We regularly come across founders of software companies who have achieved a certain degree of success in India and now wish to take their product global.

This is a perfectly sensible strategy because overseas markets are extremely lucrative.

But many of these “export initiatives” flounder.

Because what works here does not work there.

UPI is Exhibit A of such a product.

For the uninitiated, Unified Payments Interface is an Interbank / Account to Account Real Time Payments system in India. Launched by National Payments Council of India in 2016, UPI enables individuals and businesses to send money to one another’s bank accounts in real time 24*7*365.

In the four years since its launch, UPI has gathered tremendous traction. According to latest reports, UPI does an annual volume of 12 billion transactions. While that’s only 0.8% of the 1.5 trillion cash transactions made in India last year (Source: ET Prime), it crosses the psychological milestone of billion transactions a month. For UPI’s operator, National Payments Corporation of India, that’s enough reason to drink some Kool Aid and proclaim that the world needs UPI.

In the four years since its launch, UPI has gathered tremendous traction. According to latest reports, UPI does an annual volume of 12 billion transactions. While that’s only 0.8% of the 1.5 trillion cash transactions made in India last year (Source: ET Prime), it crosses the psychological milestone of billion transactions a month. For UPI’s operator, National Payments Corporation of India, that’s enough reason to drink some Kool Aid and proclaim that the world needs UPI.

World needs UPI,

1. Domestic payment rails

2. Partnerships of banks and fintechs

3. Instant, 2FA, superior consumer experience

4. Asset lite interoperable QR for P2M

5. Mandates support

6. Ready for Billion-a-daySooner than later! @NPCI_NPCI @UPI_NPCI #AtmaNirbharBharat

— Dilip Asbe ?? (@dilipasbe) June 24, 2020

In this blog post, we will predict UPI’s chances of success in overseas markets and provide some guidance on how UPI and other products from India can make headway in developed markets.

Value Proposition Of UPI In India

The digital payments market in India is characterized by the following factors:

- Huge fillip given by government diktat

- Low credit card penetration

- Low POS terminal penetration

- Heavy friction and high rate of failed payments, caused by two factor authentication

- Cooling period and other cumbersome features of existing online payment methods

- 70% of the banking industry is government owned

- Majority of retail payments are made without queues

- Low penetration of desktop / laptop and broadband

- Zero MDR

- Low privacy expectations.

UPI has a strong value propositon for India against this backdrop.

There was a huge cash crunch in the aftermath of the government’s diktat to re/demonetize high value currency notes in 2017. UPI stepped in immediately to help consumers move from cash to digital payments under the #CashlessIndia initiative.

There are nearly 900 million bank accounts in India. It’s safe to assume that every Indian with disposable income has at least one bank account. By using the ubiquitous bank account as the funding source, UPI has obviated the need for credit card to make digital payments.

UPI replaces the POS terminal with a QR code printed on a piece of paper. Consumers simply scan the Merchant QR code with the UPI app on their smartphone, and the payment is done.

