In Want v. Like: Decoding The Eternal Disconnect In Consumer Behavior, we saw a couple of examples of the eternal disconnect between what consumers say they want and what they actually like. We also speculated on the root cause of this conflict.

In this follow on post, we’ll examine the implications of the want-versus-like disconnect on product development and marketing, and offer some guidance to product and marketing managers on how to leverage the disconnect to their advantage.

Product

Product Managers should be circumspect about the source of inputs for spec’cing the feature set for their new products and new versions of their existing products.

Because of the want versus like disconnect, they should refrain from developing products on the basis of consumers’ bucket list of desired features. Instead, they should get inputs from analysts, competitors and other sources to divine what customers will like (and won’t like) without asking them; observe live customer situations; and envision the limits of what is possible.

Apple Pay has followed this playbook perfectly. More in Should You Ask Your Customers What They Want While Designing A New Product?.

Marketing

The want versus like disconnect can be used to shape the language (“consent”) used to enroll consumers for targeted offers.

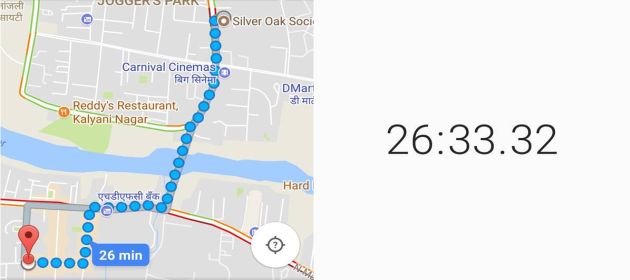

Example 1: Google Maps Driving Time

![]() If you ask for opt-in basis feature i.e.

If you ask for opt-in basis feature i.e.

“Would you like your location to be tracked?”

You will get many NOs.

On the other hand, if you ask for opt-in basis benefit i.e.

“Would you like to know how long it will take to get home?”

You’re bound to get many more YESs than NOs.

If you wish to exhibit total transparency, you can use both the feature and benefit in your consent langauge i.e.

“Would you like to know long it will take to get home? If you say yes, you agree to your location being tracked”.

Example 2: Overdraft Protection

If you ask for opt-in basis cost i.e.

“Would you like to pay $35 for overdraft protection?”

You will get a resounding NO.

On the other hand, if you ask for opt-in basis benefit i.e.

“No matter what you spend with your debit card, would you like us to pay your tab even if you have no money in your account?”

You’re likely to get many YES answers.

If banks want to be totally transparent, they could reword the consent language to:

“We will cover your tab even if your bank balance is zero. We will charge $35 for this service. Do you want it or not?”

I’m guessing this question will make consumers consciously think about the pros and cons of overdraft protection and arrive at a decision that they won’t outrage about a few months down the line.

To banks who want to be a little more aggressive, yet equally transparent, we propose the following question:

“We will cover your tab even if your bank balance is zero. We will charge $35 for this service. Opt in if you want to be saved the embarrasment. On the other hand, if you’d rather pay late fees to your Utility, TELCO and others for not paying your bills on time, don’t opt in. Do you want this service or not?”

This question is a little long but it totally moron-proofs the decision to opt-in for or decline overdraft protection.

On a side note, according to CFPB’s lawsuit, TCF National Bank used the following question:

“Would you like your debit card to work as normal?”

To me, this sounds perfectly fair but consumer rights advocates claimed that the question was “tricking consumers” into opting-in for overdraft protection services. Whatever…

The eternal disconnect between what consumers say they want and what they really like has strong implications in shaping feature sets and language of communications. Getting it wrong could backfire badly. On the other hand, by leveraging the disconnect in the right way, product managers and marketing managers can take their product roadmap and customer engagement to the next level.