In When A Business Is VC Funded, VC Is The Business, we saw how VCs are driven by traditional business metrics like profitability and ROI although their portfolio companies are not.

Contrary to common wisdom, the VC industry has a stellar track record on these conventional KPIs.

First, let’s take profitability.

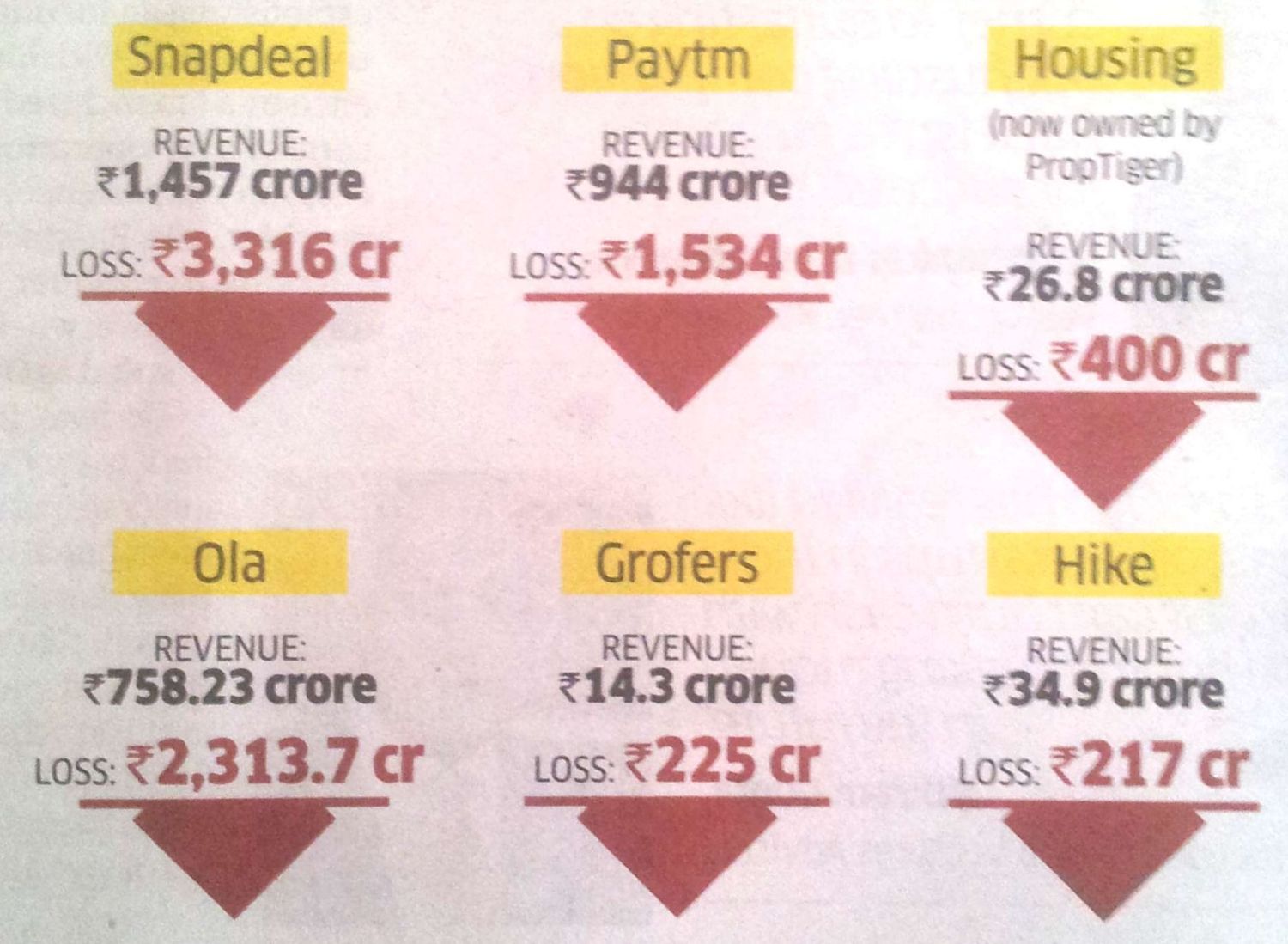

It’s no secret that many portfolio companies of SoftBank, the leading Japanese VC / PE company, are running at huge losses.

Despite that, SoftBank itself is the 19th most profitable company in the world (Source: 2017 FORTUNE GLOBAL 500).

Now let’s come to ROI.

