In Rising Friction In Banking – Part 1, we saw four friction hotspots in customer journeys and applications in banking. In this Part 2, we’ll see four more.

5. Account Opening Audit

I received a letter from the bank where I hold my Public Provident Fund account. For the uninitiated, in India, PPF is the pension component of social security. When I visited the branch of the public sector bank, I was told that my PPF account was linked to my savings account and both got blocked because they could not locate the account opening forms for either of the two accounts during a recent audit.

I completed a long form each for the two accounts and submitted them. The banker assured me that it’s Saul Goodman.

On a side note, the bank claims that tens of millions of people have opened its accounts on a mobile app. Kudos to those tenacious people for managing to navigate such a long form on a six inch mobile device with a virtual keyboard. But I digress.

A few months later, I got an SMS saying my savings account was frozen. When I went to the branch, they repeated what they’d told me on the previous visit – “our auditors could not locate your account opening form” – and asked me to fill the same form again. I pushed back saying I’d done it a few months ago, should I do it again.

The CRM officer went to the Branch Manager’s office and ruffled through a huge envelope containing tons of account opening forms that hadn’t been entered into their CBS. Thankfully mine was one of them.

She then told me to go to a certain counter and tell the officer there to remove the freeze on my account.

I asked her, if I could simply tell the officer to unfreeze my account, why did I have to jump through all the hoops. She confessed that her throat was parched from all the shouting she’d done the whole day, that’s why she asked me to talk to the officer on her behalf!

This reminded me of a bank where the branch staff would shout out the password for Electronic Accounting Machine across the corridors of the branch 35 years ago. I shared that experience with her and asked her if that’s why her throat was parched. She laughed and told me that their CBS system requires a fingerprint ID, so shouting out passwords does not work nowadays!

Anyway, I went to the counter and told the officer to remove the freeze on my account – and he did it!

Fingers crossed that I’ve seen the last of this audit nonsense.

6. Credit Card Bill Payment

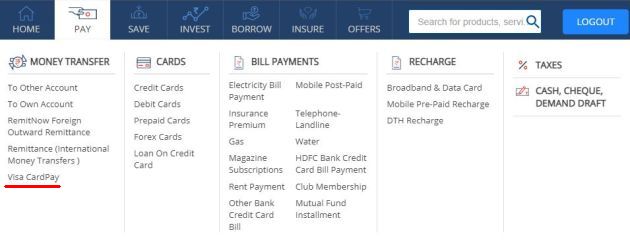

For 17 years, I’ve been paying the bill of my credit card (issued by Bank A) by using the Visa Card Pay feature on the online banking website (of Bank B). Bank B recently revamped its netbanking. I found the VCP feature at its usual place i.e. under MONEY TRANSFER section.

However, when I clicked it, it showed me some other screen. I couldn’t find any way to enter my credit card details on that screen. ByTW, I had to enter the credit card details even on the previous website every time.

Wish @HDFC_Bank VisaCardPay saved my credit card for future payments so that I don’t have to fill this form every month. #BetterCX #CROTip pic.twitter.com/nSxvdCDsCF

— GTM360 (@GTM360) August 30, 2017

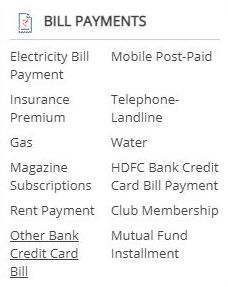

After some quick searching around, I learned that I needed to use the Other Bank Credit Card Bill feature in the Bill Pay section. (No, this bank website does not have a ChatGPT-like genAI chatbot, so I used conventional search.)

After some quick searching around, I learned that I needed to use the Other Bank Credit Card Bill feature in the Bill Pay section. (No, this bank website does not have a ChatGPT-like genAI chatbot, so I used conventional search.)

I tried the new feature but it had too much friction.

Therefore, I switched to a third party website to pay my credit card bill from then onwards. No skin off my back. The bank is the one that loses the benefits when I pay a bill from its platform.

On a side note, while banks make a huge noise about customer centricity, use of AI for personalization, etc. my experience suggests that it’s mostly humbug: A bank that truly thinks of the customer and uses personalization technology would know that I’ve used its VCP feature 204 times (once a month for 17 years), inform me proactively about its equivalent on its new netbanking portal, and guide me on how to onboard it without making me jump through so many hoops.

7. Reg Locker

When I visited this bank to access my locker, I was told that I’d need to sign a new locker agreement.

