In Part 1 of this blog post, I had lauded ICICI Bank for pushing the envelope on adopting cutting edge banking technologies by launching a Facebook App and Online Account Opening offering. In this Part 2, let me share the results of my personal experience with these initiatives and voice a few concerns around their implementation.

After completing the online account opening process, I received the following message on the bank’s website:

“Thank You. Your application has been saved successfully and Account Number XXXXXXXX abcd has been allocated to you”.

When I received only the last four digits of the account number (abcd), I felt a bit cheated since much of my praise for the bank’s initiative was centered around its promise of issuing an “Instance Account Number”. Its marketing communication was definitely misleading when compared to its actual performance.

Not only that, the website message went on to request me to keep a cheque ready for INR 10,200 or more, being account opening amount. I was wondering “why only cheque?” Since I’ve chosen the online channel to open the account, should it not strike the bank that I might be equally interested in an online channel to fund my account and logically offer me the option of electronic fund transfer? Called NEFT (National Electronic Fund Transfer), such an option has been existence in India for several years and is widely promoted by most banks including ICICI Bank, which is India’s largest private sector bank.

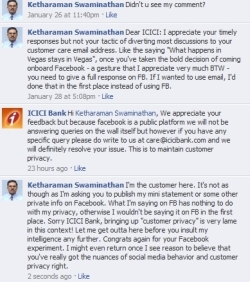

I posted these observations on the bank’s Facebook Wall since it was here that I had learned about the Online Account Opening functionality.

Instead of receiving a straight answer, I got a reply asking me to explain my problems via email to its Customer Care email address. I was immediately ticked off. For one, since I had already taken the trouble to list my questions and concerns on its Facebook Wall, there was no way that I was going to waste my time repeating everything over email. Secondly, I believed that, like “what happens in Vegas stays in Vegas”, whatever happened on FB should stay on FB. I did not appreciate the bank’s tactic to redirect me, and virtually everyone else who had posted on its wall, to another channel. I expected the bank to understand that, had I wanted to use email, I would not have bothered with Facebook. When I replied back declining to use email for the aforementioned reasons, ICICI Bank replied back saying that I had to continue the discussion only over email since it wished to “maintain customer privacy”.

Duh? Customer privacy? Did ICICI Bank not realize that I, as the customer, should be the one more bothered about customer privacy?

To me, the bank’s behavior suggested that it did not get the notion of customer privacy or, worse still, chose to use it as a bogey to avoid public admission of the obvious limitations in its online account opening offering. Either way, I did not find any point in continuing the conversation.

It is still early days for ICICI Bank’s new initiatives. Hopefully, it will quickly understand that customers are no strangers to online and social media channels and enhance its online account opening functionality and modify its Facebook behavior such that the gulf between what customers expect and what the bank offers narrows down. If it succeeds in doing so, ICICI Bank could well serve as the lighthouse for the entire BFSI industry towards adoption of cutting edge technology to cut costs and enhance customer experience. On the other hand, if it fails, ICICI Bank risks seeing its new initiatives fizzle out.