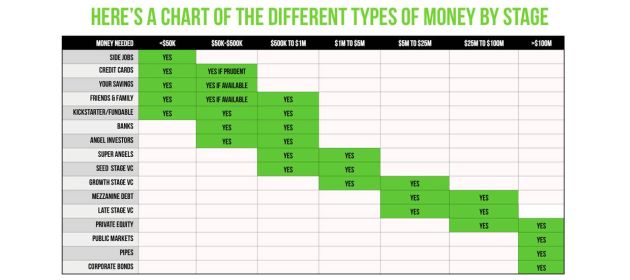

In a traditional business, an investor earns steady returns on most of their investments. Whereas VC returns are highly skewed: 50% of investments are written off on startups that fail to scale; VCs recover 30% of their investments and make multibagger returns on the remaining 20% of their investments. As a result, a VC fund delivers an overall return of ~20% per year (Source: Steve Blank). This exceeds the hurdle rate demanded by hardnose investors like hedge funds and pension funds who have pumped in record sums of money into VC funds last year.

Given below are a few examples of the multibagger returns earned by VCs in recent times:

- SAIF Partners’ $70M seed investment in PayTM, India’s #1 mobile wallet company, is now worth $2B – despite the thousands of crores of losses made by PayTM (Source: Economic Times)

- Leading Silicon Valley VC Sequoia made 50X return from its $60M investment in WhatsApp when the latter was acquired by Facebook for $19B – despite the fact that WhatsApp had measly revenues of $36M at the time (Source: Techcrunch)

- For all the blame that Tiger Global Management gets for causing the cash burn in Indian ecommerce, the New York VC’s $1B investment in Flipkart is currently worth $3B (Source: Economic Times)

- Altimeter Capital, General Atlantic, and the remaining Series F investors took only 15 months to double their investments in AppDynamics. When Cisco acquired AppDynamics for $3.7B, the Silicon Valley application monitoring startup had posted whopping losses on sales of $130M (Source: CNBC)

- In what is perhaps the mother of all returns at any stage of the VC investment model, angel investors earned 250X of their seed investment in Oyo Rooms (Source: Economic Times).

As you can see, investors made multibagger returns on all stages of their investments viz. Seed, Angel, Venture Capital (Series A, B and C), and Private Equity (Series D and E through to IPO).

From this, it would appear that the success of the VC investment model lies in its ability to consistently realize higher valuations for their stake in startups from one funding round to the next. While wags might disparage this as “pump and dump”, there’s absolutely nothing wrong with this approach.

As Geoffrey Moore says in his article titled A Quantum Theory of Venture Capital Valuations,

The purpose of a round of venture funding is to get your company from one valuation state to the next.

When they see how the VC investment model pours money to drive up valuation, the man on the street tends to believe that it creates bubbles waiting to burst. While that belief is not misplaced, fact is:

Bubbles last longer than most people realize

Bubbles last longer than most people realize- Valuations of VC-funded startups have remained fairly stable so far

- After doing down-rounds in the past, Flipkart and Zomato have enjoyed an uptick in their valuations in recent times

- Once a startup does an IPO, the parcel passes on to the common man

- Even if the music stops eventually, lots of people in the VC ecosystem will have made tons of money by then.

Deals like Cisco-AppDynamics show why, despite valuation bubble, the VC model works.https://t.co/hGKtxXQfyI

— GTM360 (@GTM360) January 27, 2017

Not surprisingly, the VC investment model has stood the test of time and attracted a record amount of investment from Limited Partners in recent times.

And not just overseas. According to Times of India, “nearly $15 billion of funds is lying as dry powder, the highest amount of free cash to date sitting and waiting to be invested in Indian ventures.”

If you’re dazed with the VC model, meet Initial Coin Offering.

If you’re dazed with the VC model, meet Initial Coin Offering.

This new kid on the blockchain allows startups to raise funds without even a product, let alone pageviews, installs, bookings and other vanity metrics. Investors plonk down millions to buy digital tokens sold by a startup on the basis of a white paper that explains its vision of a futuristic product.

If you thought VC was speculative, ICO takes speculation to the next level.

I’m sure readers are familiar with the modern day saying “When the product is free, the user is the product”.

I paraphrased this saying for the VC world in the title of the post “When A Business Is VC Funded, VC Is The Business”.

You might wonder “What happens to the startup?” in this world.

Well, the startup becomes an asset class.

This was implicit in the VC model. ICO makes it loud and clear.

gold forex forum

If You Think VCs Create Bubbles, Meet ICOs