As we all know, there was a severe cash crunch in India on the back of the demonetization of high value currency notes a year ago.

To ease the pain, the government of India made a big push towards digital payments. Trending under #CashlessIndia, the drive amplified the visibility of preexisting digital payments and triggered several new digital payment methods.

Among the former category were web A2A electronic fund transfer (NEFT, IMPS, RTGS), mobile wallet (PayTM, PayZapp), credit card and debit card (Visa, MasterCard, RuPay). Among the latter category were mobile A2A electronic fund transfer (BHIM / UPI) and interoperable QR code POS payment (Bharat QR).

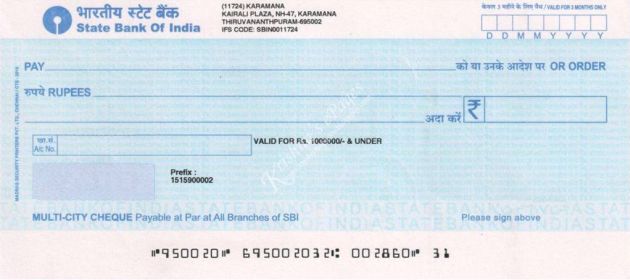

Still, most payments previously made with cash went cashless due to cheques.

Household Help

Take payments to maid servants, car drivers and other household help.

Both the maid servants in my house have mobile phones, although it’s a feature phone. While some digital payments work on feature phones, their UI is in English, a language they’re not conversant with. We offered to navigate the screens of these digital payment apps but they were not comfortable taking our help.

We were wondering how to pay their salaries. Then we learned that they both had bank accounts. It was easy to write a cheque in their name, fill out a pay-in slip, and deposit the cheque in their bank’s drop box. They didn’t have to make any effort to go cashless.

Service Provider

Next, take monthly payments to newspaper agents, milkmen, laundrymen and one-off but regular payments to handymen like plumbers and electricians.

As I pointed out in my blog post entitled #CashlessIndia – Why Putting Cart Before Horse Will Work, my newspaper agent was happy to accept cheques.

Ditto my milkman, laundryman and handymen.

Finextra Member Chetan Ghadge points out why cheque is popular in this category: “…it is easier for them to keep a track of who has paid and who has not. These people don’t maintain computerised records so for them reconciling digital payments is very difficult.”

(Actually, reconciliation of digital payments is a non-trivial issue even for enterprises maintaining computerized records, as I’d highlighted in Enhanced Remittance Data Could Multiply Electronic Fund Transfer Volumes).

Will you jump through all these hoops to make an electronic fund transfer or simply write a cheque? pic.twitter.com/j1rQ911uew

— GTM360 (@GTM360) March 14, 2016

Rent

Now, take rent payments from tenants.

Once the landlord and tenant sign a leave-and-license agreement for a typical period of 24 months, it’s customary for the landlord to take twelve PDCs (Post Dated Cheques) for a year in advance. While the agreement legally binds the tenant to paying the rent on time, PDCs provide a practical way for the landlord to enforce the tenant’s obligation without having to go to court. That explains their traditional popularity for this usage scenario.

With the plethora of digital payments available post #CurrencySwitch, it should be easy to find a replacement for cheques for rent payments. Or so I thought when I had a compelling reason to explore PDC-alternatives when my tenant was due to handover the next batch of PDCs to me and realized that he’d forgotten his cheque book in his home town, which was 500 kms away.

But I was mistaken.

Some of the options like credit card and debit card were ruled out straight away because I don’t have a merchant account letting me accept a card payment. Others like RTGS, IMPS and UPI were not suitable because they didn’t (still don’t) support scheduling of future-dated payments.

The digital payment method that came closest to PDC was NEFT. This A2A EFT method permits the payor to set up Standing Instructions for recurring future-dated payments.

But, when I dug deep, I found two shortcomings with NEFT:

- A tenant can set up an SI on their Internet Banking portal but, to show it to the landlord, they need to log into their online banking portal and show the SI screen to the landlord. During the process, other personal information becomes visible to the landlord. Not all tenants might be comfortable with the ensuing loss of privacy.

- Tenants who’re not so sensitive to privacy may go ahead but what’s the guarantee that the tenant doesn’t cancel the SIs after the landlord leaves?

In contrast, the landlord has the PDCs in his possession. While the cheques may get dishonored on the due date in future, cheque bouncing is a crime. The threat of fine and / or jail time is a good backstop for tenants to honor their cheques.

So, I’ve still not been able to find the “PDC of digital payment”. (Under the circumstances, my tenant made an IMPS payment for the following month and gave me eleven PDCs after he visited his home town and retrieved his cheque book a couple of weeks later.)

And it’s not only in India. James Furlo, Rental Property Owner / Manager in Oregon, USA, explains on Quora why he prefers cheques for rent payments despite the availability of digital payments alternatives like SQUARE, Venmo and Dwolla.

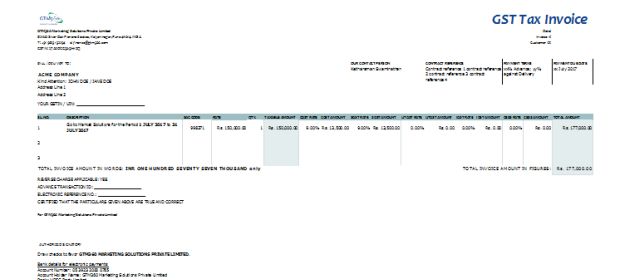

Supplier

Cheques are also fairly popular in SME payments. By taking a PDC against the delivery of its goods, a supplier secures payments due in future from its customer.

There’s no denying that digital payments like UPI have grown rapidly after demonetization. However, their sweet spot has been replacement of small value cash payments (two to three figures).

Going by the retail and commercial payment usage scenarios covered above, cheque is a fairly popular method of payment for replacing large value cash payments (four figures and above).

On the first anniversary of #CurrencySwitch, I can’t help reaching the conclusion that cheque is the unsung hero of #CashlessIndia.