Every time a stock tanks after an IPO, the common man or woman (henceforth J6P) blames Securities and Exchange Board of India, the securities / capital markets regulator of India.

The common rants against SEBI are

- Loss-making companies were allowed to IPO

- The offer price was too high

- Promoters dumped their shares on retail investors

- Issuer committed fraud

- Retail investors’ interest wasn’t protected.

Take this post on LinkedIn for example:

OP: Role of SEC / SEBI / any market regulator is to ensure a common man is not at a disadvantage compared to the institutional investors.

This worldview betrays lack of understanding of the IPO process and the remit of the securities regulator.

IPO process

Until Zomato’s IPO in July 2021, SEBI never permitted loss-making companies to IPO in India. IIRC, companies had to have three consecutive years of profits before they could raise capital from the Indian public. During that regulatory regime, several Internet startups listed in NYSE or Nasdaq in USA, where seasoned investors didn’t care too much about profit in the short or medium term e.g. MakeMyTrip.

Years to profitability in Tech: 8 years after IPO.

“Many tech companies turn a profit about eight years after their IPO” ~ Snowflake CFO Mike Scarpelli via https://t.co/AMEa9bx34E— Ketharaman Swaminathan (@s_ketharaman) January 25, 2024

As a result, stocks of these companies skyrocketed when their revenues grew rapidly even though they were making losses. J6P in India was deprived of the chance to profit from high growth Indian companies by flipping their stocks for a neat profit. Over time, this led to lobbying to permit loss-making companies to IPO in India, and the securities regulator finally acceded to their demands with the IPO of Zomato. The rest is history.

During the old LQR (License Quota Raj) regime, a company seeking to raise capital from the public market (henceforth IssuerCo) had to get its price approved by the so-called Controller of Capital Issues. CCI was rightly disbanded after the liberalization of 1991. Just as there’s no price control on food, rent, school fees, healthcare and other basic necessities after that, there’s no case for the capital markets regulator to decide IPO pricing. SEBI’s Chief has made that point amply clear.

"SEBI Has No Role In IPO Pricing" ~ https://t.co/6E66ekrirL.

Kudos to SEBI for upholding capitalism.

This will ensure that investors stay smart, take responsibility for their actions & stop running to govt for everything as though they're living in a Nanny State.— Ketharaman Swaminathan (@s_ketharaman) September 16, 2022

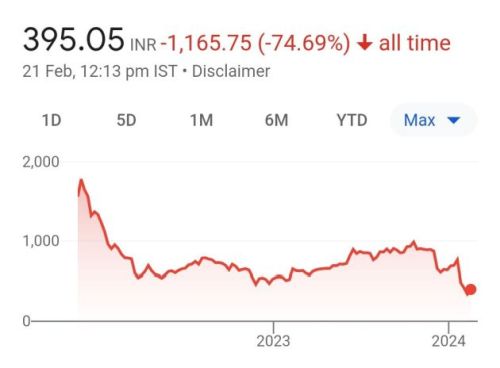

The OP also claimed that SEBI is frowning upon decreasing price of PayTM stock post IPO.

AFAIK, SEBI has not done any such thing. As we’ve seen above, it has issued an omnibus declaration against getting involved in the IPO prices of any stock. I’m also not aware of any lawsuits admitted by the courts against PayTM / SEBI from aggrieved investors seeking damages for said fall in the stock’s price after the IPO.

(PayTM may be opening itself up to Everything Is Securities Fraud lawsuits à la Matt Levine’s favorite topic after RBI’s enforcement action on PayTM but that’s irrelevant in the context of this post, which covers the period before Reg PayTM happened in January 2024.)

IPO is the go-to method for providing exit for promoters, early investors and employees with ESOPs, so they’re supposed to sell their stocks at IPO. That’s a feature, not a bug, of how private markets work. Besides, it’s largely sales by this cohort that creates the supply of shares that’s offered for sale to investors in an IPO. In other words, if promoters et al do not sell their stock, there won’t be an IPO.

In today’s world of VUCA (Volatility Uncertainty Complexity Ambiguity), stock prices rise and fall for a variety of reasons unrelated to fraud. In the early 2000s, Amazon saw a drawdown of 95% in its stock. More recently, Life Insurance Corporation of India went through a 93% erosion in its valuation.

LIC Valuation:

Expected before IPO: ?55LCR ~ $785B.

IPO Offer: ?6LCR ~ $80B.

IPO Listing: ?5.6LCR ~ $75B (-90%)

1 Year after IPO: ?3.6LCR ~ $45B (-35%, -93%) https://t.co/ejEvnCm8o9— Ketharaman Swaminathan (@s_ketharaman) May 17, 2023

Nobody alleges Amazon or LIC of committing fraud.

Remit of securities regulator

Firstly, the capital markets regulator is responsible to capital markets, and that includes retail investors and institutional investors.

Secondly, the regulator needs to ensure that the retail investor is not informationally at a disadvantage compared to institutional investors. It fulfills that responsibility the moment the IssuerCo publishes its DRHP.

Secondly, the regulator needs to ensure that the retail investor is not informationally at a disadvantage compared to institutional investors. It fulfills that responsibility the moment the IssuerCo publishes its DRHP.

It’s the investor / financial advisor’s job to analyze the information provided in the DRHP and decide suitability of the investment for themselves / their clients, whether retail investor or institutional investor. In this process, the retail investor is obviously at a disadvantage with the institutional investor on skills, capital availability, risk-bearing ability, etc. The regulator is not responsible for mitigating those disadvantages.

Thirdly, the regulator’s responsibility towards ensuring informational parity is limited to information released by the IssuerCo. Regulators don’t stop any investors from

- gathering more information by using their own resources. Hedge funds in USA are known to buy satellite imagery of parking lots of retailers’ stores.

- carrying out their own analysis on the provided / gathered information in order to decide whether to invest in the stock or not. The aforementioned hedge funds use sophisticated algorithms that translate the occupancy rate of parking lots into footfall and use that as a proxy to estimate sales of the retailer before it announces its quarterly results.

Lastly, the regulator does not stop any investor from buying up colocation servers at exchange premises in order to reduce latency and gain a few microseconds advantage in submitting trades to the exchange’s server. It’s not a secret that only institutional investors can afford the steep fees for COLO or that COLO provides an advantage to institutional investors that many have called unfair, but here we are.

Regulator is not advisor

The regulator’s remit is to ensure that all investors are dealt the same cards. It’s the individual investor’s job to decide how to play their hand – that’s not the regulator’s job. In deciding whether to invest in the IPO or not, the individual investor may choose to use a financial advisor or not – that’s also not within the regulator’s remit. Regulator has no duty to ensure that an investor gets positive returns on their investment.

tl;dr: Securities regulator is not financial advisor. J6P should stop mixing up the two entities. If J6P is not in a position to decide whether to buy a stock, she should seek help from a financial advisor. If she’s still unable to decide, she should stay away from the market. But blaming the regulator is a NO NO.

As an aside, the American securities regulator has approved the IPOs of companies whose very legality was in question at the time of application (and still is) e.g. Cannabis, rideshare and cryptoexchange. SEC has categorically stated that it’s not its job to ensure that the basic business model of the IssuerCo is legal. Not sure if such a thing has happened in India and what, if any, is SEBI’s stand on it.