In Web 2.0 and BFSI Applications, I had described several Web 2.0 applications by which the BFSI (Banking, Financial Services & Insurance) sector could provide more comprehensive and personalized service to its customers. At the time, I had noted that, barring a couple of examples of financial institutions like UBS and Dresdner Kleinwort who have used RSS technologies to distribute research to clients, Web 2.0 technologies have so far not made too many inroads into business applications, whether in BFSI or elsewhere. Subsequently, I also came across some AJAX platform vendors proposing Web 2.0 BFSI applications in the areas of Financial trading and settlement, Account provisioning and enrollment, Call center and CRM, Order processing, Field sales and service, Software as a service, Product quotation and configuration, and so on.

I recently came across a recent research paper from Deutsche Bank Research titled “Financial services 2.0: How social computing and P2P activity are changing financial research and lending”. DB Research notes that close to 40% of US internet users read blogs on a variety of topics, which “illustrates how easy it is for consumers to follow the experiences of many other users (accurately presented or not) before taking decisions”.

Subsequently, I did some looking around and found a few fully operational Web 2.0 based applications that are financial in nature, even if they’re not necessarily from traditional banks or financial institutions. By definition, all of them employ user-generated content or user-generated action, and deploy elements of Web 2.0 technologies like RSS. Many of them are in the area of collective financial action. For example, PROSPER is a leading online person-to-person (P2P) lending exchange, CIRCLELENDING supports the cumbersome administration and documentation processes involved in P2P loans between friends and family members, whereas FUNDABLE covers group financial fundraising action.

In PROSPER, borrowers specify the amount of loan they want and the maximum interest they are willing to pay. Lenders place bids for this amount with progressively reducing interest rates in an eBay-style auction. At the end of the auction, the borrower gets the loan at the lowest possible interest rate. Borrowers are urged to form groups. Because a single borrower’s default can tarnish the entire group’s reputation, the emerging group dynamics is likely to put pressure on the individual borrower not to commit a default.

In PROSPER, borrowers specify the amount of loan they want and the maximum interest they are willing to pay. Lenders place bids for this amount with progressively reducing interest rates in an eBay-style auction. At the end of the auction, the borrower gets the loan at the lowest possible interest rate. Borrowers are urged to form groups. Because a single borrower’s default can tarnish the entire group’s reputation, the emerging group dynamics is likely to put pressure on the individual borrower not to commit a default.

Because person-to-person lending excludes banks, one would imagine that it would entail negligible amount of procedure and documentation.

Looks like that’s not true … according to CIRCLELENDING, many traditional P2P loans between friends and family members end up straining personal relations, presumably because they lack clarity on important points like interest rates and repayment schedules. CircleLending, which bills itself as the “smart way to manage loans between relatives and friends”, offers services like contract negotiations, repayment scheduling, fund transfers and statementing, in order to protect the financial and emotional interests of all parties concerned in such transactions.

Looks like that’s not true … according to CIRCLELENDING, many traditional P2P loans between friends and family members end up straining personal relations, presumably because they lack clarity on important points like interest rates and repayment schedules. CircleLending, which bills itself as the “smart way to manage loans between relatives and friends”, offers services like contract negotiations, repayment scheduling, fund transfers and statementing, in order to protect the financial and emotional interests of all parties concerned in such transactions.

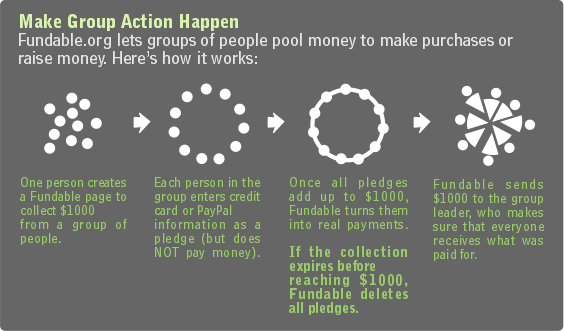

The third Web 2.0 financial application I will be covering in this post is FUNDABLE.

Fundable lets groups of people pool money for fundraising and group purchases. In the last few months that I have been following it, one popular group purchase on Fundable is a group subscription for Browsercam, a website that offers screen capture and remote access services for a wide variety of browsers. A year-long subscription costs close to 1,000 USD for 25 user licenses. Now, a private individual or a small-and-medium enterprise may find the thousand dollar tab a bit steep and would probably not need more than a couple of user licenses anyway. Fundable allows such a person or firm to create a posting (called “Fundable Page” in Fundable lingo) for collecting 40$ apiece from 25 people. If this page signs the required number of people, the fundraiser gets the required 1,000 dollars, purchases the Browsercam subscription, and gives out one user license to each of the participants of the Fundable group action. Pretty neat concept, isn’t it?

Fundable lets groups of people pool money for fundraising and group purchases. In the last few months that I have been following it, one popular group purchase on Fundable is a group subscription for Browsercam, a website that offers screen capture and remote access services for a wide variety of browsers. A year-long subscription costs close to 1,000 USD for 25 user licenses. Now, a private individual or a small-and-medium enterprise may find the thousand dollar tab a bit steep and would probably not need more than a couple of user licenses anyway. Fundable allows such a person or firm to create a posting (called “Fundable Page” in Fundable lingo) for collecting 40$ apiece from 25 people. If this page signs the required number of people, the fundraiser gets the required 1,000 dollars, purchases the Browsercam subscription, and gives out one user license to each of the participants of the Fundable group action. Pretty neat concept, isn’t it?

———-

As I mentioned before, these Web 2.0 applications are financial in nature, though they need not necessarily be deployed by BFSI companies. If any of you has come across any BFSI deployments, I’d appreciate if you could write back to me on sketharaman@sketharaman.com.

At this stage, readers may have the following nagging questions about how these applications protect the interests of all participants involved in a financial transaction.

- Beyond the social pressure against defaulting, does PROSPER provide lenders with any repayment guarantees?

- Once the successful fundraiser collects the 1,000 dollars at the end of a group action on Fundable, who ensures that she buys and distributes the Browsercam subscription to the others who have paid up 40$ each?

- Who takes the responsibility to certify that Browsercam permits resale of its license? As many readers familiar with software product licensing would be aware, many software companies have stringent conditions on their licensing agreements that prevent reselling by anyone other than their appointed Value Added Resellers (VARs).

Most of these questions are valid for all Web 2.0 applications in general.

To a large extent, they’re addressed by the excellent self-regulating framework that Web 2.0 companies have put in place. For example,

- eBay’s rating systems provides quantitative benchmarks for establishing credentials of buyers and sellers wishing to enter into transactions with each other.

- The “Challenge” facility available in Jigsaw, (a business contact marketplace), whereby any registered user can challenge an existing contact and be rewarded if the challenge is proven correct, is a step in the right direction for progressively improving the accuracy of contact information stored in Jigsaw.

However, I am sure there are still a few questions that CEOs of Web 2.0 companies think over and try to answer everyday, going by the comments I received from the CEO of a leading Web 2.0 firm that I had profiled earlier.

To the extent that Web 2.0 financial applications deal with money, these questions assume far greater significance than they do in the case of websites that deal with photos, videos and general knowledge. How well they’re addressed will determine the survival and growth of Web 2.0 financial applications.

Pingback: Covestor – Another Web 2.0 Financial Application « Talk of Many Things