Banks have created the impression that they love credit cardholders who pay only the minimum balance every month and revolve their outstandings so that they can earn juicy interest off of them.

This has led the Average Joe / Jane credit cardholder to think that banks make money only on interest, and believe that they are sticking it to greedy banks by paying their balance in full and denying banks the opportunity to make any money from them.

but why do banks give free money this easily? To promote consumerism, they want you to go beyond your 1L threshold in the flow of things (sale, EMI, etc) and when you mess up with payments, they pounce and extract nice money.

— Shailesh (@Being_Shailesh) October 28, 2022

Ergo we see questions like this:

If only this were true!

Contrary to what the average credit cardholder believes, banks have four sources of revenue for their credit card business:

- Interest charges on outstandings. This is levied at Annual Percentage Rate (APR) of 24-36%.

- Membership and other fees charged to credit cardholder. While banks offer many credit cards for free, they also have premium credit cards on which annual fees can run into three figures.

- Interchange / MDR fees charged to merchants for giving them the privilege of accepting credit card payments. MDR is in the 2-3% range. See How To Fight Surcharge And Take #CashlessIndia To Next Level for more details.

- Ad revenues generated from advertisers for targeting credit cardholders with targeted offers. Crafted off of credit card spend data, targeted ads have a higher conversion rate than virtually any other type of ads since they not only signify purchase intent but purchasing power and purchase history unlike conventional ads like PPC that stop at purchase intent. See Your Personal Data Is Not Sold, Just Used for more details.

“You spent $400 on Amazon last month. You could've used our Amazon Rewards Card. Here’s $300 to sign up for one”.

Guess this is one of those targeted ads enabled by @cardlytics to foster loyalty & drive more sales via cross/upselling. https://t.co/CYpmWXnWk2 via @FinancialBrand— Ketharaman Swaminathan (@s_ketharaman) November 9, 2018

If a credit cardholder does not revolve his or her outstandings, their bank will not earn any interest i.e. the first source of revenue will be nil.

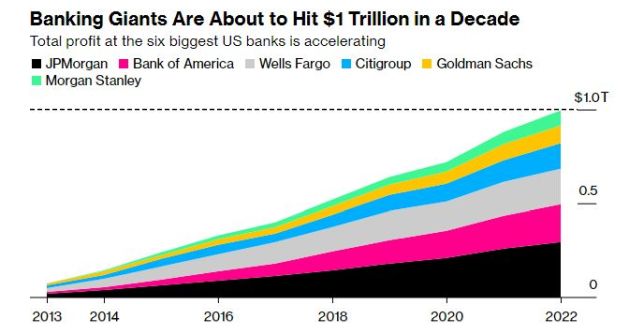

However the bank will make money from the remaining three sources – and quite a bit of money, as testified by the fact that credit card is the most profitable business in retail banking.

On a side note, I see this as one in a long line of cunning tactics used by banks to smokescreen their profits amidst widespread disdain for them among the public and the ubiquitous attempt by everyone and his dog to thumb their nose at banks at every available opportunity.

But, as always, banks go laughing all the way to the – ahem – bank.

But, as always, banks go laughing all the way to the – ahem – bank.

#FunFact: Interest rate has fallen from 15% to nearly 0% in the 70 year history of credit card industry. However, APR charged by credit card issuers has remained the same 24-36% during this entire period. Interestingly, even Jeff Bezos of the “your margin is my opportunity” fame hasn’t been able to spoil this party – Amazon cobranded credit cards have pretty much the same APR as other credit cards in the market.