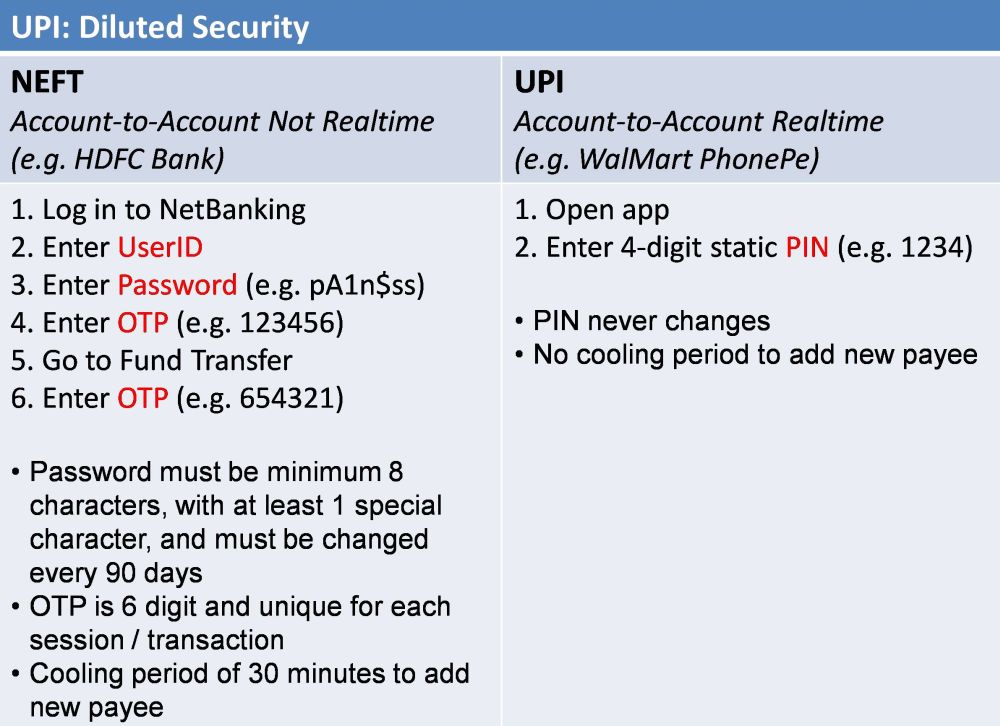

In India, access to bank account requires a password that’s at least 8 characters long, has at least one special character, and changes every 90 days. After logging in, every money transfer requires a Mobile / Email OTP. In other words, each payment must have a different password. That’s not the case with UPI. Security in UPI comprises one, solitary, static, 4 digit PIN that never needs to be changed. With that, UPI not only accesses your bank account but also makes payments out of it. In this manner, UPI shields the payer from the OTP dance required to complete payments with other Method of Payments that comply strictly with RBI 2FA mandate. By diluting security – if not also deftly circumventing the RBI 2FA mandate for digital payments – UPI eliminates friction and lowers the incidence of failed payments innate in explicit 2FA mode of payments. More at Why Two Factor Authentication Is A “Conversion Killer” & “Blood Pressure Booster”.

In India, access to bank account requires a password that’s at least 8 characters long, has at least one special character, and changes every 90 days. After logging in, every money transfer requires a Mobile / Email OTP. In other words, each payment must have a different password. That’s not the case with UPI. Security in UPI comprises one, solitary, static, 4 digit PIN that never needs to be changed. With that, UPI not only accesses your bank account but also makes payments out of it. In this manner, UPI shields the payer from the OTP dance required to complete payments with other Method of Payments that comply strictly with RBI 2FA mandate. By diluting security – if not also deftly circumventing the RBI 2FA mandate for digital payments – UPI eliminates friction and lowers the incidence of failed payments innate in explicit 2FA mode of payments. More at Why Two Factor Authentication Is A “Conversion Killer” & “Blood Pressure Booster”.

The decade-old NEFT and IMPS interbank payment methods in India are cumbersome to set up. It’s easy to make mistakes while entering the payee’s account number (“Is it four zeros or five zeros?”) and IFSC code (“Is it the number 0 or the letter O?”). Once you’ve nailed all of that, you have to wait for a few hours (“cooling period”) before you can initiate a new payment. In contrast, UPI lets you make interbank payments simply by entering the payee’s mobile number or UPI ID, and does not impose any cooling period.

Going by HDFC0000539, SBIN0006319, KKBK0001758, etc., if you thought all 7 characters following the alpha bank identifier in an IFSC Code are numerals, think again. IFSC Code of Bank of Baroda Pune Camp Branch has only one numeral. #DECAlphabet pic.twitter.com/tIJQn9uK5F

— Ketharaman Swaminathan (@s_ketharaman) October 30, 2019

70% of Indian banks are public sector banks, so they had to obey the government’s diktat to join UPI. This “forced distribution network”, to borrow a phrase from @CanadaKaz, gave a massive reach / addressability for UPI payments almost from Day One.

