I recently came across a post on social media predicting that WhatsApp will very soon become India’s largest digital payments product because it has 450 million users in India.

I politely pointed out to the Original Poster that WhatsApp has precisely zero customers for its payments service and that nobody can tell how many of the 450 million users of its messaging app will adopt its new payments product.

I don’t blame the OP for his naivette. He’s just one among a ton of pundits (and companies) who believe that existing customers of a product will automatically buy a new product from the same company i.e. cross-selling is easy. In other words, if a company has N customers for its existing product X, it will be able to cross-sell its new product Y to its existing N customers with minimal efforts and, voila, have N customers for Y product in no time.

Alas, they’re harboring a serious misconception.

Cross-selling is not that easy. There are countless instances where it has failed. Given below are a few notable flops of cross-selling from big companies (in alphabetical order).

Amazon. Amazon is the undisputed category leader of ecommerce, with a nearly 50% of market share of online retail sales. However, the company wasn’t able to cross-sell its Auctions and Fire Phone to hundreds of millions of its existing customers. Then there’s Amazon Music. I know people who have shopped on Amazon for nearly 20 years but haven’t heard of (or listened to) Amazon Music. Instead of getting free music with their Prime membership, they pay serious money for a premium subscription of Spotify, Pandora, Gaana and other pure-play streaming music services.

Amazon Fire Phone's features like Mayday and Image Shopping will go mainstream.

— Ketharaman Swaminathan (@s_ketharaman) June 16, 2019

Core Banking Software. Many core banking software companies have been unable to cross-sell their Internet Banking, Mobile Banking and Online Account Opening products to their CBS installed base. Given my close involvement with the development and marketing of these four products, this is the one cross-selling miss that I find most intriguing on this list.

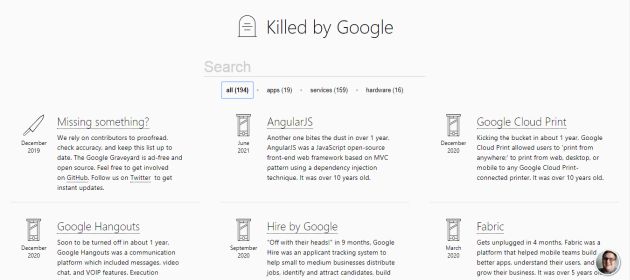

Google. The search, browser and email giant with over two billion users has made several forays into social networking. All of its products in the category – Orkut, Shoelace and Google+ – have flopped. Not one of its several shots at a web conferencing product – Duo and Hangout, to name a couple – has created waves.

With a separate website cataloging the scores of products killed by Google, the company is probably the best testimonial that cross-selling is hard.

Instagram. Instagram started as a photo sharing app but it soon allowed its users to share videos. However, it couldn’t stop the foray of video sharing apps like SnapChat and TikTok into its user and advertiser base.

Instagram. Instagram started as a photo sharing app but it soon allowed its users to share videos. However, it couldn’t stop the foray of video sharing apps like SnapChat and TikTok into its user and advertiser base.

Microsoft. Despite owning over 80% of the desktop operating system market for over 25 years, Microsoft failed to enter the smartphones owned by the very same billion-plus desktop Windows users. Even diehard Windows and MS Office fans like me didn’t want Windows in our pockets. After failing to cross even 5% market share of the mobile phone operating system market, Microsoft finally shut down Windows Phone.

OTAs. Make My Trip, Cleartrip, and other leading Online Travel Agencies have tens of millions of customers for hotels (apart from flights and train tickets). Their inventory has always included budget hotel rooms, which could be discovered by clicking the “budget” filter on their hotel listings. However, they were caught napping when Oyo arrived on the scene with an exclusive focus on just budget hotels. Interestingly, Oyo, which offers a subset of products as Make My Trip et al, has an enterprise value ($10 billion) that far exceeds the market cap of all the aforementioned OTAs put together (around $3 billion).

SAP. The world’s largest Enterprise Resource Planning company has nearly 100,000 customers for its flagship R/3 ERP software. But, when it launched a CRM product later, it wasn’t very successful at cross-selling it to its existing customers, many of whom bought competing CRMs from Siebel (now part of Oracle), Salesforce, et al.

WhatsApp. According to latest news reports, Facebook may withdraw WhatsApp Pay from India.

The aforementioned companies are market leaders in their respective product category. Their failure to sell their new products to their existing customers clearly shows that cross-selling is hard.

In a follow-on post, I’ll speculate on the reasons. Watch this space!

UPDATE-1:

It’s early days but Apple may be headed for the above list of cross-selling fails.

Soon after Apple launched its credit card in partnership with Goldman Sachs, I’d predicted that Apple Card would be a blockbuster hit. I’d based my prediction on the basis of the following features / benefits:

- Existing customer base of 1 billion + iPhone customers to cross sell Apple Card to

- Frictionless application journey

- Frictionless onboarding

- Subprime approvals driving higher customer base. (I felt Apple could mitigate the credit risk by locking / disabling iPhones of Apple Card customers who fall back on their credit card payments!)

- Apple – what’s not to like?

But that’s not to be.

Time and again, #Apple underwhelms with poor data-driven marketing. It thinks it can win the #creditcard market with a #privacy value prop. It can't and won't.

New #FintechSnarkTank post looks at why the #AppleCard is doing so poorlyhttps://t.co/pOSVgG2099

— Ron Shevlin (@rshevlin) November 20, 2020

According to Ron Shevlin / FORBES, Apple Card is doing poorly.

Hmmm. Cross selling is hard even for the world’s most valuable company.