A decade ago, China had 29 FORTUNE GLOBAL 500 companies. Today, it has 119.

India’s corresponding figures are 7 and 7.

The GDPs of both countries have grown rapidly during this period. While China has seen a proportionate increase in its representation in Fortune Global 500, India has not.

The GDPs of both countries have grown rapidly during this period. While China has seen a proportionate increase in its representation in Fortune Global 500, India has not.

This has appeared to be an anomaly for a long time including up to last year.

But no longer.

I had an epiphany moment when I read the following line in this year’s FORTUNE GLOBAL 500 issue.

Britain, which boasted 40 Global 500 companies in 2000, has just 17 this year.

Hmmm.

Given that UK’s economy has also grown during this period, the reduction in its Global 500 representation suggests that there doesn’t need to be any correlation between a country’s GDP and the number of Fortune Global 500 corporations it has.

Maybe it’s just that some economies expand by adding a few big companies that enter the Fortune Global 500 (e.g. China) whereas others do so more equitably i.e. via a lot of midsized companies that don’t enter the august list (e.g. UK, India).

Given the huge backlash in the current public discourse against income inequalities caused by large corporations, it may be a good thing that India does not have so many Fortune Global 500 companies.

With that chronic anomaly out of the way, here’s a quick overview of this year’s Fortune Global 500.

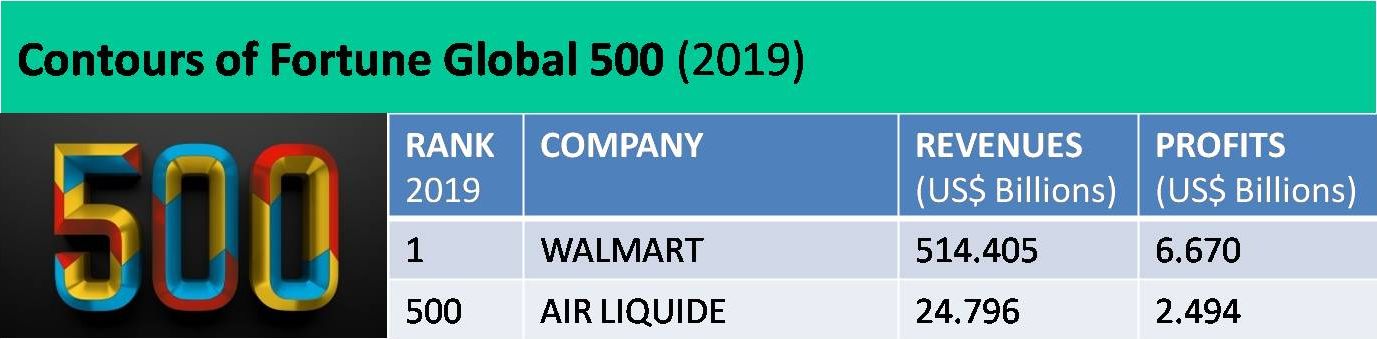

Walmart (USA) and Air Liquide (France) bring up the top and bottom of this year’s list of the world’s largest corporations.

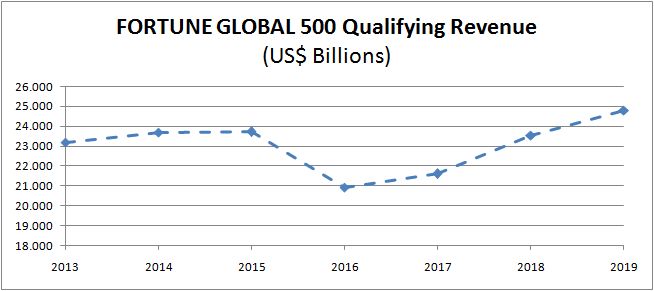

The revenue of the last company on the list has grown by 5.26% year-on-year (from US$ 23.556 billion last year to US$ 24.796 billion this year). With the sole exception of 2015-2016 when it dropped, the FG500 Qualifying Revenue has shown positive y-o-y growth in every year of the past decade.

The Saudi oil giant Saudi Aramco makes its entry to the list at #6 with revenues of US$ 355.905 billion. It’s also the most profitable company on the list with profits of US$ 110.974 billion. The company is reportedly planning to go public next year. When that happens, Saudi Aramco will dwarf Amazon, Apple, Microsoft et al to become the most valuable company in the world, with an expected market cap of US$ 3 trillion.

While Fortune Global 500 is a ranking of global corporations by revenues, the list also provides profit ranks. I tend to take a quick glance at ranking by profits just to gauge whether a company is punching above or below its revenue weight on profit. During this process, I stumbled upon an interesting tidbit: India’s largest company, Reliance Industries Limited, has the same rank on revenues and profits (#106). I don’t recall coming across such a bizarre and amazing coincidence in my +25 years experience of tracking the Fortune 500 lists.

