There’s no better introduction to this year’s FORTUNE GLOBAL 500 than Fortune’s own lede:

Change is everywhere in this year’s Global 500 – except at the very top. Walmart, with $500 billion in sales, ranks No. 1 for the fifth straight year on Fortune’s annual list of the world’s biggest companies ranked by revenue. Apple slipped out of the top 10 but remains hugely profitable, while Amazon charged into the top 20 for the first time. Chinese tech giants Alibaba (up 162 spots from last year to No. 300) and Tencent (up 147 to No. 331) rocketed higher. German sportswear maker Adidas (No. 480) is making its debut on the list, but fast-food king McDonald’s tumbled off.

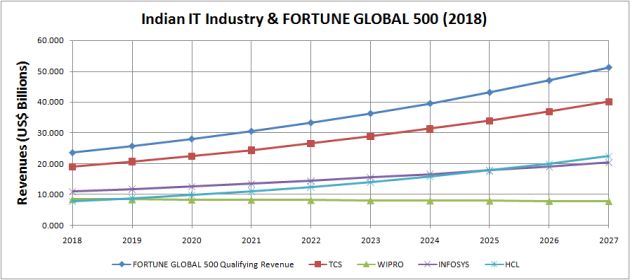

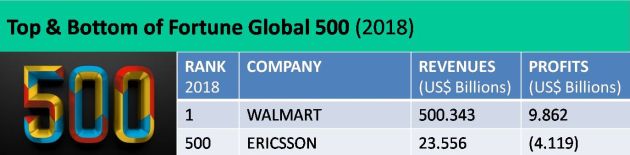

The revenue of the company ranked 500th on this year’s Fortune Global 500 list – aka Fortune Global 500 Qualifying Revenue – is US$ 23.556 billion. This is 9.01% higher than the last year’s correponding figure of US$ 21.609 billion. Such a sharp rise in the qualifying bar presages a strong impact on the number of Indian IT companies that will join the venerable list of the world’s 500 largest corporations.

Before we dive deeply into that, here are a few factoids about this year’s list:

- The Fortune Global 500 accounts for a $30 trillion in revenue or 38% of global GDP

- Walmart (USA) and Ericsson (Sweden) make up the top and bottom of this year’s Global 500 list published by Fortune on 1 August 2018.

- USA still has the highest number of companies in the list but China is surging ahead relentlessly. A decade ago, America was home to 153 Global 500 companies whereas the country’s current share is 126. During the same period, China boosted its own representation on this list from 29 companies to 111

- India’s share in the list has remained stuck at 7 companies. This is the nth year that I’m asking myself why more Indian companies aren’t able to breach the Fortune Global 500 moat, so to say. Not only is the absolute number itself disproportionately lower than India’s share of global GDP but its stagnant nature also belies the fact that India was the fastest-growing major economy in the world during this period. Some day, I plan to correlate the GDPs of countries with the number of Fortune Global 500 companies they have – and probably find the answer to this chronic anomaly there

"India is now world's 6th largest economy after surpassing France and just behind UK".

Goodbye France! Hello UK!! pic.twitter.com/AHR8cJsCHK— Ketharaman Swaminathan (@s_ketharaman) July 13, 2018

- Financials accounts for 8 out of the 20 most profitable companies on the list. The much vaunted disruption of traditional banks by new-age, VC-funded fintech startups has not happened

- This is only the second time in my memory that Fortune Global 500 is not the cover story.

Now, let me come to the Indian IT industry.

As in the previous years, my forecasting model continues to include TCS, Infosys and Wipro, which remain the Top 3 Indian IT companies by revenues.

As in the previous years, my forecasting model continues to include TCS, Infosys and Wipro, which remain the Top 3 Indian IT companies by revenues.

However, I’ve knocked Cognizant off my model this year. Although the company has regularly been emphasizing its US domicile at every available opportunity, the Indian media has blithely pretended that Cognizant belongs to the Indian IT industry (probably because of its Indian heritage).

In the past, I went along with the Indian media’s stance. But Cognizant has entered the FORTUNE 500 list of America’s 500 largest corporations. When Fortune treats it as an American company, it’d be disingenuous of me to think of Cognizant as an Indian company. (For the uninitiated, Fortune publishes two lists every year: FORTUNE 500, which is the list of 500 largest corporations in America by revenues; and FORTUNE GLOBAL 500, which is the list of 500 largest corporations in the world by revenues. Cognizant features in the former but not in the latter.)

