The title of this blog post might sound insensitive at first glance but I couldn’t find a better way to capture the fact that Covid-19 has favorably impacted some companies and adversely impacted others on the FORTUNE magazine’s ranking of the top 500 corporations in the world.

Last year, I predicted:

… the assymetric nature of the pandemic’s impact may deliver some pleasant surprises. It’s widely believed that coronavirus has dealt a more severe blow to industries like manufacturing, retail and hospitality than technology. While this might sound insensitive, I’d be amiss if I failed to point out that the frontrunners of the Indian IT industry might face diminished competition from companies in those affected industries for a place in the much vaunted Fortune Global 500 list.

That’s exactly what happened this year, which is the first full year in which FORTUNE GLOBAL 500 companies bore the full brunt of the coronavirus.

FORTUNE GLOBAL 500 – 2021

The Global 500 shrank a bit over the past year. After reaching a record high of $33.3 trillion in the 2020 edition, total revenue for the world’s 500 biggest companies fell 4.8% to $31.7 trillion this year. It was the first revenue decline in half a decade. The culprit, of course, was COVID-19, which slammed huge swaths of the global economy as countries went into lockdown. (Source: Fortune Global 500 issue)

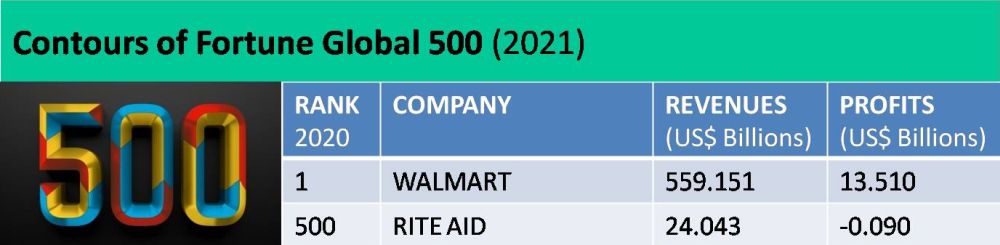

The contour of this year’s list is made up by Walmart at #1 and Rite Aid coming in at #500.

This is the first edition of FORTUNE GLOBAL 500 in which USA does not have the most number of companies. I haven’t heard much fanfare on this applecart-upsetting moment but, with 135 companies, China just overtook USA with 122 companies.

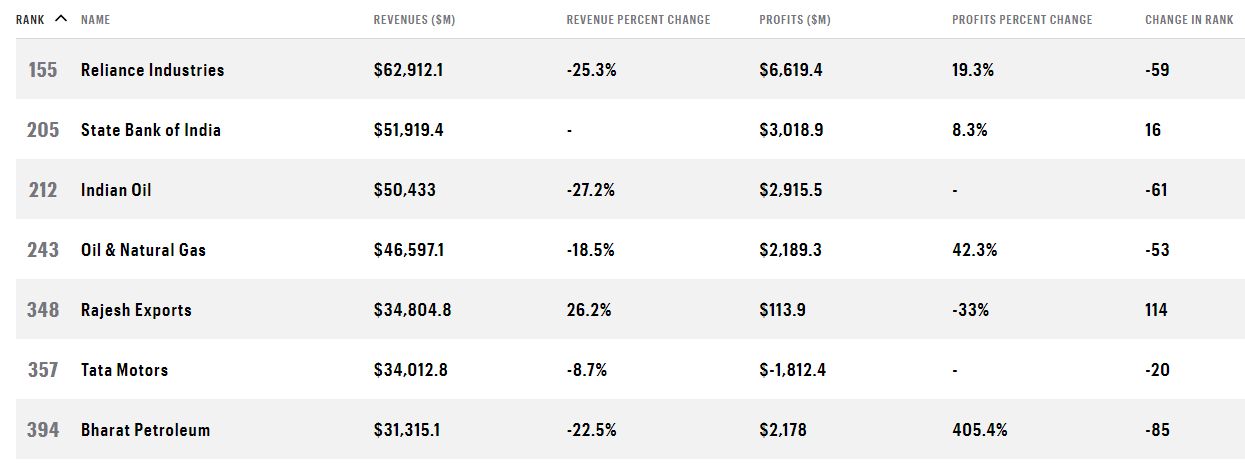

Meanwhile, India maintains its humble and consistent track record of having seven companies on the Global 500 list.

Notice the steep fall in revenues of all petroleum giants including Reliance Industries at the top and Bharat Petroleum at the bottom of the list. To quote a line from Fortune, “the culprit, of course, was COVID-19”.