Let’s see how a typical UPI payment is made: Customer takes out her mobile phone, enters a password to get past the lockscreen, locates PhonePe, Google Pay or whatever UPI app she has installed from among the dozens of apps on her smartphone, opens the app, scans a QR code or enters the payee / merchant’s mobile phone number manually, types in the amount to the paid, selects the bank account from which she wants the payment to be made, hits the PAY button, enters her UPI password, receives confirmation, and shows it to merchant. Obviously, this takes much more time than tapping a credit card on the POS terminal and moving on.

The extra time taken to make a UPI payment hardly matters when there’s no one waiting in a line behind you, more so in a time rich country. But, imagine what would happen if you were standing in a long line at checkout. People will be impatient for you to move on. UPI will be impractical. Not surprisingly, I’ve rarely seen a UPI payment in a supermarket (e.g. Big Bazaar, DMART, etc.), which is one of the very few examples of queued checkouts in India. In these stores, customers pay with cash or credit card / debit card, which are faster and more frictionless than UPI. Since organized retail accounts for only 10% of retail sales in India, a vast majority of retail payments are made at mom-and-pop stores, where there’s no line and UPI works fine.

I thought so too before Demonetization but noticed later that extra steps in mobile app matter only in queued checkouts. Ergo low UPI use in supermarkets. In unorganized retail, there's no time pressure at checkout. Mobile app friction doesn't matter, esp. in time rich cultures:) pic.twitter.com/zgcqognJ9V

— Ketharaman Swaminathan (@s_ketharaman) March 17, 2021

For a vast majority of Indians, their mobile phone is their only source of computing and Internet connectivity. NEFT and IMPS struggled to gather traction since they typically expected a desktop or laptop, which have low penetration in India. Mobile payments like UPI provide the only practical way to use digital payments.

Indians share their mobile phone numbers freely. It’s virtually impossible to get a bank account in India without a mobile number. As a result, UPI has no problem in asking and getting users’ mobile phone numbers.

At the beginning of 2020, the Indian government enforced the new #ZeroMDR regulation for certain categories of digital payments. You can find more details on MDR, see How To Fight Card Payment Surcharge And Take #CashlessIndia To Next Level. But, in plain English, #ZeroMDR means banks cannot charge fees for letting merchants accept UPI (and RuPay debit card) payments. In other words, UPI is free-of-cost for merchants. As a result, there has been a spurt in acceptance of UPI payments by merchants. This has given a big boost to the UPI transaction volumes in India. (Of course, #ZeroMDR has also reduced the incentive for banks and PSPs to promote UPI payments. But, since 70% of the banking industry in India is in the public sector, banks had no choice but to tow the government’s line. Besides, the negative impact of #ZeroMDR will not be visible in the short term.)

Value Proposition of A2A RTP In Developed Markets

USA, UK and other developed countries have a very different digital payments landscape, for both P2M and P2P payments.

Person-to-Merchant Payments

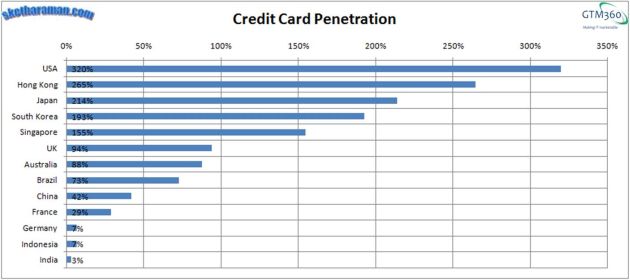

Consumers and Merchants have an extremely high credit card and POS penetration respectively.

As the following exhibit shows, USA has 320% credit card penetration (versus 3% in India).