The map used by FORTUNE in its Global 500 issue shows India and many other countries in the eastern hemisphere upside down. I don’t know what this projection is called. This is the first time I’m seeing one like this.

The map used by FORTUNE in its Global 500 issue shows India and many other countries in the eastern hemisphere upside down. I don’t know what this projection is called. This is the first time I’m seeing one like this.

6 out of the world’s 10 most profitable companies are in Financial Services. This has been a consistent trend in the Fortune Global 500 lists over the past several years. The much vaunted disruption of traditional banks by new-age fintechs has not happened. Maybe as a nod to that, fintechs have stopped threatening to kill banks and started chanting the bank-partnership mantra. Big mistake in my opinion, but that’s the topic of another blog post.

Traditionally, banks are ranked by assets. But Fortune’s ranking is based on revenues, a metric I find more apt. IMO, assets is the cards you’re dealt whereas revenues is how you play those cards. Thanks to that, India’s largest bank, State Bank of India, finds a place on this list (#236). Had the list ranked banks on assets, SBI would be missing from it – it has just one-third the assets of the bank ranked next, Deutsche Bank (#239). SBI makes up for its comparatively light asset base ($561 billion) with its disproportionately higher revenue (US$ 47.286 billion). In my blog post entitled High NIM Propels Indian Banks Into FORTUNE 500, I had attributed the higher revenue-to-asset ratio of SBI and other Indian banks to high Net Interest Margin regime in India.

You can sell 10% of your company's equity for $100M & become a Unicorn ($1B market cap). But you can’t sell 10% of your company's production for $500M & become a FORTUNE 500 corporation ($5B revenue). Ergo I find rankings of company size based on market cap a bit flaky.

— GTM360 (@GTM360) June 20, 2019

Moving on to the Indian IT industry.

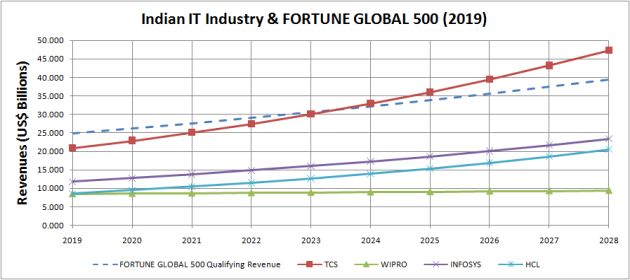

As in the last year, my model comprises TCS, Infosys, HCL and Wipro.

This is what the picture looks like:

Click here to download this model.

All companies except Wipro grew faster than the FG500 Qualifying Revenue last year. I don’t know whether they achieved their high growth rates because they took my advice to focus on sales and marketing rather than on building digital skills!

I know I said recently that the Indian IT industry needs better quality sellers. But I didn’t expect TCS, Infosys, Wipro et al to hire an “elite” salesforce so quickly! Correlation or Causation? https://t.co/yeJFdls60k via @GTM360 pic.twitter.com/IZvG0puVON

— Ketharaman Swaminathan (@s_ketharaman) April 24, 2019

TCS is within striking distance of Fortune Global 500. At its current growth rate, the company should be able to enter the list in 2024 – even just with organic growth. With some inevitable M&A, the country’s largest IT company might become one of the world’s 500 largest companies even earlier than five years out.

While Infosys has grown grown faster than the FG500 Qualifying Revenue this year, the gulf between its present size (US$ 11.799 billion) and Global 500 entry point (US$ 24.796 billion) is very wide (nearly US$ 13 billion).

Without M&A, I see no way for Infosys to bridge the gap and enter the FG500 list during my model’s time horizon (through to FYE 2028).

Even with M&A, the size of acquisition required for Infosys to bridge the gulf (~US$ 13 billion) and enter the Global 500 exceeds the company’s present revenues (~US$ 12 billion). To be honest, I see very little chances of that kind of M&A happening in the forseeable future. Infosys hasn’t demonstrated the penchance for gamechanging M&A deals (ditto the other big companies in the industry). Unless that changes, Infosys – ditto HCL and Wipro – are unlikely to become a Global 500 corporation anytime soon, even with M&A.

While HCL has grown faster than Infosys (10.13% versus 7.86%), it won’t even catch up with Infosys during the model’s timescale, let alone enter the Global 500.

As I predicted in my last year’s post, Wipro lost its third place on the industry league table to HCL.

At the moment, it appears that all our hopes are pinned on TCS to get the Indian IT industry a place in the FORTUNE GLOBAL 500.