No Indian IT company has made it to the latest FORTUNE GLOBAL 500. This is despite the industry leader TCS growing faster than the list’s hurdle revenue. I’m guessing that the gap between the two last year was too wide to be bridged in one year.

No Indian IT company has made it to the latest FORTUNE GLOBAL 500. This is despite the industry leader TCS growing faster than the list’s hurdle revenue. I’m guessing that the gap between the two last year was too wide to be bridged in one year.

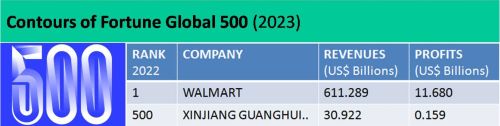

Before we do a deep dive into the industry, here’s a quick snapshot of the Fortune Global 500.

FORTUNE GLOBAL 500 – 2023

The 500 largest corporations in the world collectively generated $41 trillion in revenues. This is one-third of the global GDP.

Walmart continues to be the largest company in the world for the 10th year in a row. But Saudi Aramco is closing in very rapidly. By this time, next year, we might see an upset in the #1 spot.

The 500th company on the list is a newcomer from China: Xinjiang Guanghui Industry Investment. Can’t say I’ve heard of this company before.

The following exhibit shows the contours of Fortune Global 500.

With profit of 159 billion dollars, Saudi Aramco achieves the distinction of being most profitable company in the 28 year history of Fortune Global 500.

"Saudi Aramco is the most profitable company in the history of the world: $159B net income on $604B revenue, which is also the most profitable year ever for a FORTUNE Global 500 company. It narrowly missed #1 spot on the list to WalMart (revenue $611B)" ~ @ajs @FortuneMagazine

— Ketharaman Swaminathan (@s_ketharaman) August 8, 2023

Greater China (which includes Mainland China – People’s Republic of China, Taiwan – Republic of China and Hong Kong) continues to have the highest number of entries on the list (142). However, in a shift from last year, the aggregate revenues of Global 500 companies in USA ($13 trillion) has overtaken that of Greater China.

23 companies made their debut on the Fortune Global 500, including Daimler Truck (No. 264), Amperex (No. 292), and Uber Technologies (No. 477).

There are 118 government-owned Fortune Global 500 companies on the list, with more than two-thirds based in China.

The long-term slide of Japan was especially clear this year. As Claire Zillman / Alyson Shontell notes in THE READER newsletter dated 19 August 2023:

When Fortune released its first modern-day Global 500 in 1995… Japan had 149 companies on the list, which collectively generated 37% of Global 500’s total revenue. Fast-forward 28 years, and Japan’s presence on the list has dwindled to 41 firms that account for 7% of all revenue.

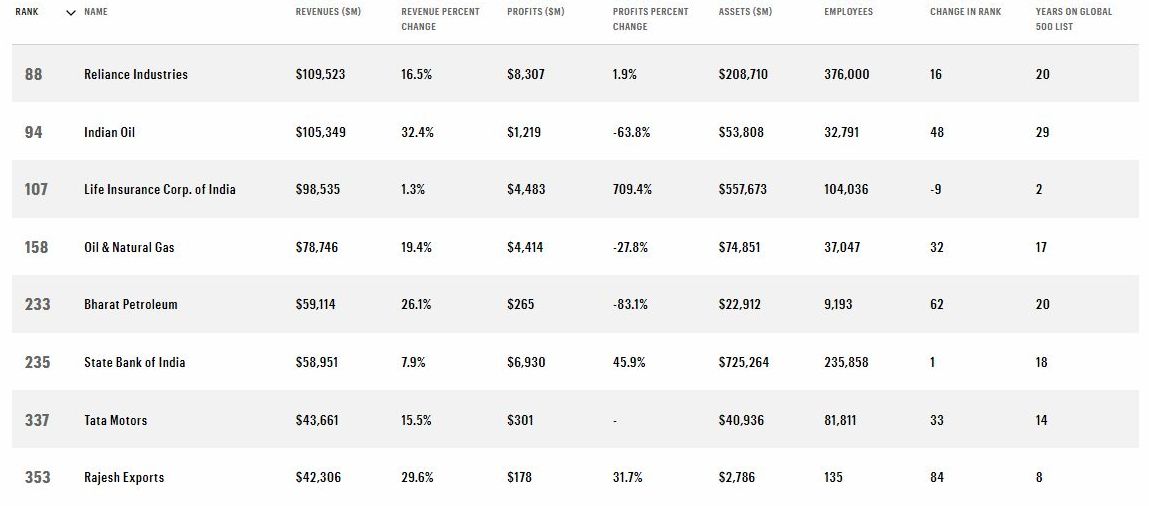

India has eight Fortune Global 500 companies.

As in the last couple of years, Reliance Industries is the largest and Rajesh Exports is the smallest Indian company on the list.