Consumers are accustomed to making credit card payments for decades. Besides being well-entrenched, credit card offers rewards, deferred payment, fraud protection and many other benefits, as I highlighted in Credit Card Versus Debit Card. An A2A RTP like UPI does not offer these benefits.

A majority of retail payments are made in organized retail stores, where there’s a line at checkout. As we saw earlier, UPI is not practical in queued checkout scenarios.

Why would a consumer using credit card in these countries switch to an alternative payment method? Yes, I thought so too. This makes it extremely difficult for any card alternative payment product like UPI to crack these markets.

If "10X better" is hard enough, imagine how much harder "(10^3)X better" is. That's how good a credit card alternative must be to trigger people switch to it. Since credit card is a three-sided network, any alternative has to be 10X better for each side.https://t.co/2BnTYLI6HH

— Ketharaman Swaminathan (@s_ketharaman) January 27, 2020

As testimony, take a look at the major retail payment products launched in the US in the last 5-10 years:

- Square, which enables micro and nano Merchants to accept plastic credit card payments on iPhone and iPad (with a hardware dongle). These are merchants who did not qualify for Merchant Account from traditional banks and could not accept credit card before Square came along and offered them what I call “Sub Merchant Account”

- Apple Pay, which tokenizes a credit card (but not bank account) and enables frictionless instore and online credit card payments by just using FaceID or Touch ID. Click Apple Pay Puts Banks Squarely At The Center Of Mobile Payments for more details

- Samsung Pay, which converts an existing POS terminal to support mobile payments via plastic credit card

- Apple Card, which is a physical MasterCard credit card issued by Goldman Sachs’ Marcus Retail Banking Division bearing the Apple brand

- Apple Mobeewave, which converts an iPhone into a POS terminal for accepting plastic credit card payments (without any extra hardware).

Square’s dongle was perceived as a pathbreaking invention when it was launched over 10 years ago. But, today, it could be argued that the dongle is clunky. Accordingly, Apple Mobeewave, which eliminates the dongle, is a step up in innovation and User Experience. Personally, I’ve always held that Square’s real secret sauce was bundling a Merchant Account, which expanded the card acceptance market to nano and micro merchants who never stood a chance of getting a Merchant Account directly from an Acquirer Bank. If Apple Mobeewave does the same, it can potentially displace millions of Square merchants in the US by virtue of its better UX and arguably lower cost. But I digress.

My point is that all of the successful new P2M digital payment products in USA in the last decade work over card networks. (See Overview Of Payment Rails for more details on different types of payment rails.)

Person-to-Person Payments

Developed markets do not have 2FA for online payments. In the USA, instore card payments do not require PIN. Online card payments do not require VbV / MSC / OTP. It could be argued that the 4-digit UPI code required to make a UPI payment actually adds friction.

Developed markets have a high penetration of desktops / laptops and broadband connections. In Europe, customers have been making account-to-account payments from their online banking portals for 20+ years. For the last 10 years or so, they have been processed instantly. As I highlighted here,

Germany had digital payments well before India implemented NEFT and RTGS, let alone IMPS and UPI. When I opened my first bank account in Germany in circa 1999, the Branch Manager told me that no one used checks in Germany but hinted that, since I came from a third world country, I might not be comfortable with digital payments, and handed me five paper checks. In a country with $40K per capita income, enough people can afford $2000 desktops and laptops whereas in a $3K per capita income economy, the majority of Internet access happens via cheap $100 mobile phones. Likewise, in a rich country, the average resident is not going to keep trying out every new digital app just to get cashback worth peanuts.

As a result, a mobile payment does not have such a strong compelling reason for adoption in developed markets.

The banking industry is largely in the private sector in USA, UK, etc. As a result, banks in developed countries can’t be compelled to join a scheme like UPI by government edict. On top of that, there are nearly 5000 FDIC-insured Financial Institutions (banks plus credit unions) in USA. So, it would be extremely difficult for UPI to spread to all – or even majority – of banks in America. Absent that, it will have low reach.

