I don’t recall the last time I looked forward to the release of the Fortune Global 500 issue as eagerly as I did this year. (For the first time ever, I set up a Google Alert for the keyword “Fortune Global 500”. It worked, although I’d to filter out a lot of noise in the days preceding the release of the list).

Reason: I’d expected the Indian IT industry to produce a Fortune Global 500 company this year.

Alas that did not happen.

TCS Misses Fortune Global 500 By A Mile:(

Despite stellar growth of 16% ($22.174B in FYE2021 to $25.707B in FYE2022), TCS misses Fortune Global 500 by more than the whisker that I'd predicted since FG500 Qualifying Revenue grew more (19%, $24.043B in 2021 to $28.649B in 2022).— GTM360 (@GTM360) August 3, 2022

While I’m relieved that the pandemic has passed (hopefully!), I feel disappointed that TCS missed its entry into the august list of the 500 largest corporations in the world, especially after it appeared to come within a kissing distance of it last year.

Before we deep dive into the Indian IT industry’s missed tryst with Fortune Global 500 destiny, here’s a quick recap of the overall list.

FORTUNE GLOBAL 500 – 2022

This is how FORTUNE summarizes its list of the world’s 500 largest companies:

“The rebound from COVID-19 created a huge tailwind for the world’s largest companies by revenue. Scattered across 229 cities and 33 countries around the world, aggregate sales for the Fortune Global 500 hit $37.8 trillion, an increase of 19% – the highest annual growth rate in the list’s history. This is more than one-third of the world’s GDP. Profits also surged to a record $3.1 trillion, an 88% annual increase not seen since 2004.”

“The rebound from COVID-19 created a huge tailwind for the world’s largest companies by revenue. Scattered across 229 cities and 33 countries around the world, aggregate sales for the Fortune Global 500 hit $37.8 trillion, an increase of 19% – the highest annual growth rate in the list’s history. This is more than one-third of the world’s GDP. Profits also surged to a record $3.1 trillion, an 88% annual increase not seen since 2004.”

WalMart continues to be the world’s largest company. It joins Umicore to shape the contours of Fortune Global 500 for 2022. (I had to look up Umicore. The new entrant to the Fortune Global 500 is a chemicals company headquartered in Brussels, Belgium.)

China has the largest number of companies on the list (145) followed by USA (124). For the first time, revenues from Global 500 companies in China exceeded revenues from US companies on the list (Source).

India has nine companies on the list. Life Insurance Corporation of India is a new entrant, and Tata Steel returns after exiting last year’s list.

LIC is the largest Indian company. Its revenue of $97.266 billion earns it the global rank of #98.

If you’re wondering why FORTUNE magazine did not feature India’s largest company in its past Global 500 lists, I can think of one reason: As a government-owned company, it didn’t qualify for coverage in the list. It became eligible only after it became a publicly-listed company on the back of its IPO last year. Memory serves, even Saudi Aramco, the world’s sixth largest corporation, entered the list only after it got listed in Riyadh stock exchange in 2019.

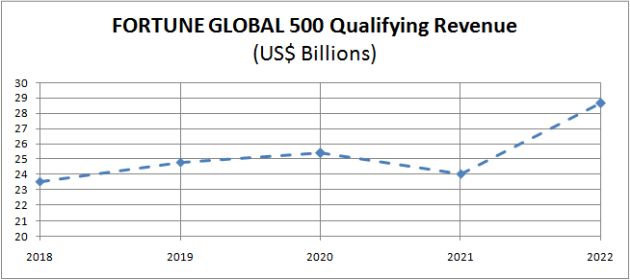

FORTUNE GLOBAL 500 Qualifying Revenue

By creating a huge tailwind for the revenues of the 500 largest corporations of the world, the rebound from COVID-19 has propped up the Fortune Global 500 Qualifying Revenue. Standing at $28.649 billion, FG500-QR has grown by a stupendous rate of 19.16% over last year. I don’t recall such a sharp rise in the entry barrier of the Fortune Global 500 in the 25 years that I’ve been tracking this number.

For the uninitiated, Fortune Global 500 Qualifying Revenue is the revenue hurdle that a company must cross to enter the hallowed corridors of the 500 largest corporations in the world. In other words, it’s the revenue of the company ranked 500th on the list. Barring a couple of years during the last decade – 2016 and 2021 – FG500-QR has always risen from one year to the next.

Indian IT Industry

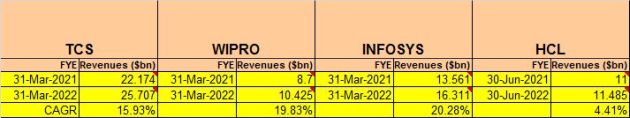

The frontrunners of the Indian IT industry by revenues continue to be TCS, Infosys, HCL and Wipro. The revenues of these companies for the current and previous year are shown in the following exhibit.

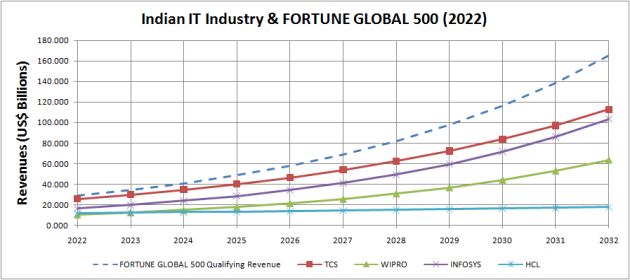

By extrapolating the current CAGRs of these four companies, I’ve forecasted their revenues for the next 10 years. I’ve then juxtaposed their revenue trajectories with the projected FG500 Qualifying Revenues for the same period. The following chart is the result:

Click here to download this model as an Excel Workbook (XLSX, 23KB).

