In my early blogging days, I’d written a blog post called Indian Education System is the Best … for India!

Despite realizing that my views on this subject were, ahem, somewhat contrarian, I didn’t hunker down in some dark corner. Instead, a couple of years ago, in another blog post, I’d wondered whether the much-maligned rote-learning method of Indian schools was what the doctor recommended for NYC’s schools. I wasn’t surprised to receive tons of brickbats from near and dear ever since, especially from friends and colleagues who’d recently relocated to India from the USA and had chosen to send their children to international schools despite the higher costs and longer commutes they entailed.

Now, after hearing about a recent HM Government’s plan and the deliberations among British public around its feasibility, I’m tempted to suggest that the Indian education system is ready for adoption by the UK as well. Before you start doubting my sanity and throw more brickbats at me, let me make my case.

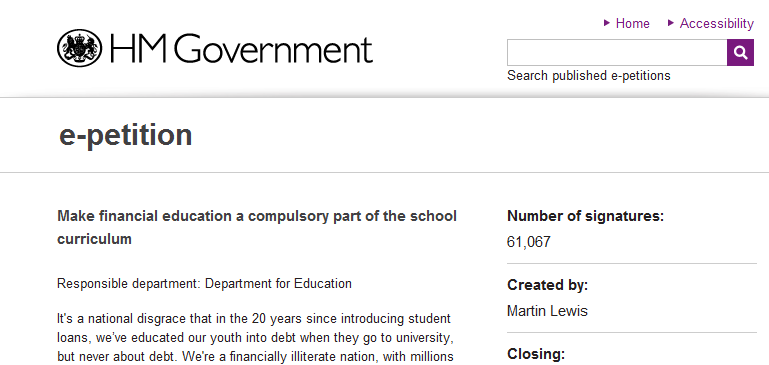

The UK government has recently raised an e-petition to make financial education a compulsory part of the school curriculum. According to the petition, banks and financial services providers are spending “billions on marketing and teaching their staff to sell” loans, mortgages and an array of financial products, and it’s time British schools ensure, as part of “buyers’ training”, that “every child in the country gets a basic understanding of personal finance & consumer rights before leaving school”.

There’s a lot of debate in the British media about the pros and cons of imparting financial education in schools. This article on lovemoney.com and the accompanying comments provide a comprehensive round-up of both sides of the story. Arguing in favor of the petition, a commenter who goes by the handle of WhosgotmyName says, “Until the government recognises that these esential (sic) skills should be part of the national curriculum, generations of consumers will continue to be vulnerable to everthing (sic) from dubious to outright illegal practices.” On the other hand, AndrewFSmith feels that “it is utterly wrong to take time out of the school curriculum whilst one in five of our teenagers leaves school without being able to read properly or do basic sums”.

Personally, I found the views of one Mike10613 to be the most sensible. Apart from suggesting that financial education should be “integrated into existing lessons” instead of being treated as a separate subject, Mike10613 predicts that it will “make learning arithmetic and maths more interesting”.

It struck me that this is probably what the Indian education system has already done when I had a casual look at some of daughter’s study material recently. Her Math text book for the eighth grade at an ICSE school in Pune, India, is full of problems around simple interest, compound interest, loan repayment schedules, and so on. For an assignment in Computers, she’d to include the revenues and profits of IBM, HP and other leading global IT companies.

I don’t remember getting this level of financial exposure even during my grad days, let alone eighth grade. Without attempting to make any claims to being young, I must note that the concepts of simple and compound interest existed back then and companies like IBM and HP were no strangers to the IT industry of that era either.

Having said that, it’s not that my daughter has a separate course called finance education or whatever. It’s just that the basic principles of finance seem to be nicely dovetailed into her existing courses. From personal experience, I can say that Mike10613’s is absolutely right when he predicts that this could make math more interesting.

Integrating finance education into the regular school curriculum is self-admittedly what the UK needs. It’s evident that the Indian school system has already done it.

I rest my case.