5 years after launch, UPI is live at 213 banks in a market where 70% of banks are state owned.

Consider USA: ~5000 pvt sector banks.

Now it should be clear why UPI's success is not that easy to replicate in other markets. https://t.co/bXByWeO0lW— GTM360 (@GTM360) March 11, 2021

It’s unfathomable for governments in developed countries to mandate a knee-jerk regulation like #ZeroMDR. As a matter of fact, Visa and MasterCard have refused to comply with the reg even in India. If NPCI has its way, #ZeroMDR may not last long even for UPI and RuPay debit card payments in India. Absent that, there’s no compelling reason for merchants in developed countries to accept UPI payments.

ZeroMDR is another reason for high adoption of UPI (in India). Such a regulation is unimaginable in developed markets as their banking & payments industries are in private sector. If NPCI has its way, #ZeroMDR will not last long even in India. pic.twitter.com/3vAaRvWr5M

— GTM360 (@GTM360) July 29, 2020

People are relatively more privacy-conscious in the West and don’t hand over their mobile numbers so liberally. Neither do they have to disclose mobile numbers to open bank accounts. This threatens the very feasibility of UPI, which uses mobile phone number as the primary identifier of both payor / consumer and payee / merchant.

While banking is regulated in USA, regulation is light brush compared to India. Fed, the American banking regulator, has been trying to push Expedited ACH, A2A RTP and 2FA in USA for 15 years. It hasn’t achieved much success with any of these initiatives. Banks enjoy float when payments take 3-5 days to clear via incumbent payment methods (ACH and Checks), so they have stonewalled both Expedited ACH and A2A RTP, which will cut down float to zero or therabouts. Merchants have rejected 2FA for the justifiable fear of loss of sales. Whatever little market exists for UPI-like P2P payments in USA has already been mopped up by Zelle, Venmo, et al.

P2P volumes in the US are one-hundredth of P2M volumes, so there isn’t much incentive for anybody to launch a dedicated P2P payment product in the USA.

Whither UPI?

As you can see, the major pain areas and drivers of UPI’s success in India are absent in USA, UK, etc.

Ergo, UPI is a solution seeking a problem in developed countries. While it may have cutting edge technology, UPI lacks a strong value proposition in these markets.

In fact, Account-to-Account Real Time Payments like UPI have been around in developed countries well before UPI was launched in India. Examples include Venmo, Zelle and PopMoney in USA; FPS, PayByBank, PayM, PingIt, Zapp in UK; and iDEAL in Netherlands. But many of them failed to gather traction and have shuttered down. I don’t see why UPI’s prospects will be any better.

Some people have made a big deal of the fact that Google has recommended UPI for the US Real Time Payments network. They probably don’t know that Google is itself out of the picture in this space: Google has no role to play in either RTP, which is a private sector realtime payments rail from The Clearing House that went live in 2017, or in FedNow, which is the public sector equivalent from Federal Reserve Board that’s slated for launch in 2023. So that’s a damp squib. More recently, Google’s payments business has gone on ventilator at the company’s Mountain View headquarters.

Over 40 countries have Account-to-Account Real Time Payments now. The first three to implement it were:

* 1973: Japan – Zengin

* 1987: Switzerland – SIC

* 1992: Turkey – TIC-RTGS#NEFT #IMPS #UPI .https://t.co/S3BMZk9ZHj— Ketharaman Swaminathan (@s_ketharaman) July 23, 2020

Also what UPI does within India – A2A RTP – has been done by SEPA ICT (Instant Credit Transfer) across 36 countries in EU since 2017.

When we implemented SEPA Credit Transfer at a Top 3 UK Bank in 2007, it was a cross border T+2 payment system.