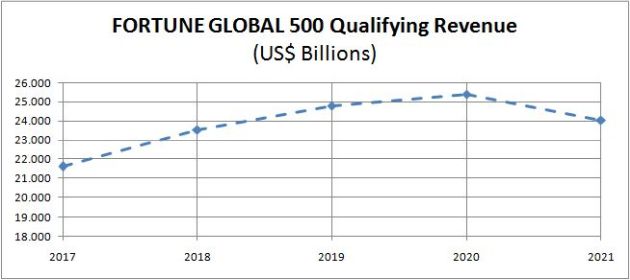

FORTUNE GLOBAL 500 Qualifying Revenue

Last year, I predicted:

Given that the pandemic has affected different industries differently, it might just displace some companies from this year’s list with new companies next year without upending the upward trend in the qualifying revenue.

The first part of my above prediction has come true. Fortune:

… all six of the airlines that appeared in last year’s ranking failed to make the cut this year.

But I was over-optimistic about the second part. The pandemic did upend the upward trend of the FG500 Qualifying Revenue.

For the uninitiated, Fortune Global 500 Qualifying Revenue is the revenue hurdle that a company must cross to enter the august league of the top 500 corporations in the world. In other words, it’s the revenue of the company ranked 500th on the list. The entry barrier has always changed – generally risen – from one year to another. So has the company ranked 500th on the list. (Unlike the company ranked first, which has been Walmart for as long as I can recall.)

FG500 Qualifying Revenue declined from $25.386 billion last year to $24.043 billion this year (down 5.29 per cent). This is the first time that it has fallen in six years.

Indian IT Industry

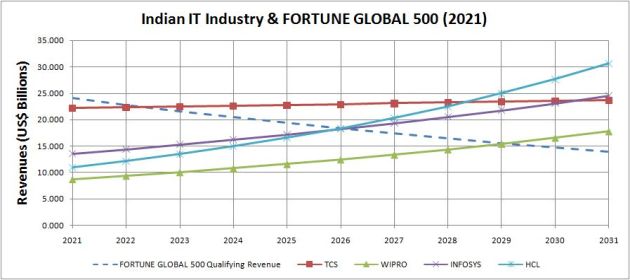

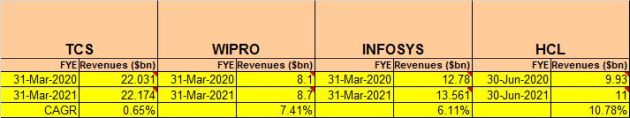

There are no surprises in the frontrunners of the Indian IT industry. Like last year and many years before that, the list comprises TCS, Infosys, HCL and Wipro. The revenues of these companies for the current and previous year are shown below.

By extrapolating the current CAGRs of these four companies, I’ve forecasted their revenues for the next 10 years. I then juxtaposed the revenue trajectories with the projected FG500 Qualifying Revenues for the same period. This chart is the result:

Click here to download this model as an Excel Workbook (XLSX, 22KB).

The highlights of the model are given below:

- According to the figures widely reported by the Indian media, TCS’ revenues increased by 0.65% year-on-year. However, The Register pointed out that the country’s largest IT company posted a negative growth of 0.8% on constant currency basis.

- The other three companies in our model – Wipro, Infosys and HCL – grew faster than FG500 Qualifying Revenue, which, as we saw above, shrank by 5.29%.

- Covid-19 had a non-uniform impact even within the global IT industry. Like TCS, other mega IT services companies like IBM, Cognizant, and DXC posted negative growth during the year (Exception: Accenture). On the other hand, the next rung of companies like Infosys, HCL and Wipro saw strong positive growth during the same period. I have no readymade explanation for this somewhat paradoxical behavior. If any of you has some insights on it, please share in the comments box below.

- For the welfare of humankind, I pray that the pandemic ends fast. But, if it persists, the FG500 Qualifying Revenue may shrink again. Even with its anemic growth rate, TCS will come within a whisker’s distance of becoming a Fortune Global 500 next year and glide into the list with a huge margin the following year.

- All of the other three Indian IT companies in our model will enter the prestigious Fortune Global 500 club within the duration of our 10-year model: HCL in 2026, Infosys in 2027 and Wipro in 2030. That has never happened before. But, then, neither has a pandemic, since FORTUNE started publishing its ranking of the world’s top 500 corporations 21 years ago.

The last time the FG500 QR had flatlined (2015), I’d predicted that An Indian IT Company Will Join Fortune Global 500 Earlier Than Predicted. The Qualifying Revenue promptly went up the following year, raining on my bullish parade. Let’s see what happens next year.