Following on Part-1 of this blog post, I’ve still not been able to get the JavaScript of the MoneyAisle Interest Rate Ticker to work (click here to see work in progress), so I’m settling for this screenshot displaying realtime interest rates for certificates of deposit and high-yield savings deposits.

Turning to the rationale behind the founding of TransFS, its FAQ section says, “Our own frustration (we’ve been in your shoes) with the financial services shopping process showed us that there was a need for a better way to procure small business financial services. When we didn’t find anything that we deemed to be doing a good job of solving this problem we decided to build TransFS”.

Even then, on the face of it, it would appear that small businesses would have the necessary time to scour the market and possess the required clout to request, and get, quotes from credit card processors. So, why would small businesses sign up with TransFS when they could simply continue with their current practice of getting quotes directly from respective vendors for most of their other needs? In his comment to my previous blog post, Eric Olson, Co-founder and COO of TransFS.com, has clarified that there are over 800 independent sales organizations (ISOs) offering credit card processing services in the United States. Assuming that credit card processing is a commoditized service where all ISOs are similar in terms of quality, service, etc., it does make sense for small businesses to turn to TransFS as a one-stop shop to obtain lowest quotes from a large supplier base.

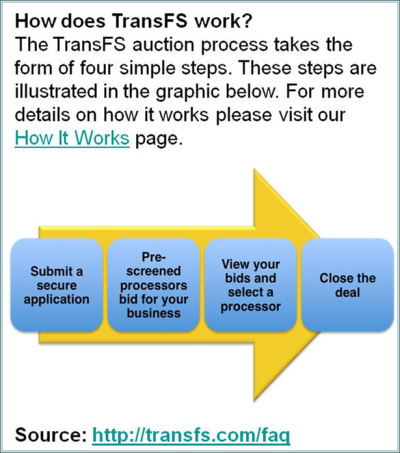

Before we see how low a quote a small business can get from TransFS, let’s have a quick look at its operating model.

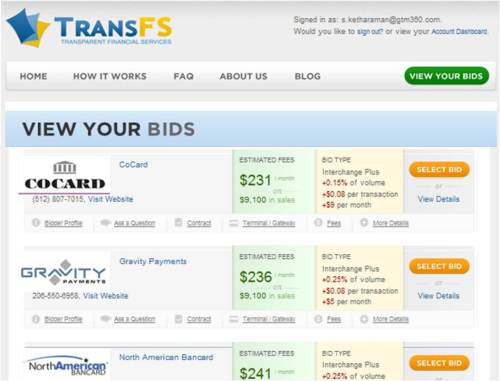

Like I’d done in the case of MoneyAisle, I ran a live auction on TransFS. As you can see from the following picture, COCARD was the lowest bidder with a quote of US$ 231 per month.

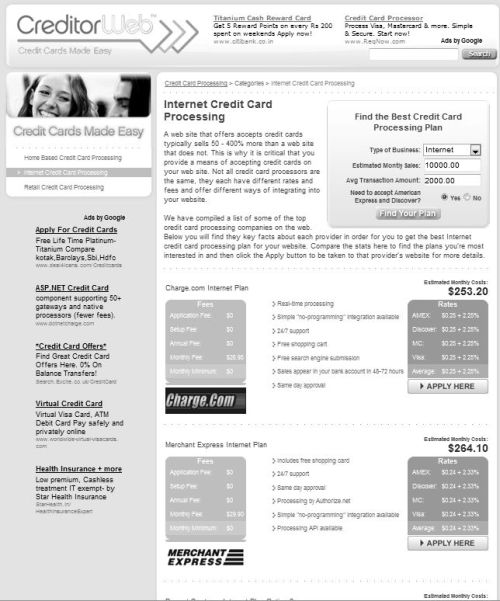

I also got comparative quotes from CreditorWeb, a leading conventional comparison engine. The lowest quote there was US$ 253.20 per month from Charge.com.

Not only has TransFS found the lowest bid but, interestingly, even its next four bids ranging US$ 236 to US$ 246 per month, are cheaper than the lowest quote on CreditorWeb. While this is by no means an exhaustive comparison, it surely lends strong credence to TransFS’ claim that it helps small businesses save a lot of money on their credit card processing costs.

With such a powerful and easily-demonstrable proof point of its core value proposition, and its early-mover advantage, TransFS looks well-placed to lead this market. How well it’s able to reach out to the market to sell this message to a critical mass of small businesses while simultaneously assuring them of quality, service and many other factors that play an important role in their selection of a credit card processor will determine how successful TransFS will become in achieving its vision of revolutionizing the market for procurement of credit card processing services.

PS: As an aside, I noticed that, in a recent auction on MoneyAisle, the highest rate for a high yield savings deposit was 1.75%. Contrast this with 4.36% I got last December for a similar amount! This is a sure sign that the market is awash with liquidity. Do we need any more proof that the last year’s credit crunch is history?

Another fantastic post. Thank you so much for checking us out. I am excited to hear some more of your feedback via email.

Cheers,

Eric Olson

Co-Founder and COO: TransFS.com

Hi Eric: Trust you’ve seen my email – hope it hasn’t landed up in your spam folder.