TIL SCT became SEPA Instant Credit Transfer in 2017, which is realtime across 36 countries in EU.https://t.co/AeAyIJ6VEz— Ketharaman Swaminathan (@s_ketharaman) August 22, 2022

But all is not lost for UPI’s global ambitions.

Other countries in emerging markets may also have the same pain areas as India, so they could be the low hanging fruit for UPI’s expansion plans (barring developing countries that launched their A2A RTP products well before UPI e.g. AliPay and WeChat Pay in China, mPESA in Kenya).

"How FedNow, the (US) govt’s new Account to Account Real Time Payments system could transform commerce" ~ https://t.co/xstAj7kac4 .

Dozens of nations around the world – including UK, India, Poland, Mexico & Nigeria – already operate A2A RTP systems. #FPS #UPI— Ketharaman Swaminathan (@s_ketharaman) August 11, 2020

As for developed markets, UPI has little chance of succeeding there. It would be a gross waste of taxpayer money to fund NPCI’s export ambitions in USA, UK, etc., at least not with its current weak value proposition.

Different countries have different ways of doing business, taxonomy, cost-versus-revenue sensitivity, tolerance to friction, availability of external sources of data, regulations, and so on. In some countries, people are time rich and money poor whereas in some other countries, they are time poor and money rich. They have different itches to scratch and pains to alleviate. What works in one market does not work in another market.

"Several countries such as Asia, Africa and the Middle East have displayed interest in UPI …" ~ @NPCI_NPCI via https://t.co/qst47iWkn0

Second Law of International Marketing: Distinguish between Country & Region. pic.twitter.com/88KmoyYEko

— Ketharaman Swaminathan (@s_ketharaman) August 31, 2020

To appeal to different markets, a product vendor needs to develop a diverse set of value propositions that will resonate strongly with business pain areas and hot topics in each individual country.

To appeal to different markets, a product vendor needs to develop a diverse set of value propositions that will resonate strongly with business pain areas and hot topics in each individual country.

(This should not be confused with “localization”, which merely entails adapting your product’s screens, menus, master data and manuals for language, nomenclature, spellings, and other attributes in each country, but does not involve any change in value proposition from one country to another.)

To illustrate how we do this, let’s cite the case study of our work for a company whose network security product was the category leader in its home market. Sadly the product’s value proposition was barely understood in overseas markets. We developed a new set of value propositions that helped the company shorten sales cycles and increase lead-to-deal conversion rates in those markets. Click here for more details of this success story.

Please feel free to contact us if you need help in taking your product global.

UPDATE DATED 1 APRIL 2022:

Pitching UPI to USA and countries in the West is like pitching DOLO650 to a guy who doesn’t have a fever. No matter how much you extoll praises of DOLO650 against CROCIN, he’s not going to buy it. There’s nothing wrong the guy or the product. The problem is with the pitch. By using it to try and sound patriotic, you’ve made a fool of yourself and a mockery of Atmanirbhar Bharat, BMKJ, etc. Exhibit A of #FauxPatriotism.

UPDATE DATED 22 JUNE 2023:

In the 45 years of existence of credit card industry in India until 2019, banks had issued 40 million Visa / MasterCard credit cards. In the next three years, they issued another 40M Visa / MasterCard credit cards. In other words, the Indian credit card industry has repeated its 45 year old track record in three years, right under the nose of UPI. (During this period, Indian banks issued only 1 million RuPay credit cards, so the local credit card network is still a tiny fraction of Visa / MasterCard).

Even NPCI, the UPI scheme operator, has acknowledged the explosive growth of credit card in its recent circular.

That leads me to believe that UPI has cannibalized NEFT, cash and cheque payments. Not credit card.

However, if you ask the man on the streets of India, he’d claim that UPI has killed Visa / MasterCard credit card. That’s partly because of nationalistic reasons and due to his ignorance of facts and figures on the ground but mostly owing to Sour Grapes Feeling caused by not qualifying for a Visa / MasterCard credit card.