Finance is full of hair splitting as I warned in Hair Splitting In Finance.

Payments is no exception. In Retail Payments Primer, I highlighted that credit card, debit card, wallet, UPI and other retail methods of payments (MOPs) are not equal.

Now National Payments Corporation of India would like us to appreciate that there are crucial differences even within a single MOP like UPI.

According to a recent circular released by the operator of UPI (among other payment schemes in India), UPI payments from PPI Wallets will now attract up to 1.1% interchange fees. (According to Economic Times, this circular was not in the public domain as on 31 March 2023. That continues to be the case one day later when this blog post was published.)

In this post, I’ll be doing a teardown of this interchange and related topics on merchant and consumer behavior in retail payments. As you might guess, it will be full of nuances.

If hair splitting is not your thing, you can skip this post.

On the other hand, if you’re a merchant accepting UPI payments and / or otherwise interested in knowing about the many variants of UPI payments and the differences in their operating model and pricing structure, you’ve come to the right place.

According to the above op-ed entitled The Great Indian UPI Migration published in the Economic Times edition dated 31 March 2023,

NPCI announced that it would charge an interchange for all purchases made via QR codes at merchant locations in excess of INR 2000.

This statement gives the impression that all merchant UPI payments above INR 2000 made with QR codes would attract the new interchange.

This is wrong! The circular references a very rare and specialized subset of merchant UPI payments made with QR codes, namely, merchant payments that are funded with PPI Wallet and are processed via UPI rails i.e. “PPI via UPI” payments and exceeding INR 2000 in value. This is a tiny fraction – 0.01% to 1% depending on which expert you ask – of all merchant UPI payments made via QR since the funding source for an overwhelming majority of UPI payments is bank account, not PPI wallet. This is true for both merchant (P2M) and person-to-person (P2P) UPI payments.

Now, the expression “PPI via UPI” hints at the existence of its compliment “PPI not via UPI”. That’s indeed the case.

Let me illustrate the difference between these two MECE (mutually exclusive and collectively exhaustive) variants of UPI payments below:

PPI via UPI

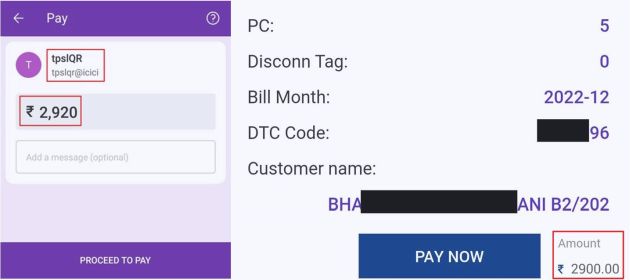

I pay a merchant using my PayTM Wallet by scanning the merchant QR code supplied by a PSP (Payment Service Provider) other than PayTM. This transaction is processed via UPI rails, and attracts the new interchange if the payment exceeds INR 2000. This is a “PPI via UPI” payment.

PPI not via UPI

I pay a merchant using my PayTM Wallet by scanning the merchant QR code supplied by PayTM. This transaction is processed via PayTM closed-loop rails. Since it’s not processed via UPI rails, it’s a “PPI not via UPI” payment and falls outside the purview of the said circular, regardless of the value.

To summarize, the new interchange is applicable only to the former type of merchant UPI payments made by scanning the QR code at a merchant establishment (and not the latter).

Just to be clear, the circular has nothing to do with P2M or P2P UPI payments made using bank account as the funding source.

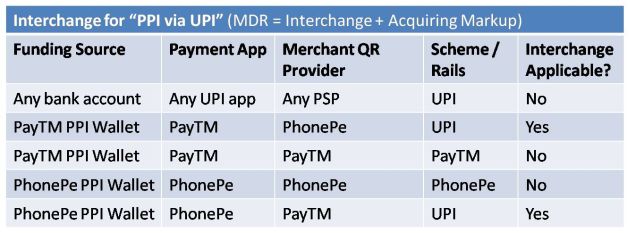

The following table summarizes the remit of the new interchange.

I’ll now move on to a few related topics around pricing structure, merchant and consumer behavior that are offshoots of the NPCI circular.

Acquirer – Not Merchant – Pays

The 1.1% fees mentioned in NPCI’s circular is reportedly Interchange, not MDR (Merchant Discount Rate).