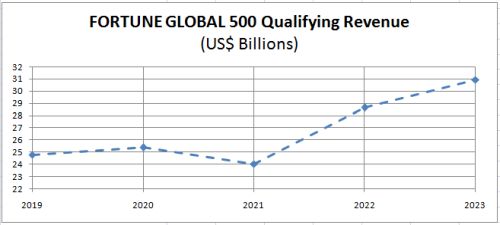

FORTUNE GLOBAL 500 QUALIFYING REVENUE

The Fortune Global 500 Qualifying Revenue rose by 7.93% to USD 30.922 billion.

For the uninitiated, Fortune Global 500 Qualifying Revenue is the revenue hurdle that a company must cross to enter the hallowed corridors of the 500 largest corporations in the world. In other words, it’s the revenue of the company ranked 500th on the list. FG500-QR has grown YoY every year in the last decade except in the lists published in 2016 and 2021.

INDIAN IT INDUSTRY

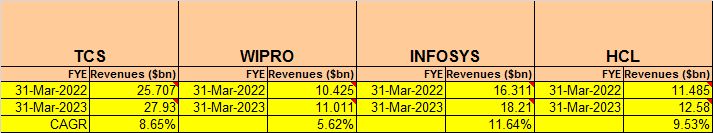

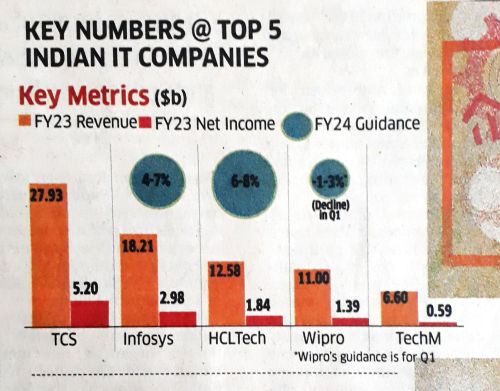

As in the past few years, TCS, Infosys, HCL and Wipro continue to occupy the top four spots by revenues in the Indian IT industry. The following exhibit shows their revenues for FYE2023 and FYE2022.

Unlike the past, I was able to find the revenues of these companies on a single chart in Economic Times.

These figures match the ones in the statutory reports filed by these companies to stock exchanges in India and USA.

With revenue of $27.93B, TCS is 9.68% behind the Fortune Global 500 Qualifying Revenue of $30.922B. The gap last year was 10.27%. While the gap has narrowed since TCS’s sales grew faster than FG500-QR this year, it has still not been bridged.

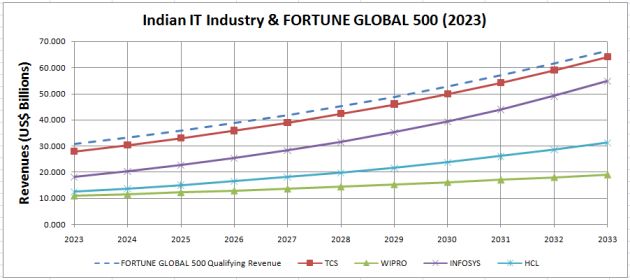

By extrapolating the current CAGRs of these four companies, I’ve forecasted their revenues for the next 10 years. I’ve then juxtaposed their revenue trajectories with the projected FG500 Qualifying Revenues for the same period. The following chart is the result:

Click here to download this model as an Excel Workbook (XLSX, 23KB).

Here are the highlights of the forecast:

- Going by the present forecasting parameters, none of the four Indian IT companies in the model will organically become a Fortune Global 500 company during the entire model’s tenure through to 2033. I’m sad at having to arrive at this conclusion for the second year in a row.

- For academic interest, the earliest any company would make it to Fortune Global 500 organically is 2039, when TCS ($105.29B) will overtake FG500 Qualifying Revenue ($104.91B).

- This can change if the Big 4 Indian IT companies engage in M&A. I’m tired of saying this because, despite eternal exhortations from industry experts, Indian IT companies haven’t done any game-changing M&As so far.

- There was some big ticket M&A buzz from Wipro around six months ago but nothing seems to have come out of it so far. Also, given that the company recently returned cash to shareholders via share buyback program, it seems unlikely that it’s pursuing any major M&A deal in the short term.

Before closing, it’s heartening to note that the top Indian IT companies have acquired an impressive roster of pilot (200+) and production (100+) projects for Generative AI, currently the hottest technology in the world. According to The Register, use cases include content creation, customer service and predictive analytics.

Indian IT Services industry leaders TCS Infosys HCL Wipro et al are delivering 100+ projects and another 200+ pilots in AI. https://t.co/3cYKEm0kR8 via @TheRegister .

Use Cases:

– Content creation

– Customer service

– Predict container price 3 months down the line

etc.— Ketharaman Swaminathan (@s_ketharaman) July 27, 2023

This throws cold water on naysayers’ repeated predictions that the Indian IT industry would get killed by cutting-edge technologies. The industry has not only weathered Y2K, Internet, Web 2.0, Mobility, Cloud, AI, and other disruptive technology waves but has emerged stronger from each one of them.