Like many, I’ve long held that nothing is broken with plastic cards for instore payments and made the case for mobile wallets to stick to gift, loyalty, ID and other forms of non-payment cards (see Mobile Wallets Should Fix What’s Broken – And It Ain’t Payments).

Like many, I’ve long held that nothing is broken with plastic cards for instore payments and made the case for mobile wallets to stick to gift, loyalty, ID and other forms of non-payment cards (see Mobile Wallets Should Fix What’s Broken – And It Ain’t Payments).

Until I read this line about Apple Pay:

“Every time you hand over your credit or debit card to pay, your card number and identity are visible”.

Coming as it did on the same day that Home Depot made the official announcement that nearly 60 million payment cards were breached at its stores, Apple’s statement suddenly sounded ominous.

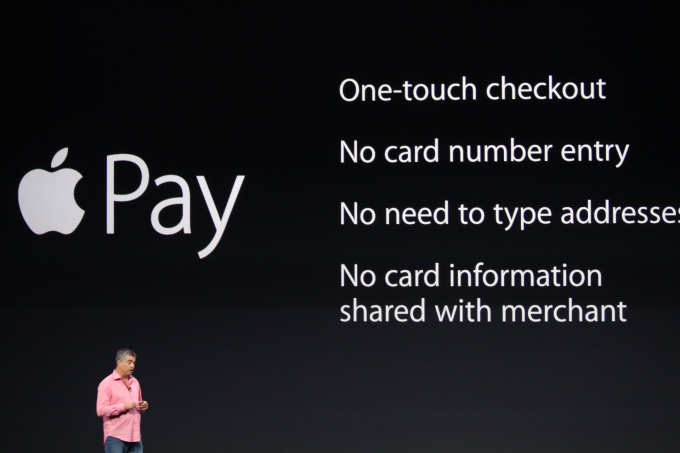

By combining existing features and apps like Touch ID and Passbook with new iPhone 6 enhancements like NFC, Device Account Number and a transaction-specific dynamic security code, Apple Pay does make a convincing case that it solves the data breach problem that’s becoming increasingly common with plastic cards in the USA. (For the record, I’m personally a happy Android user who has no plans to switch to iPhone, but credit where credit is due.)

CU Journal says "Apple's iCloud Scandal Problematic for iWallet." 300 million Apple Fanboys/girls say "nah!"

— Ron Shevlin (@rshevlin) September 9, 2014

However, people have short memories and I wonder if better security alone will be enough to convert even the most zealous FanBoy or FanGal from plastic to mobile payment. If not, some of the other strengths of Apple Pay might help Apple drive a behavior change that has eluded many other mobile wallet providers so far:

- 900 million iTunes users who are just three keystrokes and one tap away from becoming Apple Pay customers: “To get started, you can add the credit or debit card from your iTunes account to Passbook by simply entering the card security code.”

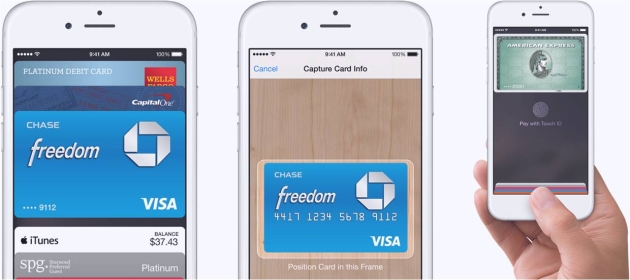

- Ease of onboarding: “To add a new card on iPhone, use your iSight camera to instantly capture your card information.”

- No need to fumble around after reaching the store checkout to find the wallet app or locate the merchant on it: “There’s no need to open an app or even wake your display”

- No need to manually select one card out of many: “The first card you add automatically becomes your default payment card.”

- No loss of privacy: “Apple doesn’t save your transaction information.” “Apple doesn’t store the details of your transactions.” “…your information stays where it belongs. With you.”

Since Apple Pay is not yet available, I’m left with quoting from Apple’s website (http://www.apple.com/iphone-6/apple-pay/) to illustrate the features that enable its above mentioned benefits.

On the whole, Apple Pay comes across as a way to improve user experience. That fits right in with what Apple has always been famous for doing. This strategy has worked well in the past to delight customers, strengthen the ecosystem and bring more converts into Apple’s fold. There’s no reason why it shouldn’t in the future.

One more thing…

In eschewing the much-expected iWallet monicker, Apple has clearly positioned Apple Pay as a feature and not as a mobile wallet product or a mobile payment platform. By highlighting that it “works with most of the major credit and debit cards from the top U.S. banks” and sprinkling its keynote and website liberally with logos of CHASE, Wells Fargo and other banks, the tech giant has put card networks and banks right at the center of its entry into mobile payments. I didn’t hear any posturing from Apple about issuing its own card or disintermediating banks from the payments ecosystem (which had been predicted by many digerati and finsurgents). Call me naïve but, all in all, Apple seems to be perfectly happy about delivering a superior CX and pushing more products out the door as a result.

I wonder how Apple plans to bring merchants onboard. After all, unless they install contactless terminals, Apple Pay will become a damp squib for instore payments. For years, retailers have been hearing about how mobile wallets will give them a wealth of information about customer identity, demographics and purchase history, using which they can run targeted offers and drive sales uplift. Against that backdrop, merchants might be a little shaken by Apple’s declaration that, when the payment is made with Apple Pay, the cashier won’t know the consumer’s name or card number. Something tells me we haven’t heard the whole Apple Pay story yet. By October, which is when Apple will make Apple Pay available in the USA, can we expect a few announcements around iBeacons, lower interchange fees and other retailer-side benefits?