According to the definitions in the payments industry,

- Interchange is paid by the acquirer (the bank or PSP that services the merchant) to the Issuer (the funding source or the owner of the app used by the customer to make the payment to the merchant), and

- MDR is the cost incurred by the merchant to accept a digital payment.

The relationship between MDR and Interchange is as follows:

MDR = Interchange + Acquiring Markup

Interchange is stipulated by the scheme operator – NPCI in the case of UPI, and Visa / MasterCard / RuPay in the case of credit card – and acquiring markup is quoted by the acquirer based on free market demand-supply forces.

In some cultures, people play footloose with jargon. Whether that’s out of inability at rigor or unwillingness to follow rules, they do so with the attitude that “as long as you understand what I mean, how does terminology matter”. Then they lose orders and fail interviews and find out it’s because customers / employers perceive them as sloppy and conclude that they can’t be trusted with large things in life when they can’t even get the small things right – which is certainly not what they meant. Then they change their stance if they know what’s good for them.

Assuming that NPCI has not followed that blase approach with this circular and has conformed with industry-standard nomenclature, its use of the term interchange means that the new 1.1% fee will apply to the acquirer, not the merchant. Whether the acquirer passes it on to the merchant or not lies outside the purview of this circular. Besides, the pass-through, if it happens, may not be 1:1 – the acquirer is free to add its margin, and often does e.g. In the case of credit card where interchange is 1.75%, acquirers typically add 0.25% acquiring markup to arrive at a typical MDR of 2%. In the case of UPI, I couldn’t find out the breakup of interchange and acquiring markup in the pre-ZeroMDR regime when MDR for UPI was 0.8%.

Merchant Can Decline PPI Via UPI

It’s up to the merchant to accept “PPI via UPI” payments and incur the MDR, if any.

In other words, merchants can decline “PPI via UPI” payments. This is a nod to my contention here that “it’s the Merchant who tells PayTM which payment options to offer or not on the app”.

However, going by typical merchant behavior observed worldwide over the decades, I doubt if any merchant will go out of the way to decline “PPI via UPI” payments if there’s a demand for it from consumers.

Merchants Won’t Abandon UPI

Naysayers are outraging all over social media that merchants will stop accepting UPI because of this new fee and we’ll all go back to cash. This is BS.

No merchant will say that they’re happy to incur a cost to accept digital payments but no merchant will have the guts to decline a method of payment either. Therefore, we need to look at what merchants do, not what they say.

Most people don’t recall that UPI attracted 0.8% MDR during its first three years of existence. It was only in January 2020 that the government enforced Reg ZeroMDR, which decreed zero merchant fees for accepting UPI payments.

If you compare the volumes and values of UPI payments processed by NPCI across the MDR cutover point (Source: UPI Product Statistics), you will not see a sudden spike in usage. That suggests two things:

- Just because it became free, merchants did not accept more UPI payments.

- Consumers never paid for UPI payments before and after Reg ZeroMDR, so they had no reason to change their usage of UPI after ZeroMDR came into effect.

Ergo, consumers, not merchants, shape volumes and values of UPI payments. This vibes well with the payments behavior observed globally whereby customers decide the MOP and merchants acquiesce because every MOP is a source of sales uplift.

Before ZeroMDR came into effect, credit card had 3% MDR and UPI had 0.8% MDR. After ZeroMDR came into effect, credit card still has 3% MDR whereas UPI has 0% MDR. Obviously, no merchant would be happy to cough up 3% to accept credit card when they can process a UPI payment for free. However, during the three year regime of Reg ZeroMDR, I have not come across a single merchant who accepted credit card before ZeroMDR and declines it now.

That’s because payment is the last step in the sales funnel and no merchant risks losing the sale by refusing a MOP just because it costs a bit.

When all is said and done, there are only two reasons for a shopkeeper to accept credit card: (1) He will lose business if he does not (2) He will be able to make the customer overspend if he does. https://t.co/lEDrJ60Moj via @ValuePenguin

— GTM360 (@GTM360) August 24, 2018

Small Merchants Pay More

Some people say the above logic is only valid for medium-to-large merchants. They claim that small merchants can’t afford to pay fees, which is why they don’t accept credit card, and that’s why India has such a low credit card penetration rate (5-6% of population).

This shows ignorance of how credit card industry works.

Anybody with a bank account can accept UPI – it’s a right. However, credit card is a privilege – not everybody can accept it. It’s not widely known that banks do due diligence before letting merchants accept credit card (there’s no such thing in UPI).

