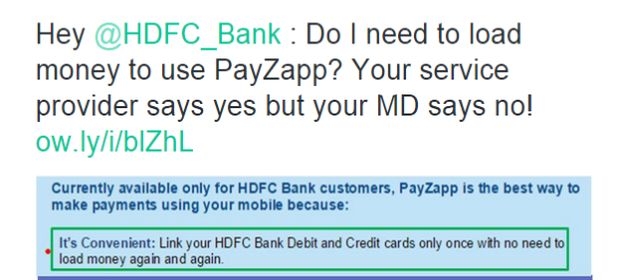

In a recent interview with McKinsey, Citigroup CEO Michael L. Corbat alluded to shopping cart abandonment when he mentioned that today’s digital customers “just stop filling out the application” for financial products when they’re asked for “things that weren’t necessary”.

In a recent interview with McKinsey, Citigroup CEO Michael L. Corbat alluded to shopping cart abandonment when he mentioned that today’s digital customers “just stop filling out the application” for financial products when they’re asked for “things that weren’t necessary”.

Long a bugbear of ecommerce, this problem has started hampering the BFSI industry’s efforts to boost digital distribution of checking accounts, mortgages, certificate of deposit, insurance policies, and other financial products. Since these are generally more complex than books, CDs, gadgets and the other “usual suspects” purchased online, banks and financial services providers tend to suffer even higher abandonment rates than ecommerce companies.

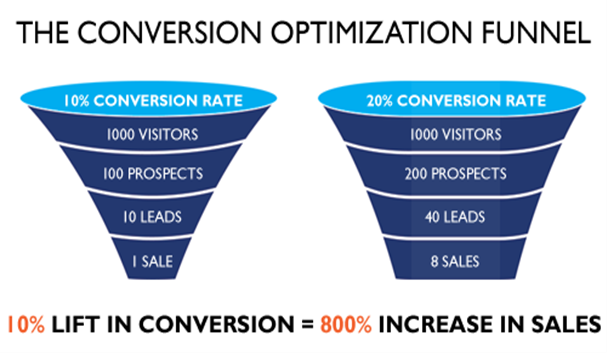

But, with our CRO for BFSI, it doesn’t have to be that way. Under this service targeted exclusively at the Banking, Financial Services and Insurance industry, we test drive your digital sales process, identify friction hotspots and suggest remedial measures, which could help you to convert more browsers to buyers and multiply bang for your digital marketing buck as illustrated below*:

More details on our offering, methodology and success stories can be found here. The impact of CRO on your topline is best illustrated by the following graphic:

Acutely sensitive to the compliance challenges faced by the BFSI industry, our methodology does not hinge on intrusive testing or rely on insertion of tracking code into your website or mobile apps. Since we focus exclusively on CRO, we’re not subject to the usual conflict of interest faced by digital advertising providers who benefit by recommending higher ad spends. While we’re second to none in technical skills, we pride ourselves on our unmatched domain expertise in BFSI as a result of our involvement in fintech with several financial services companies in USA, UK, Middle East, North Africa and India for over a decade.

Over the years, many companies have benefited from our CRO service, one of whom is a leading private sector bank that pioneered the online sale of bank accounts. We enhanced the CX of this bank’s Instant Account portal by recasting its language and navigation around product specifications, branch nomenclature and email delivery timing, to name a few areas. To find out the identity of the bank and know more about how our engagement helped it to multiply its rate of converting browsers to buyers, click here.

Should banks, financial institutions and insurers wish to explore ways of using our unique combination of CRO expertise and experience to bolster their digital sales, we’d be happy to discuss further.

*PS: The tagline in this stock image is not entirely correct: 1 Sale to 8 Sales is an increase of 7 Sales i.e. 700%, not 800%. 10% Conversion Rate to 20% Conversion Rate is an increase of 10 percentage points, not 10%. The line should read “100% Lift In Conversion = 700% Increase In Sales”, which is still quite impressive!