There’s a wide gulf between what one can do and what one will do.

Can depends on ability whereas will depends on wish. The two are not always aligned.

Without realizing this, many people jump to simplisitic conclusions about motives and behaviors of individuals and companies. This includes troll armies on Twitter spinning conspiracy theories and regulators introducing harebrained rules.

There are many examples in consumer behavior, marketing, fintech, crime and other facets of everyday life that show that just because you can do something doesn’t mean that you will do it.

In Part 1 of this blog post, I’ll cover seven of them.

1.

You can sit in a Starbucks all day without ordering anything. Therefore, you will.

Just because you can sit in a Starbucks all day without ordering anything doesn’t mean you will.

In my 20+ years of visiting various outlets of Starbucks in several countries, I haven’t seen a single guy who has done this. Have you?

2.

You can’t see a security camera. Therefore, security camera can’t see you.

Just because you can’t see a security camera doesn’t mean security camera can’t see you!

You can’t spot a CCTV camera from one kilometer away. However, the Fujifilm SX800 can read your license plate from that distance. The long range surveillance camera brings about a paradigm shift in how people and motorists should think of CCTVs (Source).

3.

Customers can find their own solutions. Therefore, they will.

Just because customers can find their own solutions in the digital world doesn’t mean they will.

There are at least three good reasons why human sales reps are still required, at least in the B2B technology products and services space with high ticket size (five figures or more). Click here to know what they are.

4.

