In Product Versus Services Selling – Part 1, I’d highlighted three differences between IT product and services selling.

In this second part, I’ll cover two more differences and examine the implications of these five differences on the way forward for the Indian IT industry.

#4. PROSPECTING V. CLOSING

According to the popular narrative, it’s easier to generate leads – but harder to close deals – in product than services.

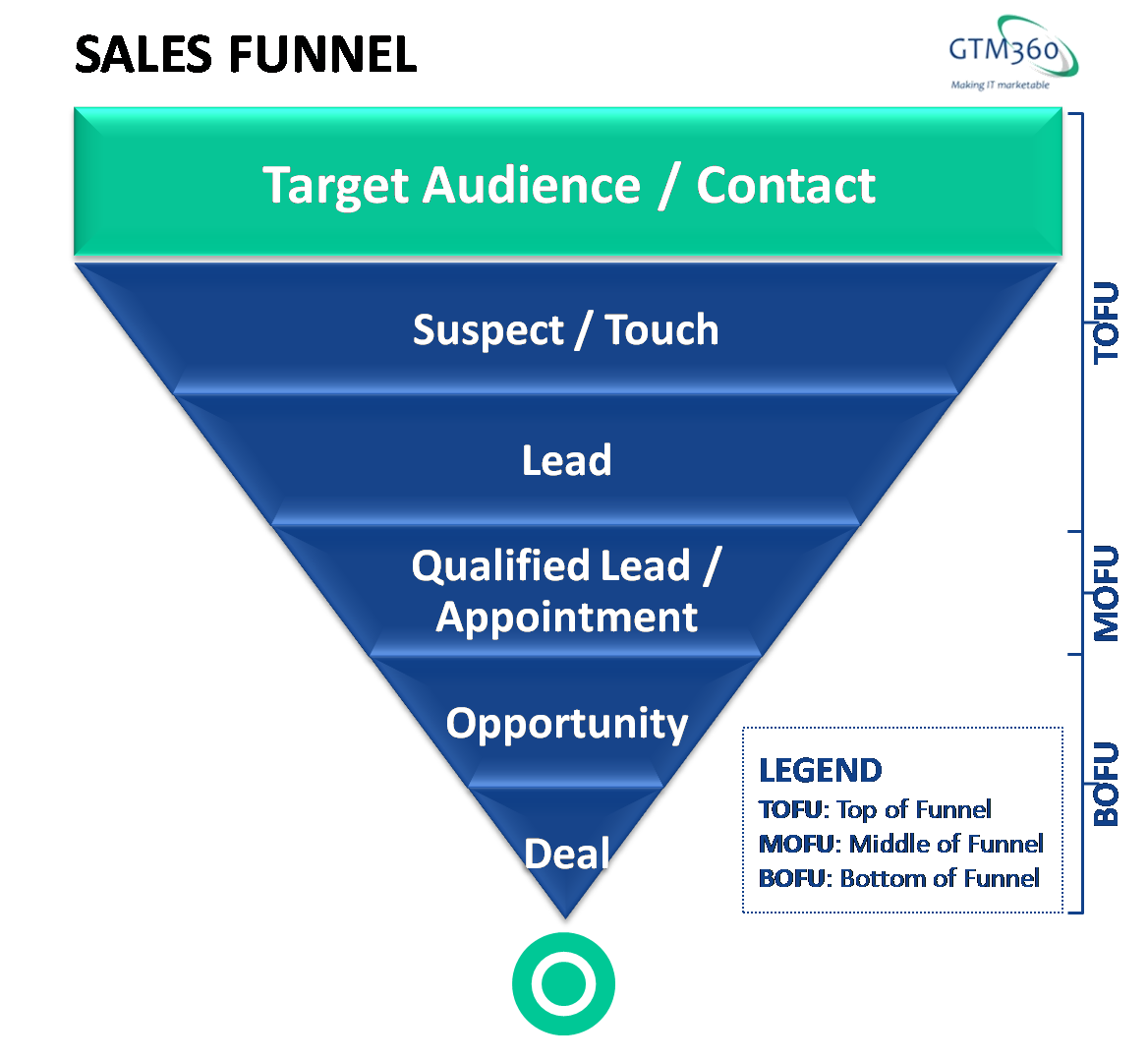

Put differently, in product selling, Contact-to-Lead process (aka Prospecting) at TOFU is easier than Lead-to-Deal process (aka Closing) at MOFU; and exactly the reverse in services selling.

This notion stems from the standard operating procedure of most product sellers to offer a product demo in the very first cold call / email. Since there’s something tangible to see / do, the average contact in the Target Audience tends to grant the appointment for the product demo / free trial without much fuss. When that happens, the product seller has generated a Qualified Lead and has reached the MOFU stage. From experience, this happens more easily in product selling than in services selling, which has nothing tangible to offer at the TOFU stage.

