They said cash is costly. It didn’t work with merchants.

They launched one mobile wallet after the other to drive cashless behavior. It didn’t work with consumers.

They scared people away from currency notes, claiming they contain all kinds of germs, bacteria and viruses. It didn’t work with anyone.

Today:

- 85% of world’s transactions happen in cash. Source: Business Insider

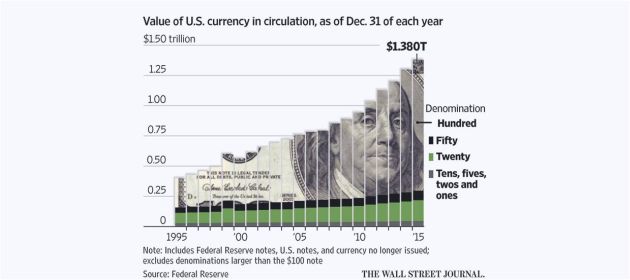

- Currency in circulation is growing in USA, according to the below exhibit in The Wall Street Journal

- There are mile-long queues of people waiting to withdraw cash from ATMs (Source: Finextra). Ironically, mobile payment apps were supposed to eliminate cash but many of them are now facilitating cash withdrawals from ATMs! The slew of such apps launched in the last 2-3 months makes me wonder if “cardless ATM cash withdrawal” will becomes the next fintech killer app à la Mobile Remote Deposit Capture

- For Millennials, cash is still king. Source: Financial Brand, and

- Cash will never die according to PayPal CEO Dan Schulman.

Where did it all go wrong?

I hold the “War on Cash” brigade responsible. They have caused the current state of affairs by

- Being self-serving while promoting cashless payments. As FORTUNE rightly observes in its article about MasterCard, “(CEO) Banga espousing the benefits of going cashless is a little bit like Howard Schultz saying everyone should drink coffee – after all, this is a company that makes money on transaction fees every time someone uses credit instead of cash”

- Refusing to acknowledge that cash is still the only truly realtime retail payment method in the world (Source: DB Research). Cash is also the only form of payment that accomplishes transfer of value between payor and payee without any dependency on bank, hardware, software, network, battery, and other third parties

- Naively linking all cash use with drugs and tax evasion, thereby casting aspersions on the legitimacy of several industries. This puts off etailers, QSRs and many other industries that carry out a lot of genuine cash transactions and pay their taxes like any POS and mobile wallet wielding member of the aforementioned brigade

- Barking up the wrong tree that cash is costly. A bunch of retailers in USA have sued banks over credit card interchange fees, saying it’s their second highest cost after healthcare. On the other hand, I haven’t come across a single merchant who has sued a central bank because cash is too costly.

Governments and regulators have tried to reduce cash by mandating lower interchange fees and EFT gateway charges. However:

- There’s no evidence from countries where interchange has already been capped that merchants have passed on the benefit of lower card processing charges to consumers by way of lower prices. (Where interchange is not regulated, debit interchange is much lower than credit interchange. Still I haven’t come across a single merchant who offers a lower price for consumers paying with debit card as compared to credit card.)

- When regulators repealed the “no-surcharge” rule, merchants have been known to slap extra charges of as much as 7.5% for accepting cards although their card processing costs never exceeded 2.5%

- Lowering interchange fees will disincent banks from increasing the spread of POS terminals, which will in turn restrict card acceptance.

Therefore, short of banning cash, I doubt if regulatory intervention will work.

However, all is not lost.

The financial services industry should stop being inward-looking and start focusing on the needs and concerns of payors and payees, who’re the two most important stakeholders of a payment transaction. By taking the following measures, the industry can drastically bring down the use of cash in many everyday scenarios:

- Relax two factor authentication for online payments below a certain threshold. This will reduce the friction of online payments and eliminate the risk of failed payments, both of which will encourage many people – including me – to go back to using credit cards online

- Popularize the “card on delivery” option to coax ecommerce customers to pay by cards even if they’ve opted for cash on delivery at the time of making the purchase. As of now, very few etailers support this option. Even the ones that do support it use flaky smartphone-based POS terminals on which every other transaction fails. If you’re wondering how finserv comes into the picture in a point related to ecommerce, it’s because merchants have complained that banks are charging exorbitant rates for supplying GPRS POS terminals.

Does @Amazon know that 50% of its Card on Delivery payments fail? High time to replace flaky @ezetap mPOS w/ sturdy @Ingenico?

— Ketharaman Swaminathan (@s_ketharaman) July 9, 2015

- Reduce hidden cost of electronic payments. By eliminating CICO (Cash In Cash Out) costs described in my blog post Cash in Hand Is Worth More Than Card In Bush, merchants like cab drivers will stop throwing temper tantrums when their customers proffer their credit cards for payment

- Provide confirmation of payee name in realtime so that payors no longer face the anxiety that their payments might go to the wrong beneficiary.

IMO @Rabobank 's Beneficiary Name Check feature will drive a manifold increase in electronic fund transfer volumes.https://t.co/PDJok4CDL5

— Ketharaman Swaminathan (@s_ketharaman) October 9, 2017

- Provide enhanced remittance information along with electronic fund transfers so that payees will receive enough information to be able to match their receipts with the true purpose of payments. Payments UK’s “Enhanced Data with Payments” is a great initiative in this direction

Issue proof of receipt for payments made via NEFT, IMPS, FPS and other Account-to-Account Electronic Fund Transfer methods of payments. If you need to understand how this will reduce cash usage, see PSA: Insist On Receipt When You Pay By NEFT & FPS for more details.

Issue proof of receipt for payments made via NEFT, IMPS, FPS and other Account-to-Account Electronic Fund Transfer methods of payments. If you need to understand how this will reduce cash usage, see PSA: Insist On Receipt When You Pay By NEFT & FPS for more details.- Stimulate credit card use. I know many people who don’t use their credit cards. While some of the reasons for their behavior are genuine, most of them are rooted in misconception e.g. credit card means debt. Banks can get fencesitters among their cardholder base to shed their inhibitions and start using their credit cards more frequently. There are many ways of doing this. I’ll describe them in a separate blog post but suffice to mention for now that these include frictionless reward redemption, inherently superior fraud protection, better accounting, and so on.

While I doubt if cash will ever disappear totally – even after 190 years – I strongly believe that the above tactics can be the low hanging fruits for replacing cash by electronic payments.

Executing these measures will cost money as well as require changes in products, processes and mindsets of banks and fintechs alike. But I’m sure financial institutions will be able to realize a decent return on their investments by earning greater interchange revenues and incurring lower cash handling costs when consumers move from cash to digital payments.