In Part-1 of this blog post, we introduced the concept of omnichannel banking and explained how it differed from multichannel banking. We’d claimed that 100% multichannel support was neither necessary nor practical. In this Part-2, we’ll explain why.

While banks have traditionally viewed their relationship with customers through the prism of channels, customers don’t necessarily share that perspective. Customers just want to get the job done in the most convenient and secure manner possible. Besides, according to the recently published World Retail Banking Report 2011, “…customers view the branch and internet as having different strengths. The internet excels in information gathering, transacting, and looking up account status, customers said. The branch is the preferred channel for solving problems, indicating the value of having a human touch in certain situations. Mobile banking has yet to make a positive impression”.

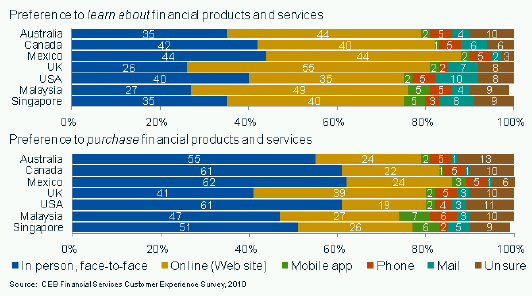

No wonder customers in different countries expressed an overwhelming preference to open accounts at the branch even if most of them wanted to research new accounts online.

The above chart makes it clear that a majority of customers want to research online but buy at a branch.

This clearly shows that fully fledged multichannel support is not really necessary.

Now, let’s look at the feasibility of delivering 100% multichannel support.

The typical retail banking landscape is dotted with a plethora of systems that have evolved over a period of several decades on mainframe, client server, Web 1.0 and other heterogeneous technologies. While allowing every banking transaction to be conducted on every channel – that is, providing 100% multichannel support – is technically possible in many countries, it would call for a massive overhaul of existing systems. Even in the best of times, the ROI for such “rip and replace” projects has been uncertain.

So, fully fledged multichannel support is not practical either.

Good news is, customers are increasingly displaying omnichannel behavior, and banks can jump on the omnichannel bandwagon quickly.

Omnichannel behavior is the broader adaption of “omnichannel retailing”, a term we first heard about from Paula Rosenblum, Managing Partner of Retail Systems Research, who, in turns, credits it to Leslie Hand of IDC. It refers to increasing consumer readiness, or even preference, to use more than one channel to execute a single transaction provided there’s “something in it” for her. Point to note is that the behavior is voluntary and not forced upon the consumer by the business whom she’s dealing with.

I can readily relate to omnichannel behavior from my own experience of buying a Palm T|X PDA in London a couple of years ago. Starting with a Google Search, I landed on PriceGrabber.co.uk, an excellent price-comparison website. PriceGrabber listed several deals and informed me that the “buy online, collect at store” one offered by the leading electronics retailer Curry’s Digital was the best. I placed the order on the retailer’s website and made the payment online and was happy to collect the product from the retailer’s nearby physical store in Canary Wharf instead of having it shipped to my home address since I wasn’t sure if I’d be home when when the consignment arrived.

While online only meant Internet at the time, it could very well include Mobile and Social Media today. With mobile apps like RedLaser making child’s play of doing price comparisons at the store, omnichannel behavior is bound to become de riguer soon.

With most banking products being intrinsically more complex than retail goods, we expect omnichannel behavior to gain traction very quickly in retail banking. It’s not difficult to imagine a scenario where a potential customer hears about a new banking product on Facebook, gathers more information about it from the bank’s Internet Banking portal and finally visits a branch to seek face-to-face advice before deciding to buy it.

On the face of it, it might appear that banks have to first get their multichannel strategy right before they can think of omnichannel banking. We feel differently. In Part 3 of this post, we’ll suggest ways by which banks can jump on the omnichannel bandwagon even if they’ve missed the multichannel bus. Stay tuned!

Pingback: Whither Cross Selling & Upselling With eBills & eStatements? « Talk of Many Things