In Part-1 of this blog post, we’d described multichannel banking. In Part-2, we’d introduced the concept of omnichannel retailing. In this concluding part, we’ll explain what omnichannel behavior could mean in the context of retail banking and suggest ways by which banks could jump on to the omnichannel bandwagon even if they didn’t / couldn’t fix shortcomings in their current multichannel offerings.

Research is showing increasing customer tendency to hop channels even to complete a single transaction. This forms the bedrock of omnichannel banking and can be attributed to the perception by customers that different channels perform different steps of the same transaction with differing levels of convenience, security, speed and cost. Let me cite two examples from my personal experience:

- Account Opening: I prefer to complete a form online. But, when it comes to submitting supporting documents, I find it much easier to snail-mail them to the bank instead of scanning several pages and uploading them electronically.

- Bill Payment: While I don’t mind online bill payment, I can’t stand e-statements and insist on receiving printed bills by post. Click here and here to find out why.

The recent decision by INGDirect USA to introduce checkbooks shows that omnichannel behavior is not my personal eccentricity: Although they opened accounts in an Internet-only bank that doesn’t have any physical presence, the bank’s customers want to write paper checks to make everyday payments instead of jumping several hoops to put through electronic payments.

To make the leap to omnichannel banking, we recommend that banks identify the channel preferences of the majority of their customers for each step of every key transaction. They should then direct their investments to ensure that each channel delivers the best customer experience for that step even if it doesn’t do so well on the other steps. This approach will guarantee the best customer experience for the majority of customers even if ticks off those outliers among customers who want to do everything on an iPad or at a branch.

To see how this approach would play itself out, let’s take the example of a bank which currently makes available product information on its Internet Banking and Mobile Banking channels but lacks support for completing the account opening process on its remote https://disabilityarts.online/klonopin-clonazepam/ channels. Such a bank has the following choices:

To support 100% multichannel support for, say, its account opening process, the bank would need to establish realtime integration between its existing internal account opening systems and third-party identity and address verification services. A bank that only provides product information on its remote channels and lacks this level of sophisticated integration has the following two choices:

- Option 1 (Multichannel support): Invest in technology and resources to establish realtime integration between its internal account opening system and third-party identity and address verification services. Eliminate friction from the current web/mobile channels. Deliver 100% account opening functionality on online / mobile channels.

- Option 2 (Omnichannel support): Freeze investment in the online and mobile channels. Let the prospective customer research and make a shortlist of products on Internet / Mobile Banking and, as at present, request her to visit the branch to complete the account opening process. Use clickstream analysis and other technologies on its remote channels to ensure that, when she walks into the branch to complete the process, the branch staff is able to progress the offline transaction from where she left the online one, instead of wasting her time by telling her to start the process from Step One.

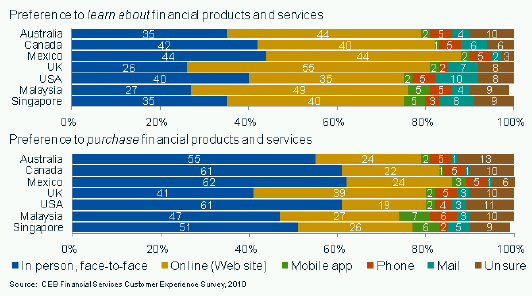

Although we have nothing against the first option, we believe that it’s neither necessary nor practical under today’s market conditions. If banks won’t or can’t provide fully fledged multichannel support for whatever reason, the second option gives them a headstart in meeting changing expectations of a majority of their customers who prefer to open accounts in the branch even if they demand online research capabilities from their banks. According to CEB Financial Services Customer Experience Survey cited in this TowerGroup report, this segment constitutes as much as 62% of customers in Mexico followed closely by 61% in the USA.

We conclude this three part series with this recent Finextra article that describes how two banks, Dupaco Credit Union in the USA and DBS in Singapore, are using state-of-the-art mobile and social media technologies to drive more customers to their, ahem, branches! Kudos to these two banks for taking this concrete step towards omnichannel banking!