Every now and then, somebody points to the challenges of cracking the overseas markets and claims that the Indian market is big enough for Indian companies.

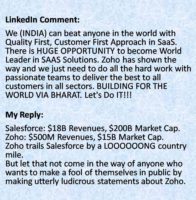

Take the example of this founder of an Indian IT company, who commented as follows on LinkedIn:

We (INDIA) can beat anyone in the world with Quality First, Customer First Approach in SaaS. There is HUGE OPPORTUNITY to become World Leader in SAAS Solutions. Zoho has shown the way and we just need to do all the hard work with passionate teams to deliver the best to all customers in all sectors. BUILDING FOR THE WORLD VIA BHARAT. Let’s Do IT!!!

Full marks to their patriotic fervor.

Full marks to their patriotic fervor.

But faux patriots are deluding themselves if they assume that the Indian market is the chattel of Indian companies.

Foreign companies dominate all enterprise software categories in India. In fact, you’d be hardpressed to find a single Indian company anywhere even in the Top 3 positions. Examples:

- German company SAP is #1 in ERP in India. It sells more ERP than all the other ERP companies put together in India. As a matter of fact, SAP has a higher market share in India (estimated at 65%) than even in its home market of Germany (estimated at 35%). SAP is also the #1 ERP in the world.

- American company Salesforce is #1 in CRM in India. While Zoho is an Indian CRM company, it makes only INR 193 crores (US$ 26 million) from India out of its global revenues of INR 4274 crores ($570 million) (Source). In contrast, SFDC makes over INR 500 crores from India. H/T to a customer, who wishes to stay anonymous, for bringing to my notice the tiny revenues of Zoho from India. On my own, I wouldn’t have guessed it. Going by the number of billboards of the company one sees around in major cities of India and the array of nationalistic causes espoused by its Founder CEO, one would think the company exists solely for India. Salesforce is also the #1 CRM in the world.

- Microsoft is the #1 desktop operating system and office automation software company in India and in the world.

The situation is the same in many other product categories. AWS, Google and Lenovo are the Top 3 brands in public cloud infra, consumer internet and laptops respectively – in the world and in India.

Faux patriots should stop making the mistake of taking the Indian market for granted.

It requires a certain mindset to succeed in software product business.

I have covered this topic in Developing The Product Mindset, Product Versus Services Selling – Part 1, and Product Versus Services Selling – Part 2.

I have worked in some of the largest IT product and IT services companies in India. Going by my personal experience, only a handful of companies in India have the product mindset e.g. i-flex / Oracle Financial Services Software (Disclosure: My ex-employer), Ramco (Disclosure: My ex-employer), and Zoho.

Not saying the others can’t develop the product mindset but they probably won’t – and maybe shouldn’t.

Nothing right, nothing wrong. Whatever floats their boat. It’s not like there’s anything inherently superior about products or inferior about services. End of the day, greenbacks are greenbacks.

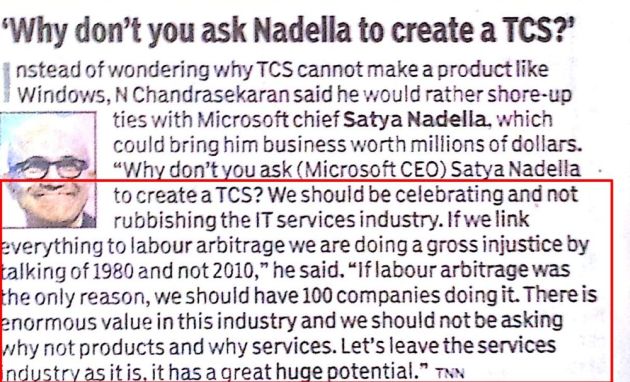

Mr. N Chandrasekaran, the current Chairman of Tata Group, made this point eloquently when he was CEO of group company TCS a few years ago:

The mindset of Indian IT is perfectly suited for services. Not surprisingly, despite starting at the same point 30 years ago, Indian IT Services has become a $200 billion industry whereas the Indian IT Product business has not yet crossed the $10 billion mark.

That said, both product and services companies face several challenges in the Indian market:

Low prices. The same software engineer who will fetch INR 300,000 per month ($25/h*160h/mo*75$/INR) from Western markets will barely be able to generate a billing of INR 75,000 per month from the Indian market

Delayed payments. This seems to be a perennial problem in India, not just in the IT industry. Everyone from the clerk to CFO thinks they’re doing a favor by clearing payments due to vendors. In egregious cases, certain unscrupulous characters even demand a commission for releasing payments.

Long sales cycles. Meetings get canceled without prior intimation. Time is not valued. Multiple demos / proofs of concepts aka POCcalypse are the norm for each prospect because somebody or the other who promised to attend the demo bails out at the last minute. While suppliers are to blame for some of the causes of long sales cycles – see Don’t Lose Deals By Belaboring Business Value – the same Indian company that takes 8-9 months to win a $100,000 deal in India manages to close a million dollar deal from western markets in 3-4 months, so long sales cycle is more of a market trait than a manifestation of the supplier’s shortcoming.

Then there are zillions of delivery related challenges caused by scope creep, lack of sanctity of sign-offs, go live delays, and so on.

I’ll refrain from getting into them since we’re not a delivery company.

If the Indian market is not good enough for Indian companies, what should they do?

Westward ‘ho!

In a follow-on post, we’ll publish a primer for Indian IT companies to grow rapidly by focusing on western markets. Watch this space!