PayPal came under regulatory scrutiny in India a year ago when it appeared as though its exports payments feature was not quite compliant with the laws of the land.

According to a recent announcement, PayPal’s wings have been further clipped with India’s central bank (Reserve Bank of India) imposing a maximum limit of US$ 500 per transaction on export-related payments for products and services.

Stepping back a few months, PayPal had virtually suspended its export payments feature for a couple of months pending a closer look by the regulator. When the service resumed, I imagine that PayPal was required to follow tighter KYC (Know Your Customer) norms before opening and activating a merchant account. However, they never tell you this when you enroll your company for a business account and collect the HTML code for publishing the PayPal button on your website.

You’re naturally thrilled at the speed at which you’re able to to accept credit card payments on your company’s website. No other competing service lets you do it so fast – in hindsight, it appears that they must be following the laws that PayPal has been flouting. Money starts flowing in and, after a few days, you initiate withdrawal of funds from your PayPal account to your bank account. Then, suddenly, PayPal puts a hold on your account, reverses the bank transfer, and levies reversal charges both ways, which turns your account balance negative. At first, PayPal claims that their action was prompted by a request from the buyer to cancel the transaction. You go back to check and find that the buyer didn’t do any such thing.

When you go back to PayPal with this information, they suddenly change the tune and tell you that your account is on hold status since it needs to be verified according to KYC norms. They ask you to submit documents to prove your company’s incorporation status and business address. You wonder how they let you open an account and let funds enter it without KYC. Deciding to let this doubt pass, you upload all the requested documents on their website. A few more days pass. PayPal doesn’t release the hold on the account despite acknowledging receipt of documents.

When you call them to follow up, they tell you that all the documents are fine, but they can’t take any action on your account because it shows negative balance, so can you please just add some funds so that your account balance turns positive and they’ll restore your account to full functionality. You ask them why you should be blamed for the account balance going negative – after all, you never tried to withdraw more money than your account held, it was their unjustified reversal charges that was responsible for this situation. They promise to credit back the reversal charges as soon as the account turns positive. All this happens over the telephone, they won’t send any confirmation email, when you point out that their website shows some other status, they blame it on some technical fault and tell you ignore it. Faced with no other choice, you arrange for additional fund transfer, which PayPal gladly accepts into the account and reflects a positive account balance.

You wait for PayPal to release the hold on your account, but that day never arrives.

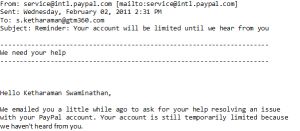

What does arrive, after a few days, is an email from PayPal saying your appeal is denied and that your PayPal account is being terminated. However, despite the passage of several months, they don’t refund the reversal charges, nor return the balance in your account. Emails to them go unanswered. Their website is not updated to reflect the status they communicate via telephone. Two months after they terminate the account, you suddenly receive a totally contradictory email in which they urge you to respond to them ASAP so that they can help you enjoy all features of your account! You wonder if they’ve really lost it.

If not for the huge amount of time and money wasted, you’ll find this experience surreal and hilarious. You might also wonder if there’s a more blatant example of cheating by a company as well-known as PayPal. Thank God RBI has it on its radar.

Many industry observers predict that RBI’s recent restrictions spell doom for PayPal in India. Am I delighted to hear that! Good riddance to bad rubbish!!

Consequent to new laws passed in the US in the wake of the recent financial crisis, PayPal suddenly faces regulatory scrutiny in its parent American market where it has been unregulated so far. So, the day when PayPal faces an India-like situation in other countries is probably not too far away.

How well does Paypal work as a way to collect payments from users in India?…

I’ve used PayPal to make payments for almost eight years when I’ve lived in India, Germany and UK to merchants in USA, UK and elsewhere. Can’t remember ever facing any problem. However, accepting PayPal payments as a merchant in India has lately bec…

As a PayPal user, how do I accept card payments from non-PayPal users?…

You just need to publish the PayPal button on your website. A buyer clicks on the button and is automatically provided a choice of paying with their PayPal account or credit card even if they don’t have a PayPal account. This happens by default and is…