Entrepreneurs are driven by idea, originality, product, problem solved, team, technology, and so on.

But, for VCs, they’re merely means to an end. As we saw in Teardown Of The VC Investment Model, the goal for venture capital is to earn multibagger returns in the short-to-medium term.

While the exact numbers could vary from one market to another, multibagger usually means 3-5X and short-to-medium term often does not exceed 18-36 months.

The goal of VC model is to earn "Multibagger Returns in 2-3 Years". Some VCs like @letsventure overachieve it, other VCs underachieve it. But the goal does not change. #VC #VCModel pic.twitter.com/MJ4rvpYkid

— GTM360 (@GTM360) October 24, 2018

No traditional company will deliver 3-5X returns in 18-36 months for its promoters / shareholders.

Even an average new-age tech startup is unlikely to deliver the 45%-200% CAGR demanded by the VC Investment Model.

But Flipkart, Oyo, PayTM, Uber, Zoom and scores of other startups have generated that kind of value for VCs.

How have they managed that? What sets them apart?

It’s packaging of certain common traits.

Here are the six secrets of packaging a startup to attract Venture Capital:

- “Painkillers” are more compelling than “vitamins”.

- Execution matters more than Idea. “How” works better than “What”. How relates to using technology to mediate a real world market e.g. Move shopping from brick-and-mortar stores to ecommerce. What relates to a non-existent utopian market e.g. Uplift the downtrodden. According to a study by McKinsey, a majority of the 195 unicorns went after markets that were already very large at their inception and did not wait for the market to mature. In over 65% of cases, their aim was to grab market share from others, not to create a new market.

“They went after markets … with demonstrated high demand. They did not create the demand … (or) wait for the market to maturate.” ~ https://medium.com/@alitamaseb/land-of-the-super-founders-a-data-driven-approach-to-uncover-the-secrets-of-billion-dollar-a69ebe3f0f45 via @alitamaseb

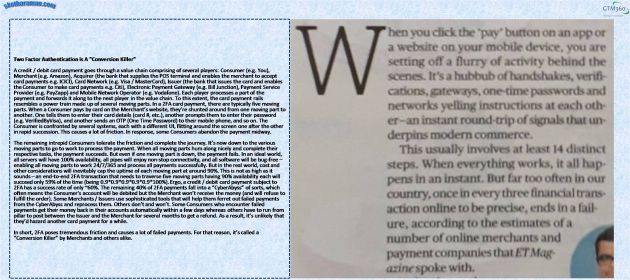

- Find that one metric on which you can achieve hockey-stick growth. It’s unlikely to be revenue or – gasp! – profits, so you need to look at other operational metrics that have financial impact.

- Chant the “Disruption” mantra. Claim that your new digital approach will kill existing giants who operate in the old-fashioned “analog” way.

“FinTechs that have raised the most funding to date build a lower cost (and often better) version of an existing financial product that consumers already pay for today” ????

— Bryan E. Clagett (@Clagett) December 31, 2019

- Have a powerful, but credible, founder / company origin story. I like the one from SQUARE: “I lost a sale for my glassware because I couldn’t accept credit cards. So I decided to find a way for small businesses to be able to process card payments.” That said, if you don’t have a powerful and credible founder story, give this step a miss. Don’t make up a ridiculous founder story just for the sake of it. My favorite example of a ridiculous founder story is that of a mobile wallet startup that went thus: “Five of us went to a coffee shop. We realized that none of us had carried our wallets. So we founded a mobile wallet”. I’m not the only one who found this founder story ridiculous – the startup went bust within a few months.

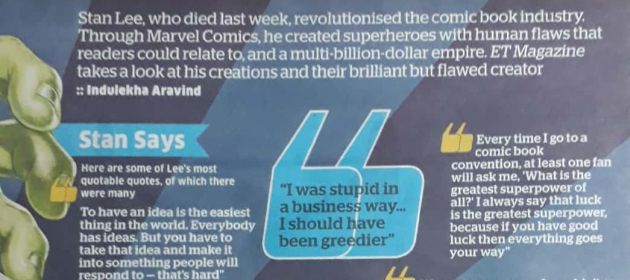

- Stan Lee once remarked that he was stupid for not being greedier. Unlike the recently deceased comic strip moghul, very few VCs will admit to being Ayn Rand fans publicly. So champion at least one social cause. For your ready reference, a partial list of social causes currently trending includes “financial inclusion”, “eliminate the middleman”, “people in small towns shouldn’t be deprived of the products enjoyed by their brethren in metros”.

Venture capital has changed the world in many ways. In the the last 10-12 years, it has

- Redefined the roles of startup and VC such that VC Has Become The Business and Startup Has Become An Asset Class

- Created a new paradigm in which wealth can be generated without profits. Gone are the days when a company had to make profits for its stakeholders to become rich. Today, promoters and investors of many VC funded companies have become billionaires even though their companies have never made profits e.g. Flipkart, PayTM, Uber.

- Enabled startups to serve customers with world-class products for free or low prices (read freemium model), pay outsized salaries to employees, and spend big money on real estate providers and other suppliers – in short, throw money round despite making losses.

- Ensured that the party lasts forever by either (a) selling the startup to a large company, in which case its profitability is obfuscated forever e.g. Flipkart in India and several examples in the USA, or (b) listing it in public markets, where it can continue to make losses as long as the common man believes that a famous company must be financially sound e.g. Dropbox, SurveyMonkey, Tesla, and many other companies listed in Valuation Tax – If Digital Companies Can Disrupt, So Can The Taxman.

- Shifted the action from steady state to the transient state. Even if somebody loses his shirt when the bubble eventually bursts at steady state, VC ensures that a lot of people make a lot of money when the bubble grows in the preceding transient state – somewhat like the “everybody has a share” promise of Milo Minderbinder in Catch 22.

Since many of us are conditioned to think that a business must make profits in the steady state, it’s hard for most founders to fully grasp the above paradigm shift created by the VC model. They need to get over their legacy thinking and reorient themselves to the reality of the VC Investment Model. Once they get past that stage, they need to backstop their story lest it crumble on the face of reality.

In short, packaging a startup for VC Investment Model needs a lot of creativity and an aspirational approach.

If you need help in these areas, feel free to contact us.