual return) and 37 per year for companies with annual turnover exceeding INR 1.5 crores (@ 3 returns per month and 1 annual return). This poses a massive overhead on filers.

The GST Return calls for a staggering amount of information. You need to enter virtually every line item of every sales invoice and purchase invoice in your GST return. It’s obvious even to a non-techie like me that the GST Portal would require humungous amount of storage and computing capacity. I hope the powers that be took this into consideration when they wrote the rules on GST returns.

Not just in GST. Ability to push thru' change without being totally ready is India's competitive advantage. Seriously. https://t.co/MzTlDyYOXC

— Ketharaman Swaminathan (@s_ketharaman) June 5, 2017

That’s it for now. In a follow-on post, I’ll cover a few more elements of GST.

(Spoiler Alert: The real fun begins in Part 2!)