“A basic premise of Web3 is that every product is simultaneously an investment opportunity”

The previous post entitled How Tokenonmics Has Revolutionized Web3 Software was about the revolutionary impact of tokenomics on Web3 software.

In this post, we will do a deep dive into the following characteristics of Tokenomics.

- The genuine Tokenomics innovation

- Phases of Tokenomics

- Tokenomics and financial engineering

- Tokenomics is not only for Web3

Let’s get into it.

#1. The genuine Tokenomics innovation

You might be wondering how tokenomics is any different from buying a share of, say, SAP when you bought a license for the world’s #1 ERP software. Surely, the value of SAP’s share has skyrocketed since then and you got multibagger returns even without being in Web3 world?

It is different in that SAP was not public when early buyers bought its software, so they could not buy its shares. Buyers who signed up with SAP after it became a public company could have bought the company’s shares and made decent returns if they held the stock for a decade or two.

(Ditto in the case of Oracle, Salesforce and any number of market leaders in various other enterprise software categories.)

In sharp contrast, tokenomics helps customers to partake in the future success of promising startups from the very early stages and provides meaningful exits in months, rather than years or decades.

That is the genuine innovation of tokenonmics, as Matt Levine highlights in his Money Stuff newsletter dated 6 July 2022:

Decentralized platforms are owned by their users. That means that users get a cryptocurrency token with some economic and governance rights rather than a share of equity. If the platform becomes popular, successful and widely used, then its users get rich. This form of organization is a new phenomenon, a genuine innovation of crypto.

– @matt_levine

#2. Phases of Tokenomics

In the previous post, we saw five ways in which Tokenomics pumps up the prospects of Web3 software.

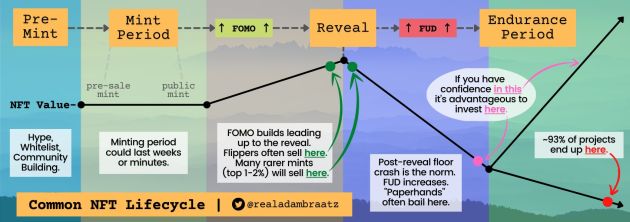

The phases through which Tokenomics accomplishes that are illustrated in the following exhibit.

In Web 1.0 and Web 2.0, 20% of VC-backed startups succeed. It’s early days in Web3. Besides, tokenonomics is unregulated and can be abused by bad actors. So, the success rate of Web3 startups is 7% as of now.

If you’re long on Web3, you’d expect that figure to go to the moon. If you think Web3 is a scam in disguise, you’d expect that figure to go to zero. We’ll only know with time which prediction comes true.

#3. Tokenomics and financial engineering

In Kickstarter and other crowdsourced product development platforms, a founder conceptualizes a product, develops video and other marketing content for it, raises money, and only then starts building the product, with the people who contributed to the project getting usage rights for the product as and when it’s built.

Tokenomics does all of that but with one major twist: The utility tokens received by investors not only confer usage rights for the product but can also be traded in a cryptoexchange.

If the difference sounds more like financial engineering than software engineering, I wouldn’t disagree. In fact, I’ve said so myself:

@gtm360: Web3’s major innovation is in financial engineering rather than computer engineering or marketing.

It’s not only me.

As The Atlantic article titled The Internet Is Just Investment Banking Now says:

The Internet Is Just Investment Banking Now. The internet has always financialized our lives. Web3 just makes that explicit.

– Ian Bogost

#4. Tokenomics is not only for Web3

The other day, I stumbled upon an article in The Register about IBM winning a contract from the UK savings bank National Savings & Investment.

The mention of Premium Bond in this article reminded me of the following lines from Thick As A Brick by Jethro Tull:

With their jock-straps pinching, they slouch to attention

While queuing for sarnies at the office canteen

Saying: “How’s your granny?” and good old Ernie

He coughed up a tenner on a premium bond win.

I googled to find out more about the reference to premium bond in one of my all time favorite music albums.

The following tweet was on top of the search results:

Stumbled upon your tweet when I Googled "Jethro Tull Premium Bond" while reading https://t.co/nWn4f3e4ZN.

Thick As A Brick is my most favorite music album ever. Despite listening to it for 40+ years, I never knew that what ERNIE meant!

Thanks a lot, you've made my day!— Ketharaman Swaminathan (@s_ketharaman) July 6, 2022

This told me that Premium Bond had a lottery component, decided by ERNIE, to stimulate its sales. I can imagine the pitch for this product going “With Premium Bonds, you not only get steady returns on your investment but also stand a chance to win the jackpot”.

By using the mechanism of a lottery, NS&I had injected buoyancy into its premium bond financial product.

That’s quintessential Tokenomics! It happened half a century before Web3 came into existence.

Then there’s Chingari.

When TikTok was banned in India, it led to many homegrown clones of the Chinese short video app. Chingari was one of them. The startup minted a token called $GARI, which it used to reward creators on its app.

Premium Bond and Chingari suggest that, while tokenomics is associated with Web3 software, there’s no reason in principle why it can’t be retrofitted to Web 2.0 and prior generations of software (or even investment products).

Of course, whether they use tokenomics in Web3 or anywhere else, vendors will need to work through the legal provisions of issuing cryptocurrency tokens alongside their products in the first place. I reckon the legalities of that will vary from one jursidiction to another.

Should you be wondering about the wisdom of buying into a company at its early stages just because you want to use its product, I’ll leave you with the following take from Matt Levine:

@s_ketharaman: Two sides of strict public listing requirements:

– Pros: You get vetted companies, so your odds of being defrauded are low.

– Cons: You get only big and old companies, so your your exposure to fast-growing innovative companies is less.

(H/T @matt_levine)

DISCLAIMER: The Blockchain world has an eclectic mix of elements like cryptocoin, ICO, and so on whose legal status is ambiguous and swings wildly between various states of the spectrum such as illegal, maybe-illegal, not-illegal and legal and from one country to another. Before following through with the guidance given in this post, please consult your legal counsel about their legal status in your respective jurisdiction. We offer no guarantees as to legality of any of the guidance provided in this post.