Personally, I don’t find too many serious shortcomings in the digital banking offerings from my banks.

Personally, I don’t find too many serious shortcomings in the digital banking offerings from my banks.

On the contrary, virtually every neobank / fintech I’ve come across is little more than a leadgen tool.

But that’s outside the purview of this blog post, the purpose of which is to do a reality check on the following founding premise of neobanking:

Gen Y and Gen Z (collectively “Millennials”) are digital natives. Ergo they will choose digital interactions over physical interactions in all facets of their life, including banking.

Let me begin by sharing a couple of personal experiences.

EXAMPLE 1

My tenant called me in the middle of the night, requesting me to pay his electricity bill immediately. He explained that he was traveling in the USA – where it was middle of the day – and hadn’t carried his credit card.

EXAMPLE 2

I listed my apartment on Housing.com, a leading real estate portal in India. Founded by a team that recently graduated from my alma mater IIT Bombay, the startup has built an awesome map-centric housing portal. A potential tenant viewed my listing on Housing and called me to ask if my house was situated within 5 kms radius of his workplace and child’s school. (In case you’re wondering why I’m talking about a real estate portal in this context, Housing has been included in Finovate’s latest FinTech Unicorn List).

I was a bit intrigued with the aforementioned interactions.

I’m not a Millennial but

- I regularly make online payments without having the plastic credit card in my possession. All I need are the credit card’s 1s and 0s aka credit card info

- I could easily use the map on Housing.com to find out the distance between my apartment and the prospective tenant’s workplace and child’s school.

As Millennials, why weren’t these guys able to do the same?

Lest you think it’s only me and my tenants, let me share some insights from the mainstream media from all over the world:

- Millennials are not as tech savvy as you think (Source: Wall Street Journal).

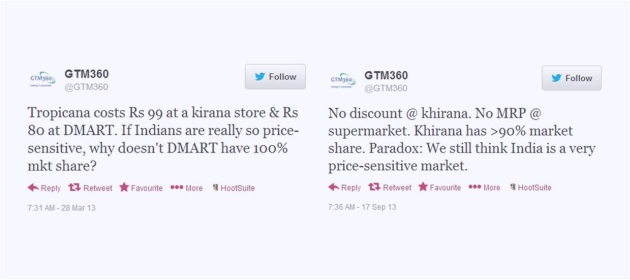

Previous generations in India used to flock to “blade companies” offering 150-200 bps higher interest rates without worrying too much about the credit risks associated with informal and unregulated lending (see my blog post Calling B.S On Banking The Unbanked for more). While Millennials are attracted to tech-mediated versions of informal lending, they’re not so aggressive when it comes to taking risks. They still want to know the old-fashioned CIBIL scores of borrowers. (For the uninitiated, CIBIL is India’s equivalent of FICO scores.) Since they’re not to able to get CIBIL scores of most borrowers on online P2P sites, they’re shying away from them. Apparently, “borrowers far outnumber willing lenders” on these portals (Source: Economic Times).

Previous generations in India used to flock to “blade companies” offering 150-200 bps higher interest rates without worrying too much about the credit risks associated with informal and unregulated lending (see my blog post Calling B.S On Banking The Unbanked for more). While Millennials are attracted to tech-mediated versions of informal lending, they’re not so aggressive when it comes to taking risks. They still want to know the old-fashioned CIBIL scores of borrowers. (For the uninitiated, CIBIL is India’s equivalent of FICO scores.) Since they’re not to able to get CIBIL scores of most borrowers on online P2P sites, they’re shying away from them. Apparently, “borrowers far outnumber willing lenders” on these portals (Source: Economic Times).- An overwhelming majority (73%) of Millennials wouldn’t consider opening an account in a branchless / digital-only bank (Converse of the finding “27% of Millennials would consider a branchless digital bank” by First Data).

- In some product categories, especially financial services, “consumers of all ages are still picking up the phone to talk to someone” (Source: Digiday).

Millennials no doubt spend a lot of time on mobile devices. But that doesn’t mean that they’re savvy / comfortable enough to complete financial transactions or take financial decisions without some degree of physical interaction with objects or people. And, just because Millennials can do something digitally, doesn’t mean that they will do it digitally.

Many digerati claim that banking is only data and can be completely digitized. Well, with my professional interest in fintech software, I wish that were true, but a combination of personal experience and anecdotal evidence signals that customers think there’s a lot more to banking than 1s and 0s.

Ironically, the very same demographic that neobanks are banking on – pun intended! – might actually prove to be their undoing.

Maybe it’s time they listened to the experts and pivoted to other market segments.

There’s this obsession with millennials. The truth is millennials aren’t spending any money with anybody because they don’t have any.

– Sucharita Mulpuru, Forrester Research, Bloomberg article entitled Retailers Urged To Ditch Millennials In Favor Of Older Shoppers

and

@Clagett @Geezeo don't know why #fintech targets only millennials. All the apple airs in cafe other day had very experienced owners

— Stessa Cohen (@stessacohen) April 12, 2015

Nimble as they pride themselves to be, neobanks shouldn’t find it too hard to make this pivot.