The banker asked me to get a 500 rupee stamp paper. I went to a nearby store, bought the stamp paper, and went back to the branch. The officer attached a standard contract to the stamp paper and asked me to sign it. In addition, he told me that it was now necessary to open a fixed deposit to have a locker and allow the bank to access it subject to certain conditions.

When I pushed back, he called the branch manager, who explained the need for FD: Many customers don’t pay the annual locker rentals and, by law, the bank was authorized to break the locker open if the amount was outstanding for more than three years, so they need to cover the cost of breaking and repairing the locker to cover that eventuality. When I asked him why they can’t simply put a lien on my savings account for the like amount, he gave a very sensible reason: If I have to anyway lock up a certain sum of money to avail myself of the locker facility, why not lock it in a higher yield fixed deposit than lower yield savings account.

I was convinced, signed the agreement, opened the FD, and left the bank.

As it has happened zillions of times that I’ve been banking with this bank over the last 40 years, I went into the branch mildly annoyed with the bank but came out singing high praises of its staff’s expertise!

I thought that was the end of it but I got a call from the branch staff a few months later saying RBI had changed some clauses in the contract, so I had to re-execute the contract. As a consolation prize, they told that they’d furnish the stamp paper and bear the INR 500 cost, all I had to do was visit the branch with a copy of my Aadhaar and PAN cards.

8. Credit Card Bill QR Code

I recently started using a new MasterCard credit card. (This card also came with another AMEX credit card although I haven’t used it.) When I received the statement for this credit card, I saw a QR code on it. It said I could scan the QR to pay the bill via UPI apps. (I’ve not seen a QR code on any of my other credit card statements).

When I scanned it, I got an error message on both Walmart PhonePe and Google Pay UPI apps.

I then clicked a picture of the QR and uploaded it to the bcTester app on my laptop. When I clicked Barcode > Recognize QR code command, it said the image was too small. I then used my go-to graphics software IrfanView to double the size of the QR image. bcTester resolved this QR to the following:

upi://pay?pa=ccpay.0274940378725003@icici&pn=ICICI%20Credit%20Cards&cu=INR.

I noticed that this string contained the number of the AmEx credit card viz. AMEX 5003.

I then opened Walmart PhonePe app, selected Money Transfer to UPI ID. When I entered the above UPI ID ccpay.0274940378725003@icici, PhonePe said “No such UPI ID exists”.

I then removed the leading 0 and retried with ccpay.274940378725003@icici. This time, PhonePe was able to resolve the payee details correctly.

I then made an INR 1 pipecleaning payment. Soon afterwards, I received an email receipt from the bank saying “Payment of INR 1 towards Credit Card XX5003 has been received through UPI on March 14, 2025.” Note that this is the AMEX card, not MC card.

I then tried ccpay.6241930379774001@icici on PhonePe. This is the number of the said MasterCard credit card I wished to pay. PhonePe correctly resolved this payee as well. I then initiated a INR 2 pipecleaning payment. I received an email from the bank acknowledging receipt of this payment towards MC-4001, which is the correct MC credit card.

I visited NetBanking of this account. I noticed that both INR 1 and INR 2 payments were reflecting in the SOA of MC-4001 credit card. Seems like both the Amex and MasterCard credit cards are considered as one for the sake of billing, statementing and payments. Emboldened by this, I paid the full outstanding amount due on MC-4001 via PhonePe. My temerity had not backfired: I did receive an email confirming receipt of payment towards MC-4001. Mission accomplished!

I then logged a ticket with the bank regarding this issue. I got a reply saying “Dear Sir, I’m unable to generate new QR for the credit card payment using UPI. Instead you can use “ccpay.(16digit card number)@icici on the upi id of the UPI payment to proceed with the payment.”.

This validated my troubleshooting and the resulting fix.

I ascribed five reasons in Why Banks Will Never Catch Up With The Frictionless UX Of Fintechs to explain why websites and apps of banks will never be as frictionless as those of fintechs.

- UX Mindset

- Attitude Towards Regulation

- Tolerance To Outage

- Capacity For Absorbing Losses

- Legacy

I don’t think any of them adequately explains the rise in friction that I experienced with banking processes and applications in the last few months. While #1 and #2 come close, they don’t fully explain the root cause. I’d put my money on Brute Force Digitalization combined with Overzealous Regulation.

Brute-Force Digitalization™ BFD. My next strategic investment.

— Clagett (@Clagett) March 31, 2018