We ended Banks Have Not Lost The UPI Plot on a sobering note:

Sadly, interoperability has been given the short shrift in the way UPI has evolved.

In this post, we’ll see how interoperability has lost the UPI plot.

One of the founding principles of UPI is “interoperability”, which stipulates that anyone with any UPI app should be able to send money to anyone else with any other UPI app by simply using the receiver’s VPA (Virtual Payment Address) aka UPI ID.

One of the founding principles of UPI is “interoperability”, which stipulates that anyone with any UPI app should be able to send money to anyone else with any other UPI app by simply using the receiver’s VPA (Virtual Payment Address) aka UPI ID.

For the uninitiated, there are 50+ UPI apps in India, of which around 40 are from banks and 10 are from nonbank fintechs. For reasons explained earlier, banks haven’t pushed their UPI apps aggressively. The top three are fintech apps viz. Walmart PhonePe, Google Pay and PayTM.

UPI has been around for five years. Assuming you’ve been using it for a while, do you know

- What’s VPA?

- What’s your VPA?

I thought so, too.

But you’re not to blame. The widespread lack of awareness of one of the basic elements of UPI is caused by factors beyond consumers’ control.

Not a single leading UPI app makes it easy for their users to find out their VPA. Some claim that they go out of their way to make it hard.

I agree about the “hide VPA” part.

But “ban and fine” is silly.

UPI is what it is today because of the massive distribution push given by fintechs to acquire customers and merchants. If scheme operator NPCI bans companies that generate 93% of its volumes, the entire edifice of UPI will come crashing down.

But, either way, since VPA is not widely known, it’s hardly used to make UPI payments.

What people typically ask before initiating a UPI payment is “Are you on GPay?”.

If the answer is yes, they type the beneficiary’s mobile phone number to make the payment.

If the answer is no, the next question is “Are you on PhonePe / PayTM?” – not what’s your VPA.

I don’t use UPI often – huge credit card fan! – but, on the rare occasions that I’ve used it to make a payment, I’ve asked the beneficiary for their VPA.

Not a single person has understood my question.

As a receiver, I’ve not been asked by a single payer what my VPA is.

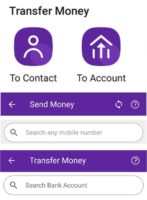

Just as well. On Walmart PhonePe, the #1 UPI app, I can’t even find any way to make a payment by VPA / UPI ID. The only two options to transfer money are “To Contact” and “To Account”. Even if the beneficiary had told me their VPA, I couldn’t have done anything with it.

But this should not come as a surprise to anyone who knows the business model of fintechs.

Like all startups, fintechs operate on the VC investment model, which must drive the “Winner Takes All” outcome. Telling consumers to “use any app, as long as it’s UPI” does not jell with that model. Ergo, Fintechs strive to keep consumers on their own platforms, even it means throwing interoperabilty under the bus. That they have done a great job of it is reflected by the fact that the top three UPI apps – all from fintechs – have garnered 93% market share of UPI volumes.

As a result, interoperability has been sacrificed. In effect, UPI has devolved into multiple walled gardens / closed loop payment systems connected to bank accounts. Which is exactly the opposite of what its founding fathers had wanted when they envisaged UPI.

People are right in lamenting about it.

But, IMO, UPI lost the interoperability plot well before Winner Takes All set in. The way I see it, interoperability was compromised the moment UPI introduced

and failed to curb ill-formed VPAs.

Doubt if a VPA like johndoe@okicici-ICIC0002390-000502054296-UPI will drive much interoperability, however prominently it’s displayed by a UPI app.

But all is not lost. There are still ways to revive interoperability in UPI.

More in a follow-on blog post. Watch this space!

DISCLAIMER: This post is speculative and is the result of my connecting of the dots that I’ve seen in the public domain. It does not purport to provide any inside track into the thought processes, business plans or financials of banks or fintechs around UPI, except if noted otherwise. This post is also not legal or investment advice.