Every month, I pay off my credit card bill by way of a cheque,  which I simply drop into a drop-box placed at the bank’s premises. [Note: In India, we spell check as ‘cheque’.] Today, when I visited the bank, I saw the drop-box sealed off. Instead, there was a sign asking people to deposit their cheques in a new “Cheque Deposit System”, which looks similar to the picture on the right. For those who are interested, send me an email on s_ketharaman@sketharaman.com, I’ll tell you the name of this bank.

which I simply drop into a drop-box placed at the bank’s premises. [Note: In India, we spell check as ‘cheque’.] Today, when I visited the bank, I saw the drop-box sealed off. Instead, there was a sign asking people to deposit their cheques in a new “Cheque Deposit System”, which looks similar to the picture on the right. For those who are interested, send me an email on s_ketharaman@sketharaman.com, I’ll tell you the name of this bank.

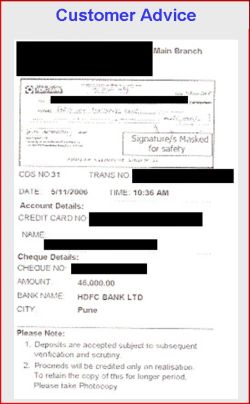

This machine has a display and a keypad just like an ATM (Automated Teller Machine). I was asked to enter my 16-digit credit card number. When I did that, it retrieved and displayed my name as the holder of the credit card. It then asked me to insert the cheque into a slit on the right-hand-side of the machine. Shortly thereafter, I could see an image of my cheque on the display. I was then asked to enter the cheque amount, which I did. The transaction then got completed and I received a printed ‘customer advice’, which is a receipt for deposting the cheque. Since the receipt included the name of the bank and branch of my cheque — information that I never entered — I am sure this machine also has an in-built MICR reader. [Note: Most cheques in India carry a so-called ‘Magnetic Ink Character Reader’ or MICR at the bottom, which is a unique identifier of their issuing bank and branch. A MICR reader reads the bank + branch information and feeds it to cheque processing systems].

The advantage of this system to a bank are obvious: it saves the labor costs of having to do the data entry for the cheques it receives from customers.

However, for the customer, I see more disadvantages than advantages.

Advantages

- Facility of getting a printed receipt. In the drop-box system, the customer

doesn’t receive such a receipt. A receipt can be quite valuable, especially in the context of recent cases where customers who actually deposited their utility payment cheques into drop-boxes were still declared as defaulters by their utility companies which somehow did not receive the cheques. With a printed receipt, the customer is on more solid footing when it comes to disputes.

doesn’t receive such a receipt. A receipt can be quite valuable, especially in the context of recent cases where customers who actually deposited their utility payment cheques into drop-boxes were still declared as defaulters by their utility companies which somehow did not receive the cheques. With a printed receipt, the customer is on more solid footing when it comes to disputes.

Disadvantages

- With the drop-box system, you could avoid making the trip to the bank and instead have someone else drop the cheque for you. For example, I know of firms like ‘Madat Online’ who collect cheques from different employees from their offices and drop them into various drop-boxes. Now, with the system asking for the credit card number, cheque amount, and such things, this task is no longer so mundane, and might therefore demand that you make the trip yourself.

- It hardly takes a second or two to drop off a cheque into a drop-box. As against that, it took almost a minute to complete the transaction on the Cheque Deposit System. I fear that this could lead to queues forming in front of the system and resultant delays for the customer.

I invite readers to comment on whether I have missed out any other advantages and disadvantages of this system. I also solicit readers’ opinions on whether the advantages are outweighed by the disadvantages or vice versa.

Pingback: Technologies Without Tradeoffs « Talk of Many Things

Pingback: Good Riddance To Cheque Deposit Systems | GTM360 Blog

Pingback: Good Riddance To Cheque Deposit Systems « Talk of Many Things