A couple of years ago, ET Prime reported that core banking systems (CBS) at Indian banks were creaking under the load of burgeoning UPI volumes.

Being an account to account realtime method of payment (A2A RTP MOP), every UPI transaction pings the CBS of the payor’s bank. Suppose a payor (aka remitter) spends a total of INR 1000 split into ten payments of INR 100 each, each INR 100 payment adds to the load of his or her CBS. Since CBS systems in most – if not all – banks were installed well before UPI was launched, they were not designed to handle the load created by UPI, and will obviously start creaking.

The Joe Six Pack / Jane Six Pack (aka common man / common woman aka J6P) may make light of this problem by exhorting banks to upgrade their servers to process more transactions (TPS in industry parlance). However, that’s not so simple. Infrastructure upgrades cost tons of money. Due to Reg ZeroMDR, banks don’t make any revenue on the UPI business. Besides, if they increase the TPS rating of their CBS servers to handle the abnormal load, the extra transaction processing capacity will remain idle for most of the time (see footnote 1). So, this led to a stalemate situation.

“We have talked to the banks and presented the costs … their board asks about business implications because, as it stands, no one is making money from UPI. It is just a loss” – Economic Times.

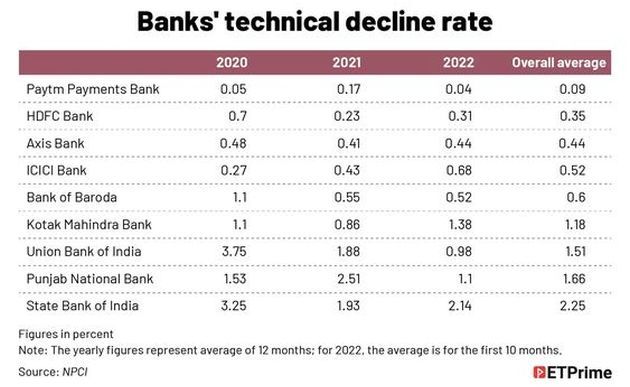

Against that backdrop, it was not so easy for banks to make additional investments in their CBS infrastructure to support UPI. As a result, their UPI onramp and offramp systems frequently breached the 1% technical decline rate stipulated by the UPI operator, as you can see from the following exhibit.

Enter UPI Lite.

UPI Lite is a wallet inside a UPI app. The remitter tops up the on-device wallet with a sum of money from their linked bank account and makes individual payments by paying down the wallet balance. Only the INR 1,000 topup transaction in the above example hits the CBS of his or her bank. Each of the individual INR 100 payments do not – they’re drawn from the wallet without going to the remitter’s bank’s systems. In short, UPI Lite is like PayTM, MobiKwik and other mobile wallets that ruled the roost for 10+ years until UPI dislodged them from the top of digital payments league table in 2016-17.

1/10 This is like UPI. 5-6 years ago, they claimed direct account payment was great advancement. Now they’re claiming UPIlite is advancement, although UPIlite is as old as the stored value card I used in Germany in 2000s and PayTM Wallet of the 2010s.

— GTM360 (@GTM360) December 1, 2023

At its inception, customers were allowed to load the UPI Lite wallet with up to INR 2,000 and make a single payment of up to INR 500 from the wallet.

I was bearish about the outlook of UPI Lite for two reasons:

- Retrograde move

- PINless operations

Let me elaborate.

Before UPI was launched in 2016, J6P was using mobile wallets like PayTM and MobiKwik, which needed to be topped up before payments could be made. UPI enabled the payor to make realtime payments directly from their bank account without locking up their money in a mobile wallet. Sold on this benefit, customers deserted the PayTMs and MobiKwiks in droves and moved to UPI apps en masse. There are nearly 50 UPI apps, with Walmart PhonePe and Google Pay owning 85% of the UPI Total Payments Value (TPV).

Before UPI was launched in 2016, J6P was using mobile wallets like PayTM and MobiKwik, which needed to be topped up before payments could be made. UPI enabled the payor to make realtime payments directly from their bank account without locking up their money in a mobile wallet. Sold on this benefit, customers deserted the PayTMs and MobiKwiks in droves and moved to UPI apps en masse. There are nearly 50 UPI apps, with Walmart PhonePe and Google Pay owning 85% of the UPI Total Payments Value (TPV).