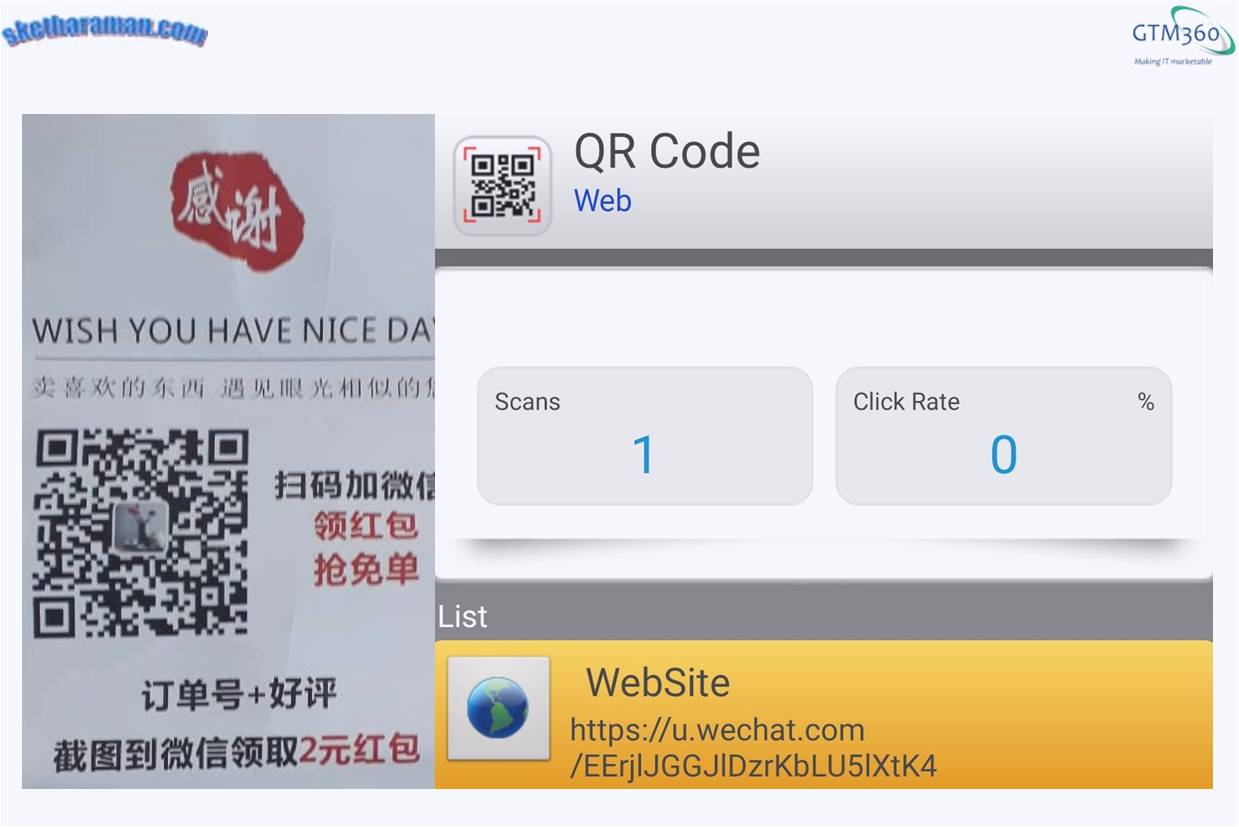

People scan QR codes regularly to make trillions of payments a year ($26T in China, $625B in India, $300B in USA). Therefore, they will scan each and every QR code they see.

Just because people scan QR codes regularly to make trillions of payments a year ($26T in China, $625B in India, $300B in USA) doesn’t mean they will scan each and every QR code they see.

According to anecdata, scan volumes of QR codes found in print and outdoor ads are abysmally low.

But there’s good news: You can stimulate scans and click thru’ rates of your QR codes in both B2C and B2B ads and marketing collateral by using them in the right context. Download our QR360 Framework (PDF 730KB) to find out the best practices in this space.

5.

Real Estate Agents receive commissions only for “closed deals”. Therefore, they will push customers to close deals all the time.

Just because Real Estate Agents receive commissions only for “closed deals” doesn’t mean that they will push customers to close deals all the time.

I’ve bought, sold and rented umpteen number of houses in many countries including India. Not once has a Real Estate Agent pushed me towards doing a deal if I didn’t show enough interest. The way the industry works, every Real Estate Agent has several houses in his or her inventory to show to several prospects in their Rolodex. Agents get their commission regardless of which prospect strikes a deal for which house, as long as one of them does for one of them. Therefore, they don’t need to push every prospect towards every house. Click here for more.

6.

There are more poor people than rich people. Therefore, poor is more popular than rich.

Just because there are more poor people than rich people doesn’t mean that poor is more popular than rich.

Likewise, just because there are more than 900 million debit cards and 250 million UPI users and fewer than 50 million credit cards in India doesn’t mean debit card and UPI are more popular than credit card.

As I highlighted here, credit card is a privilege whereas debit card / UPI is a right, so you can’t compare their popularity by number of customers.

7.

There’s scope for conflict of interest. Therefore, there will be conflict of interest.

Just because there’s a scope for conflict of interest doesn’t mean there will be conflict of interest (or a practical way to avoid it).

Under the present system of credit rating, which dates back a long time, issuer of the debt pays the Credit Rating Agency to get their products rated. People conveniently jump to the conclusion that, in this system, issuers will demand higher ratings so that they can minimize their cost of borrowing. If they applied the same logic in an opposite system where the investor pays the CRA for ratings, they’d realize that investors in debt would demand lower ratings so that they can maximize their yield. Either way, there’s scope for conflict of interest in theory.

You can’t do much about it because, if nobody pays CRAs, there will be no credit ratings, which is not a great outcome in practice.

It should mean something that the same bunch of CRAs who precipitated the Great Financial Crisis in 2007 still enjoy 94% share of the ratings market ten years later. More in Why Nobody Went To Jail For Great Financial Crisis.

If Issuer pays, he'll want higher rating to minimize interest rate. If Investor pays, he'll want lower ratings to maximize yield. Kudos to Arvind Chari / Quantum Advisors for pointing out that it's not so easy to eliminate conflict of interest in the credit rating business. #CRA pic.twitter.com/zofr91Ajc0

— Ketharaman Swaminathan (@s_ketharaman) March 11, 2019

There’s more!

In Part 2, I will give eight more examples that show that just because you can do something doesn’t mean that you will.

Watch this space!