Today’s Times of India has two op-eds on petrol pricing.

The one by Swaminathan S Anklesaria Aiyer (@swaminomics) advises the government to hold taxes at their present levels and leave petrol prices as they are.

The other by Chetan Bhagat (@chetan_bhagat) advocates exactly the opposite approach.

In the past, I’d leaned towards the former point of view.

That changed after I got the following perspective from the latter article.

- “Fuel prices are technically supposed to be market driven, linked to international crude prices and foreign exchange rates. Practically, they are not.”

- That’s because local taxes are the third driver of price and they’re under the government’s control. Ergo, government can modulate petrol prices if it wants to

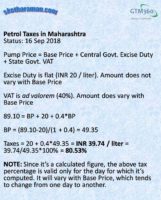

- Taxes comprise Central Government Excise Duty and State Government VAT

- Excise Duty is a flat figure of INR 20 / liter. It does not vary with the price. Therefore, central government does not earn more or less tax revenues as a result of increase or decrease in the base price

- VAT is ad valorem, which means it’s a percentage of the base price. (The percentage also varies from one state to another. For the rest of this post, I’ll use the figure of 40%, which is the prevailing rate in Maharashtra.) VAT collections by state government do rise or fall as a result of increase or decrease in the base price

- Since total tax percentage is a computed figure, it can change from day to day. This is unlike most other taxes, which are fixed at a certain percentage that remains constant until the next Budget

- Four years ago, Excise Duty was INR 9 / liter and VAT was INR 14 / liter. If we went back to those taxes, current price would be INR 63 / liter. Incidentally, this is close to the imputed fair price of INR 69.03 / liter, computed on the basis of the so-called Big Mac Index (Per Statista, Big Mac Index is 2.51 for INDIA and 4.23 for UK; Pump prices per liter of petrol are INR 80.22 and INR-equivalent of 116.34 in UK respectively. Ergo fair price in India is 116.34*2.51/4.23 = INR 69.03 / liter)

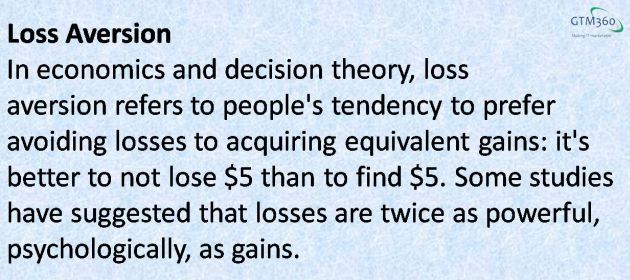

When crude prices fell four years ago, pump price should have fallen to INR 40 / liter but they did not. That’s because the government interfered and increased the Excise Duty to INR 20 / liter from the then prevailing figure of INR 9 / liter. The common man didn’t seem to notice this move at the time. I don’t know how a billion-plus, supposedly-price-sensitive Indians missed it. Maybe it’s another manifestation of the famous Loss Aversion principle of Consumer Behavior, which states that the fear of losses is twice as powerful as the lure for gains. In this context, it appears that Consumers are more likely to notice a price increase than the absence of a price reduction

When crude prices fell four years ago, pump price should have fallen to INR 40 / liter but they did not. That’s because the government interfered and increased the Excise Duty to INR 20 / liter from the then prevailing figure of INR 9 / liter. The common man didn’t seem to notice this move at the time. I don’t know how a billion-plus, supposedly-price-sensitive Indians missed it. Maybe it’s another manifestation of the famous Loss Aversion principle of Consumer Behavior, which states that the fear of losses is twice as powerful as the lure for gains. In this context, it appears that Consumers are more likely to notice a price increase than the absence of a price reduction- If the government intervened to increase Excise Duty four years ago, it should very well intervene to reduce Excise Duty and VAT now, thus bringing about a welcome drop in petrol priceS. This is despite @swaminomics’s warnings against lowering excise duty for reasons related to maintaining foreign investor confidence and other arguments around the need for more money for infrastructure development, and so on

- Barring the pump price and base price, the above perspective is equally applicable for diesel pricing.

Many people, including Chetan Bhagat, seem to believe that petrol prices will automatically come down if it’s brought under the GST regime, the logic being the highest slab of GST @ 28% is much lower than current petrol taxes of ~80% (see sidebar on the left).

I’m not so sure. What’s the guarantee that a special GST slab of ~80% won’t be created just for petrol?

So, I’ll stick to my call for cutting down Excise Duty and / or VAT in order to reduce petrol price.