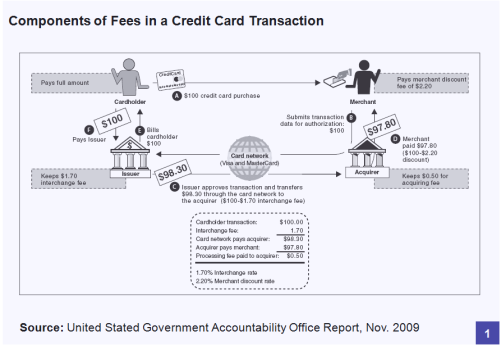

Retailers incur a cost for accepting credit cards from their consumers. Known by various names like ‘merchant discount’ and ‘swipe fee’, it is usually levied as a percentage of the sale value and used to pay for the services rendered by the various entities that enable a credit card transaction. While the exact percentage depends upon the merchant category, card type, type of merchandise, mode of acceptance and other parameters, it can be as high as 3.5%. According to a recent report from the United States Government Accountability Office, merchants typically receive $97.80 for a $100 sale, which indicates an average cost of 2.2% in the United States. Costs in other countries around the world are not very different.

How do retailers recover this cost?

Barring a few exceptions of countries like Australia and high-cost merchandise like jewellery, retailers are prevented by their agreement with card networks (e.g. Visa, MasterCard) from passing on this cost by way of increased price (often called “surcharge”) to consumers paying by credit card – prices have to be the same for all consumers, whether they pay by cash or credit card. (Even in the case of jewellery, which is one category of merchants historically known to levy surcharges for credit card payments, there’s the recent trend whereby they differentiate between items like gold coins where they continue to levy surcharge versus ornaments where they’ve stopped levying them.)

Under this situation, marking up prices across the board might be the only way for retailers to recover card acceptance costs. In other words, they charge higher prices to all their consumers, whether using a credit card or not. Credit card holders can recover at least a portion of this higher price by way of reward points and cashback offers whereas noncardholding consumers lack such avenues and land up paying more for shunning credit cards. This flies against the face of conventional wisdom in India and other conservative societies that using credit cards leads to overspending.

This contrary reality – that is, not using credit cards results in overspending – provides a powerful go to market theme for banks to promote more widespread usage of credit cards in such conservative markets. When that is augmented with greater convenience, deferred payment, higher safety (if you’ve tried to reverse a fraudulent debit card charge, you’ll know how difficult it is) and other benefits offered by credit cards, banks have a great potential to boost credit card spend volumes from such markets.

UPDATE:

Just stumbled on to http://www.truecostofcredit.com which is a tool from TransFS.com, a company I’ve covered in a couple of my posts. This website tells you the exact cost that merchants incur for accepting different credit cards for a range of merchandise.

Just enter the first six digits of your credit card number – which reveals absolutely no personal information about your card, the website assures you – and find out the credit card fees for chewing gum (for one of my cards, it is 25.1%), sandwich (5.2%), pizza (3.8%), gasoline (2.1%), flat screen TV (2.5%).

Pingback: Why Pay By Credit When You Don’t Have To Pay By Kwedit « Talk of Many Things

Pingback: Forget Overspending, You Can Actually Save Money By Using Credit Cards! « Talk of Many Things

I shan't dignify this ridiculous article with a comment. Rats, I just did..