Here are some observations about my methodology.

Dollar Revenues

Since the top companies in the Indian IT industry earn majority of their revenues from USA – and almost all of it from outside India – you might think that they’d report their revenues in USD or some other global currency. However, because all of them are domiciled in India, their financial results are in INR.

Since the top companies in the Indian IT industry earn majority of their revenues from USA – and almost all of it from outside India – you might think that they’d report their revenues in USD or some other global currency. However, because all of them are domiciled in India, their financial results are in INR.

The objective of my model is to predict the year of entry of the Indian IT industry into Fortune Global 500, a list that’s denominated in USD for all companies in the world, regardless of where they’re domiciled (dollar hard power, I know). Ergo I need dollar revenues for my model.

While searching for dollar revenues, I discovered that Infosys and Wipro file a statutory report called 20F with the US capital market regulator SEC (as against 10K filed by publicly-listed American companies). I found the dollar revenue of Infosys and Wipro from their 20-Fs on Last10K.com.

HCL Revenue

I could not find HCL’s dollar revenue on the company’s website, SEC EDGAR or Last10K. Wikipedia reports it as US$ 11 billion. That’s the same as the company’s revenue for FYE2021. I couldn’t believe that HCL’s growth had flatlined in FYE2022. Besides, I noticed that the next four KPIs on the Wikipedia page reference 2021. Therefore, I concluded that the “2022” marked beside revenue must be a typo.

I could not find HCL’s dollar revenue on the company’s website, SEC EDGAR or Last10K. Wikipedia reports it as US$ 11 billion. That’s the same as the company’s revenue for FYE2021. I couldn’t believe that HCL’s growth had flatlined in FYE2022. Besides, I noticed that the next four KPIs on the Wikipedia page reference 2021. Therefore, I concluded that the “2022” marked beside revenue must be a typo.

I found the INR revenues of top Indian IT companies, including HCL, on Economic Times. I calculated the ratio of INR and USD revenue of TCS and applied the same ratio on the INR revenue of HCL of ?85,651 crores – which is slightly lower than the figure of ?85,665 crores reported by Wikipedia – and arrived at the dollar revenue of US$ 11.485 billion.

I found the INR revenues of top Indian IT companies, including HCL, on Economic Times. I calculated the ratio of INR and USD revenue of TCS and applied the same ratio on the INR revenue of HCL of ?85,651 crores – which is slightly lower than the figure of ?85,665 crores reported by Wikipedia – and arrived at the dollar revenue of US$ 11.485 billion.

HCL’s revenue of US$ 11.485B represents a growth of merely 4.41% growth over the previous year’s figure of US$ 11B. Having competed with HCL in a former life, I find it repugnant to the company’s DNA to post such a feeble growth during a year when its chief competitors achieved double digit percentage growth. But, until I get a more authoritative source for HCL’s dollar revenue, I’m going ahead with the figure of $11.485B for the sake of my model.

Wipro Discrepancy

I noticed that Infosys had the same INR:USD revenue ratio as TCS (7457).

But Wipro did not. Its ratio of 7585 reminded me of another discrepancy I’d reported about Wipro’s numbers in TCS Slips And HCL Zips In Indian IT Industry’s FORTUNE GLOBAL 500 Race two years ago.

Forecast Highlights

The highlights from this year’s forecasting model are outlined below:

- In keeping with the popular narrative that the pandemic has dissimilar impact on different industries, I’d predicted last year that, if the pandemic persisted, IT would be favorably impacted whereas Fortune Global 500 companies in most other industries would be adversely impacted. As a corollary, I expected that the Fortune Global 500 Qualifying Revenue would flatline or decline and that the revenues of the Big 4 Indian IT companies would accelerate. Accordingly, I predicted that the Indian IT industry would enter Fortune Global 500 this year or next year.

- My second expectation has materialized: Three out of the four companies in my model have posted double digit revenue growth this year. However, with the waning of the pandemic, the FG500 Qualifying Revenue has grown even more (19.16%). As a result, even though TCS has grown by as much as 15.93% this year, it has missed Fortune Global 500 and, that too, by a mile ($25.707B versus $28.649B).

- Going by the present forecasting parameters, none of the four Indian IT companies in the model will organically become a Fortune Global 500 company during the entire model’s tenor through to 2032. I’m saddened to say that this has never happened before.

- This can of course change if the Big 4 Indian IT companies engage in M&A.

- Despite exhortations from industry experts over the past 4-5 years, Indian IT companies have resolutely eschewed game-changing M&As so far. Let’s see if that changes in future.

I hope the spike in this year’s Fortune Global 500 Qualifying Revenue is a blip. Otherwise, the Indian IT industry can kiss its aspirations of producing a Fortune Global 500 company goodbye for the forseeable future.

On a side note, this is the second time that the entry barrier to the Fortune Global 500 has lowered in recent memory. On both occasions – 2016 and 2021 – I seized the opportunity to optimistically predict that an Indian IT company would breach the FG500 barrier sooner rather than later. But a sharp rise in the FG500 qualifying revenue the following year has rained on my parade both times.

Maybe I should take this as a lesson that I should be bullish about the prospects of the Indian IT industry only if I’m equally bullish about the outlook of the global economy as a whole?