I go directly to the websites of my favorite brands whenever I shop online e.g. Amazon for products, Cleartrip for flight tickets and hotels, Housing for real estate, Play Store for mobile apps, Product Hunt for software and websites, StockImages for images, and so on.

I can’t remember the last time I went to Google to search for anything I bought online.

In other words, the aforementioned websites have replaced Google as my destination site.

And it’s not only me.

55 percent of online shoppers start their product searches on Amazon https://t.co/1hGOcyk3HK via @Recode

— AdvancingRetail (@AdvancingRetail) October 2, 2016

Going by this, Google’s search volumes should have nosedived by now.

While exact figures are hard to come by – Google doesn’t always disclose them publicly – Search Engine Land estimates that Google Search volumes went up from 1.2 trillion in 2015 to 2 trillion in 2016.

How come?

I’m guessing that, for every power user who bypasses Google and goes directly to Amazons and Cleartrips, there are tens of casual users who still start their online shopping journey on Google i.e. use Google Search as their “destination site”.

People continue to use Google to search for concepts, phrases, lyrics and other forms of “knowledge”.

Then there’s a new use of Google Search that was probably not anticipated when the company launched its search engine two decades ago: To get clickable links to websites.

Then there’s a new use of Google Search that was probably not anticipated when the company launched its search engine two decades ago: To get clickable links to websites.

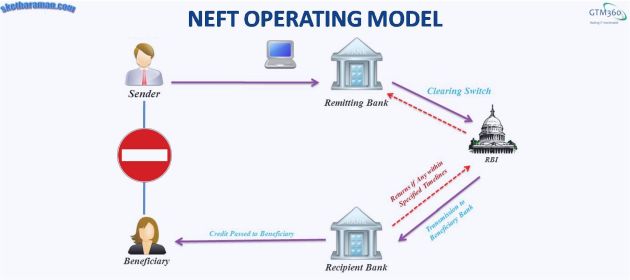

To illustrate this, I’ll take my company as an example. The quickest way to visit our website is to enter www.gtm360.com directly in the browser address bar and hit enter. But that’s only me. Going by my website’s Google Analytics reports, very few people come directly. Instead, most visitors go to Google, enter “gtm360” in the search box, hit enter and click the first entry they see on the SERP (Search Engine Results Page). This generates additional search volumes for Google.

We have seen three major usage scenarios for Google Search:

- Product search

- Knowledge search

- Website search

(I’m ignoring searches done via Google Custom Search Engine because they’re proprietary to a specific website and lie outside public domain.)

Product search volumes by power users may be dwindling but are probably growing overall because of casual users.

Knowledge search is growing from power and casual users alike. (Given that the first result of most knowledge search is the Wiki entry for that term, I’ve always wondered why people don’t go directly to Wikipedia but that’s a story for another day.)

Website search is definitely growing from all kinds of users. My confidence in this statement stems from my observation that people use this method not only to visit one-off websites whose URLs they couldn’t be bothered to remember but also to access everyday online services to which they’re registered e.g. Dropbox, Internet Banking, eTrading.

As an aside, this unorthodox – yet increasingly common – use of Google was exploited by fraudsters who launched a phishing attack on cryptowallet users.

Unlike gtm360.com, which comes up as the first entry when people enter “gtm360” in the Google Search box, these fraudsters got their phishing websites to appear above the genuine websites on Google SERP by buying Google Ads for popular keywords like “blockchain” and “bitcoin wallet.”

Because of these factors, search volumes have not taken a beating so far.

Looking to the future, will Google Search become outmoded, as Farhad Manjoo asks in New York Times?

There are two parts to the answer:

- Search volumes

- Search revenues

I doubt if Google’s search volumes will decline in the future.

They depend on consumer behavior trends with respect to the above use cases. While population of power users will rise, so will that of casual users as the next billion people come online. So, I don’t think we’ll see the end of search in the forseeable future.

I see an analogy with bank branches here: Even as existing customers are increasingly moving to digital channels to carry out their banking activities, newly-banked customers tend to use branches to get their first experience of banking – a trend that I’d covered in Why Branch And Digital Channels Will Coexist Forever.

Likewise, newly online users will turn to Google to explore the web.

I’m not so sure about Google’s search revenues in the future.

Google generates ~90% of its revenues from digital ads (Source: New York Times). Growing search volumes have translated into a steady increase in Google’s advertising revenues – despite the “ad armageddon” predicted by pundits caused by the allegedly rampant use of ad blockers.

But there are a few dark clouds on the horizon:

- Mobile search volume overtook web search volume for the first time last year. Mobile ads are cheaper than web ads

- Voice search is gaining traction lately. As users of Amazon Echo, Google Home and Apple Siri would know, there are no ads in voice search results

- Blockchain is threatening to upend the traditional ad-supported model of the world wide web. Brave browser and Basic Attention Token (BAT) are a couple of distributed apps (“dApps”) that seek to monetize the web via cryptocurrencies rather than ads.

These factors will put Google’s ad revenues under stress. When the cash machine sputters, it would strain the company’s ability to pay for the servers and datacenters required to keep its search engine humming smoothly.

Even if more users flock to its search engine, the search giant’s financial wherewithal to service the growing demand may decline. It would be interesting to see how Google overcomes this challenge, if and when it comes to pass.