UPI Lite came into this world and tried to tell the J6P that wallet mode was better. It didn’t take a genius to know that this would cause a ton of disconnect.

UPI operator NPCI probably anticipated this disconnect and tried to sidestep it by seguing to PINless payment, which is another feature of UPI Lite (see footnote 2). While the wallet topup transaction requires a PIN, each of the subsequent payments do not. In a TVC I watched, a woman is kneading atta (wheat flour) in the kitchen when the bell rings. One of her hands is soiled. She opens the door with the other free hand. It’s a delivery agent who has come to deliver a Cash On Delivery consignment. She can’t use normal UPI to make the payment since that needs the use of both hands, one to hold the phone and the other to enter the PIN. UPI Lite comes to her rescue. Since it’s PINless, she’s able to make the payment with just one hand. Mission accomplished! (see footnote 3)

While this was a nice ad in itself, I was skeptical if it’d achieve the purpose. To make a credit card, NEFT and other modes of digital payments, the consumer needs to jump through CVV, OTP and the other hoops of 2FA. When they complain about the friction and failed payments caused by so many moving parts, they’re told it’s all in the interest of security. It’s very hard for the same consumer to believe that UPI Lite payments are safe without a PIN or any other security step.

There were some consumers who presumably felt that INR 2,000 was a small amount, didn’t worry about forfeiting interest and making payments without PIN, and signed up for UPI Lite.

However, there weren’t too many of them, ergo UPI Lite flopped.

UPI Lite has not gained significant traction.

Without the expected top cover from UPI Lite, bank networks are choked, according to Economic Times.

A solution is desperately required.

Bankers and the media have nailed the low balance (INR 2,000) and transaction limit (INR 500) for the lackluster performance of UPI Lite. To remedy it, RBI has recently increased the balance and transaction limit on UPI Lite to INR 5,000 and INR 1,000 respectively.

This is simplistic action that misses the real reasons for the failure of UPI Lite, and might actually backfire.

The blase attitude of the few users of UPI Lite towards interest and security in the case of the old balance of INR 2,000 might not port well to the new balance of INR 5,000. People who didn’t mind losing interest or even the whole 2K might hesitate when the amount goes up to 5K. Accordingly, I seriously doubt if the new move will help.

What will?

IMO, the following two measures may have a better chance of boosting the adoption of UPI Lite:

- Pay interest on wallet balance.

- Backstop losses caused by potential hack of the wallet.

On a side note, the interest on the consumer’s wallet balance works out to INR 300 per year (6% @ INR 5,000). Given that the consumer does not get it, I wonder who pockets it.

FOOTNOTES:

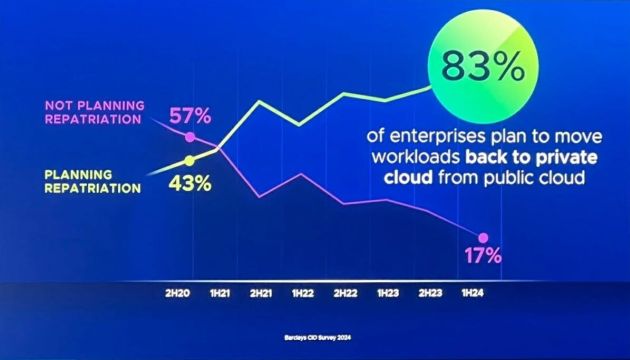

- Cloud infra can solve this. However, I don’t know a single bank in India or anywhere else in the world that has moved its CBS from onprem infra to cloud even today, let alone two years ago.

- I’d heard that UPI Lite would work without Internet connection. While that’s true after you scan the QR code at a merchant establishment, my Walmart PhonePe UPI app required Internet to scan the QR. This is the chief reason why I deleted my UPI Lite wallet.

- Although it’s a Cash on Delivery consignment, a substantial number of COD orders are paid for with digital payments, just at the point of delivery, ergo the term e-COD.