Before issuing a Merchant Account to enable a Merchant to accept Credit Card payments, an Acquirer Bank verifies that the Merchant can deliver what she's selling (and more).

Zelle / FPS / UPI don't.

Ergo credit card can provide fraud protection whereas A2A can't. pic.twitter.com/SL9MdbrLX6— Ketharaman Swaminathan (@s_ketharaman) December 6, 2022

Since small merchants pose high Acquirer Risk, acquirers do not issue Merchant Accounts to let them accept credit card. Therefore, a lot of stores don’t accept credit cards because they CANNOT. Cost of accepting credit card is irrelevant.

But there’s ample evidence worldwide that even small merchants would like to accept credit card.

In USA, UK, and other advanced nations, Merchant Aggregators like Square (brick-and-mortar) and Stripe (online) solve for this by taking a merchant account in their own name from an acquirer and issuing sub merchant accounts to nano and micro merchants. This allows small merchants to accept credit card without having a merchant account in their own name. For the privilege, they pay around 2.75% fees to Square / Stripe as against 2% levied by acquirer banks. Despite charging a higher fees, merchant aggregators have acquired millions of small business customers.

I’m not sure how exactly the construct of Payment Aggregators works in India but I’ve seen many small merchants even in India using eZetap, mSwipe, et al to accept credit card. I believe these mobile POS vendors charge at least 75 bps higher fees than the MDR levied by acquirer banks.

So, contrary to popular misconception, small merchants pay MORE than large merchants to accept digital payments. This is variously known as “Poverty Premium” and “Reverse Robinhood Effect” in the payments industry.

They do but not back-to-back. Merchant incurs 3% MDR cost on credit card, can't pass it as 3% Surcharge to rich people who use credit card, instead raises price to everyone incl. those who pay with cash / debit card / UPI. IOW, poor subsidize rich ergo Reverse Robinhood Effect.

— Ketharaman Swaminathan (@s_ketharaman) March 30, 2023

Precursor For “Credit Card Via UPI”

Some people in the industry are wondering why NPCI is making such a big deal about PPI via UPI when it constitutes less than 1% of all merchant UPI volumes. I’m guessing that this circular is a trial balloon for NPCI’s forthcoming policy announcements on “Credit Card via UPI”, which is likely to have a higher share of UPI TPV and unlikely to have zero MDR.

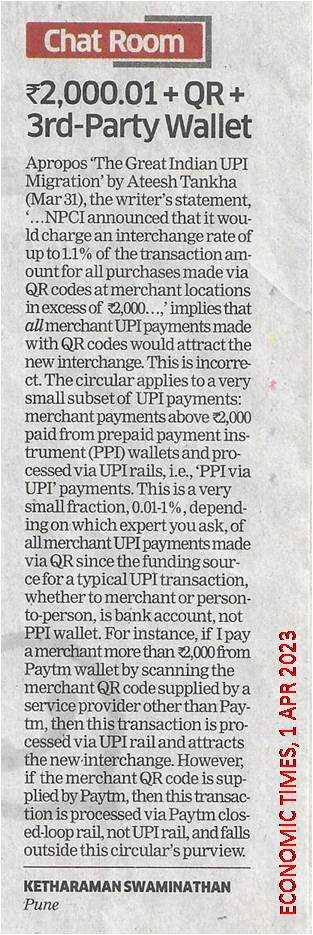

The Economic Times published a condensed version of my above post on 1 April 2023.

I was joking to my engineering college alums that, if the headline (given by ET) is any indication, we might need to use Boolean Algebra to describe and / or decipher the terms and conditions of some of these financial products – it’s becoming very hard to do this much hairsplitting in plain English!

I realized shortly thereafter that it was not a joke: I really had to use Boolean Algebra principles on creating a truth table to make the one displayed above.

It was thanks to the following succinct tweet that I was able to understand the edge “PPI via UPI” use case quickly.

Blind men & an elephant twitter edition: 100% confusion for 0.001% UPI Txns. Let me also add to this confusion? You hv to do a Txn of Rs.2k frm your prepaid wallet & scan a UPI QR of some other acquirer at a merchant who explicitly accepts MDR charge is when this gets applicable

— Deepak Abbot (@deepakabbot) March 29, 2023

Ergo I dedicate this piece to @deepakabbot.

DISCLAIMER: This post may need updates after the aforementioned NPCI circular is available in the public domain and I’ve had a chance to read it.