In continuation of Part 1, here are three more situations in which the old adage, “something is better than nothing” is critically flawed.

#3. DARK STORE INVENTORY

The way ecommerce works, you place an order on the website of an ecommerce company (e.g. Amazon) and the company ships the ordered good(s) from a central warehouse. This takes many days, which is okayish for books, gadgets, and other “one-off” items.

But, when it comes to grocery, people won’t wait for so many days. I remember reading somewhere that 90% of Americans don’t know at lunch time what they’re going to make for dinner that night! (I don’t have the corresponding figure for Indians but I suspect it won’t be that different!)

Therefore, grocery delivery companies (e.g. InstaCart, Big Basket, Grofers, et al) typically set up mini versions of their central warehouse closer to their markets. These are called “dark stores” – dark because they don’t appear as stores to outsiders. The goal is to service as many orders from the dark stores (instead of requiring a trip to the central warehouse) and thereby crush the delivery period from days to hours.

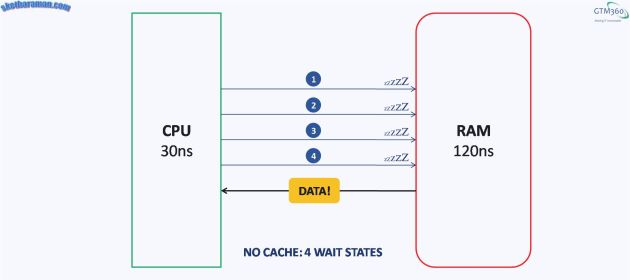

The model is quite similar to the CPU-Cache-RAM architecture described in the first example in When Nothing Is Better Than Something – Part 1 – just replace cache with dark store and RAM with central warehouse and you get the picture.

To achieve their goal of bringing down delivery times, grocery delivery apps need to have right amount of inventory in their dark stores.

Too much inventory at the dark store will escalate inventory carrying costs.

Too little inventory will mean that orders can’t be fulfilled from the dark store and would need a trip to / from the central warehouse. That would not only delay lead times but also defeat the purpose of a dark store.

Wonder if the last minute setback and the consequent delay in delivery were caused by the inability to find the ordered item in the dark store and the subsequent need to ship it from the central warehouse. #Grofers https://t.co/Ut2aj5BH2T

— Ketharaman Swaminathan (@s_ketharaman) October 29, 2019

Determining the right level of inventory at a dark store is one of the burning issues in the retail industry today. It’s more complex than rightsizing cache memory in the CPU-Cache-RAM architecture because (a) Number of dark stores is inevitably more than the three levels of cache used today (b) A dark store has thousands of SKUs and rightsizing of inventory needs to happen at the level of each individual SKU, unlike cache memory, which is a fungible commodity.

The details are beyond the purview of this post but it’s obvious that, below a certain threshold, it’s better not to have any inventory in the dark store at all.

No inventory is better than some inventory.

#4. MARKETING SPEND

Marketing takes time to bear fruit. Depending upon the product, target market and selling skills, you’d need a certain minimum amount of marketing spend. The payback for that could range from six months to a year or more. Spending a fraction of the minimum figure for a month or two in the hope that you’d get a fraction of the returns during that compressed period does not work.

If you can’t go all-in, don’t go in at all.

Take the example of TV advertising. According to the article entitled DTC brands are running into TV advertising’s legacy limitations in Digiday,

We might spend $100K a month and not get good enough CAC but, if we’d spent $1M, we might have.

Put in another way, you might get great Return on Marketing Investment for a $1M TV ad spend but you may not get any ROMI for a $100K TV ad spend. If you can’t spend $1M, you’re better off keeping that $100K in the bank – it’s not going to fetch you 10% of the bang for the $1M bucks.

No marketing spend is better than some marketing spend.

"Nothing Is Better Than Something" goes against the popular maxim but it is true in some cases e.g. TV advertising.

“We might spend $100K a month and not get good enough CAC but, if we'd spent $1M, we might have”.

~ https://t.co/kRA5n9Yge9 via @Digiday— Ketharaman Swaminathan (@s_ketharaman) March 8, 2019

#5. CAPITAL REQUIREMENT

The storefronts in both my office and home buildings have seen a lot of churn in the last decade. Back in the day, stores used to shut down after 12-18 months. Now, some of them are downing their shutters in 2-3 months.

I spoke to a couple of these storeowners (and their franchise consultants) regarding the following passage from Part 1:

#2. CAPITAL FOR NEW COMPANY. The capital raised by a new business should at least cover its cash burn till Breakeven Point. Any amount below that could result in the company shutting down before achieving breakeven and whatever capital is raised until then will go down the drain. Better not to raise any capital at all. No capital is better than some capital.

They told me that they did raise enough capital to reach the breakeven point. But they had apparently underestimated the time it would take to achieve breakeven. As a result, they ran out of money very early and had to shut down their stores prematurely.

They told me that they did raise enough capital to reach the breakeven point. But they had apparently underestimated the time it would take to achieve breakeven. As a result, they ran out of money very early and had to shut down their stores prematurely.

It also didn’t help that some of them got carried away in the beginning and blew too much money on interior decoration due to which they were left with inadequate working capital to even tide over half of their expected breakeven period.

Sadly, whether a businessman / businesswoman raises enough capital to reach the incorrectly estimated breakeven point, as in this case, or fails to raise enough capital to reach the correctly estimated breakeven point (Case #2), the effect is the same: Whatever capital is raised goes down the drain.

No capital is better than some capital.

While “something is better than nothing” is generally right, it doesn’t work in resource allocation.

Almost all business endeavors require a certain minimum amount of resources. Anything below the threshold will inevitably be wasted. If you can’t allocate the minimum, don’t allocate anything at all.

No resource is better than some resource.

PS: This two part blog post is from the perspective of return on investment, especially when external funding is involved. It’s not a critique of the famous self-motivation slogan it’s better to try and fail than not to try at all. But it should serve as a reminder that banks, VCs and other external investors will not shell out hard money to stoke a founder’s passion even if s/he plans to realize it frugally.

Despite cash burn, Investors make record-breaking returns, Consumers get big discounts, Founders generate great wealth & Employees earn fat salaries.

Further proof that Cash Burn strategy works in VC model.

He who can understand that raises funds; he who can't fails.

— Ketharaman Swaminathan (@s_ketharaman) December 22, 2017