But that’s not to say the common practice of generating leads in product is right.

Offering a product demo / free trial during prospecting creates a bigger problem by shifting the challenge from TOFU to MOFU, where it’s harder to surmount.

Because of this approach, the prospect sees the demo because it’s something tangible to see, but then struggles to develop a business case for the purchase of the product because he has no clue what pain areas of his company the product solves. As a result, the case does not progress to the BOFU stage, and the Lead-to-Deal conversion rate suffers. This translates into the “too many demos, not enough deals” syndrome. Roughly half of our product customers were beset with this problem when they decided to seek our help. You can find more details of our solution in our case study entitled Enterprise Mobility Solutions Provider Multiplies Deal Size.

To mitigate the risk of low Lead-to-Deal conversion, we strongly recommend product vendors NOT to demo their products at the start of their sales cycle. Instead, they should first uncover the prospect’s pain areas, position the general product category (not their specific product) as the high-level solution, and slip in their product as the best solution based on its specific features that best alleviate the specific prospect’s pain areas.

It’s only after doing all this at the TOFU stage that product vendors should do a product demo at the MOFU stage. The demo should cover the whole product but should highlight how the aforementioned specific features make their product best suited for the prospect’s specific situation.

This overlaps significantly with our recommended approach for services prospecting (where it solves the classical TOFU problem of low conversion rate from Contact-to-Qualified Lead).

If done this way, Lead-to-Deal conversion improves but prospecting in product selling becomes no easier or harder than it is in services selling.

#5. VENDOR RISK

I’ll conclude this list with what I believe is the most important difference between IT product and services selling, especially in the context of the Indian IT industry.

When a customer buys a product, he more or less marries the product vendor. His business runs on the vendor’s product and has huge dependencies on support, updates and the vendor’s long-term survival. This is called vendor risk in procurement parlance. In product, it’s high.

Vendor risk is minimal in services since the services vendor only develops what the prospect tells him to and also hands over source code to prospect-turned-customer after completing the project. If the original services vendor folds up, the customer can easily get support from other services vendors. So long term surival is not an important selection criteria for services vendors (except in the case of total outsourcing deals, which are a small fraction of services deals).

Demo, functionality, price, references – everything can go perfectly for a product vendor but he could still lose the deal at the last minute because the prospect’s C-Level Executives haven’t heard of the vendor and don’t want to take the risk of entrusting their company’s fate to a stranger.

In contrast, very few services purchase decisions go to the C-Suite for vendor approval, so vendor risk is minimal in services selling.

It’s this difference that creates a glass ceiling for the Indian product industry. Indian IT Services companies can boast of FORTUNE 500 customers whereas Indian product companies struggle to win deals from large companies – even inside India, not just in the developed markets of USA and Europe. (Testimony: German ERP giant SAP has 80% market share in India, which is way higher than the 35% it has in its home market).

It’s obvious that there are many differences between IT product selling and services selling.

It has been said that product selling is a very different ballgame compared to services selling. Some have even gone to the extent of saying that the differences are so stark and irreconcilable that India shouldn’t bother with products and stick to services, which has been the mainstay of the Indian IT industry since its inception.

While I’m sensitive to the enormity of the differences between IT product and services selling, I don’t subscribe to the above point of view.

While I’m sensitive to the enormity of the differences between IT product and services selling, I don’t subscribe to the above point of view.

If you take a hard look at the differences, some of them will fade away if the flawed parts of the sales process are rectified and the others will become less significant when the comparison is restricted to large-to-mega services deals (vendor risk in those deals is as high as it’s in product selling.)

I tend to believe that it’s a matter of time and reorientation of mindset before product companies in India are able to develop the selling skills required to succeed globally. Good news is, they have a couple of lighthouses to emulate, such as my ex-employers Ramco Systems and Oracle Financial Services Solutions (formerly i-flex solutions).

UPDATE DATED 1 MARCH 2022:

Three years after the original post was published, I’m ambivalent about the guidance I gave at the end of the post.

On the one hand, there are many more successful product companies out of India, so my optimism was well placed. However, many of them have moved out of India; besides, in terms of revenues, product revenues out of India have gone up from $2 billion to merely $5.3 billion during this period.

SAAS Industry Vital Stats (India):

* $5.3B revenue @ 51% CAGR

* 50K employees

* $105K RPE

* $75B revenue & $1.3T valuation by 2025(E)

* 2X capital efficient as Consumer Internethttps://t.co/YyWAdo8n7b via @ETPrime_com— Ketharaman Swaminathan (@s_ketharaman) August 2, 2021

On the other hand, Indian IT services companies have done much better: They have added nearly $50 billion in revenues during the same stretch to cross $200 billion during FYE2021.

While the forecasts for the future are equally gung-ho for both products and services, services has a better track record of delivering on its expectations compared to products.