I’ve replaced Cognizant with HCL – the fourth largest Indian IT company – in my model this year.

Now a word on the metric used to estimate the future FG500 Qualifying Revenue and project the future revenues of the IT companies. In the past, I used the most recent annual growth rate as the basis of forecasts. Last year, I contemplated switching to 5-year growth average from this year if the FG500 Qualifying Revenue continued to go up and down like a yoyo. But it has not been volatile this year. Like it did in four out of the last five years, the Qualifying Revenue has gone up in the latest year. So, I’ll eschew rolling averages and stick to the latest growth rate for all projections in this year’s model.

Based on the above, this is where the chips fall:

(Click here to download the model as an Excel).

Accordingly,

- The FG500 Qualifying Revenue has grown faster than the revenues of three out of four companies in the model, HCL being the sole exception

- The Fortune Global 500 will elude the Indian IT industry for the forseeable future – assuming the industry relies solely on organic growth. But there’s no reason why it should

- TCS is within “kissing distance” of the FG500 Qualifying Revenue (US$ 19B versus US$ 23.6B), so it’s relatively easy for the company to enter the Fortune Global 500 club by making an acquisition in the US$ 4-5 billion range

- HCL will overtake Wipro this year. By now, this is no longer just a prediction: According to Economic Times, HCL has already overtaken Wipro on Q1-FYE19 revenues to become the third largest IT company in India

- HCL will also overtake Infosys in 2024. That’s five years away and anything can happen during that period, so I wouldn’t take this prediction too seriously

For the first time since I’ve been writing these annual posts, the FG500 Qualifying Revenue has grown faster than the revenue of India’s leading IT companies. Automation and Digital are expected to further crimp the growth rate of the industry (albeit in different ways).

According to Economic Times, large clients are pursuing automation aggressively and are seeking hefty price cuts from their Indian IT vendors. Vendors who agree face margin pressures whereas those who refuse face topline growth barriers. This resonates strongly with the automation challenge I predicted in Indian IT – Crisis Or No Crisis?

In the same post, I’d also felt that the challenge from digital was less technical and more related to sales and marketing. Recent trends reinforce that view: Not convinced about their Indian IT vendors’ digital value proposition, many customers are reportedly insourcing digital work, according to Times of India.

Big challenge for Indian IT industry:

"IT Services companies want to digital work for banks. But banks want to do digital work themselves and outsource only legacy work to IT Services companies". https://t.co/PiV3sss1f9 via @timesofindia— GTM360 (@GTM360) September 3, 2018

But there’s a silver lining in the dark cloud: The falling rupee.

Since the Indian IT industry is largely export-driven, it will get a windfall boost of 7% in revenues and profits from the recent drop in the USD:INR exchange rate (from 1:65 to 1:70). However, that benefit of “earn in dollars, report in rupees” won’t carry over to the industry’s chances of making the Fortune Global 500 because the list is reported in dollars, no matter the native reporting currency of the individual companies.

It’s increasingly becoming obvious that M&A is the low hanging fruit for the Indian IT industry to break into Fortune Global 500. Equally evident is the growing appetite of Indian IT companies to make larger acquisitions. And they will be aided strongly in that endeavor by the significantly higher “Market Cap by Revenue” multiples they enjoy compared to their global peers.

What's the secret to TCS' #1 rank on Market Cap / Revenue? pic.twitter.com/FrMdRUdlUY

— Ketharaman Swaminathan (@s_ketharaman) April 24, 2018

The combination of these factors emboldens me to repeat my last year’s prediction that, in a year or two, at least one or two of the companies in my model will appear on that year’s FORTUNE GLOBAL 500 list.

UPDATE DATED 11 SEPTEMBER 2018:

As I predicted, the mainstream media is reporting that the falling rupee will lift Indian IT companies’ margins.

However, my estimate of 7% is a bit simplistic.

According to an Economic Times entitled Rupee fall may lift IT companies’ margins: Analysts, while the weakening rupee will deliver revenue and profit boost, the actual percentage of gains will depend on each company’s hedging strategy, offshore exposure, and a couple of other factors.