Electronic delivery of bills and statements promises to save stationery, printing and postage costs for banks, mobile network operators, municipalities / boroughs, utilities and other types of billers. Attracted by the cost savings potential, a large number of billers have adopted eBilling / eStatements technology in recent times. To actually realize the savings, many billers have launched campaigns to promote their electronic document offerings and encourage paper turn offs by their customers. Some of them have followed the ‘carrot’ approach: An MNO we know offers a 1% discount on the bill amount for eBill adopters. Whereas others have resorted to the ‘stick’ – an insurer and another MNO we’ve come across forcibly send you electronic bills and statements if you happen to have disclosed your email address to them. In theory, ‘paper reinstatement’ is just a phone call away. But, to make it happen in actual practice, you’ve to navigate through phone trees and listen to hold music for 20-30 minutes before you getting through to a live operator to log your request.

The primary purpose of this blog post is neither to voice our concerns about electronic documents nor proffer our comments about the professionalism of the aforementioned billers who forcibly enroll their customers for eBills and eStatements (although we’ve done both on many other occasions). Instead, it’s to bring TransPromos into this discussion and examine how they introduce the revenue dimension into a topic that has hitherto been driven by cost alone.

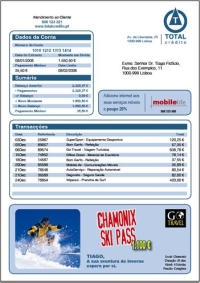

TransPromo is a portmanteau word ‘formed from the words “transaction” and “promotional”. By adding relevant messages, companies can piggyback promotion or even advertising onto existing transaction-related documents, such as statements, invoices, or bills’ (Source: Wikipedia).

Depending upon whether they feature products and services from the biller or third-party companies, TransPromos can be termed as “First Party” or “Third Party” respectively. For many reasons, including the one explained in our post Whither Cross-Selling And Upselling With eBills And eStatements, First Party TransPromo are not very common in actual practice. Therefore, in this post, we shall only focus on Third Party TransPromos e.g. An offer for ‘40% discount for Domino’s Pizza’ carried on a credit card statement. Using demographic data and transaction history, it’s possible to craft Third Party TransPromos at an extremely granular level and target them at a “customer segment of one” (assuming that the said customer has opted in to receive offers in the first place).

When phone bills, credit card statements, utility bills and all other categories of transactional documents are added up, they can easily address 20-25% of the total population of many countries. Therefore, TransPromos have a reach that’s arguably unmatched by any medium of communication. Unlike TV ads, unsolicited mail and email, transactional documents are expected by their recipients, prima facie bestowing TransPromos with a high degree of ‘openability’. This unique combination of reach and openability makes transactional documents highly coveted by FMCG and CPG companies for advertising. (It’s another matter that not all billers might want to ‘rent’ their bill and statement real estate for ads.)

Openability, however, is not uniform across all channels of delivery of transactional documents.

Let’s take printed documents first. When a mobile phone subscriber receives a printed bill in an envelope bearing the mobile network operator’s logo, s/he’s bound to open it. According to an executive at a leading MNO we’ve spoken to, printed bills have open rates of almost 100%.

Now, take electronically delivered documents. They come in two flavors viz. PULL and PUSH. In a PULL technology, the customer has to take a conscious decision to visit the biller’s website / portal, enter her credentials to log on and then view / download her bill / statement. In PUSH, the biller emails the bill or statement to the customer as a PDF file that is often password-protected. As we’d pointed out in our blog post How Suitable Is Email For Delivering Bills And Statements?, it’s unnatural for people to have to enter a password to open an email attachment. Because of such intrinsic sources of friction, neither PULL nor PUSH based electronic documents enjoy anywhere near 100% open rates.

Print trumps electronic documents for TransPromos in one more area. With eBills and eStatements, consumers have to enter a password before they can see ads. This goes against the basic grain of advertising whereby consumers should put in efforts only to avoid ads, not to view them!

With so many fundamental differences between them, advertisers are likely to attach different value to print and electronic document real estate. And, in our experience, they do. Many advertisers we’ve come across are willing to pay a premium for advertising on printed documents compared to eBills or eStatements. This suggests that, by thinking beyond cost reduction, billers could unlock additional value from their paper bills and statements. By continuing with paper, they might lose a few pennies to higher operating costs, but they’re likely to gain a lot of dollars from greater advertising revenues. They might want to keep this in mind while deciding their future strategy regarding document delivery channels.