I recently read the following question on Quora:

Is there any app that helps to store all your loyalty cards digitally?

I am looking for an app which is India based or atleast caters to the Indian market.

Someone once said that, on Quora, you answer the question that’s asked, the question that’s not asked, and the question that should be asked.

When I read this question, my first reaction was to wax eloquent about an Indian app that stores all loyalty cards in the world digitally. After doing a quick reality check, I felt that was a bit of wishful thinking and decided to restrict myself to the question that was asked.

Given below is a lightly edited version of my answer.

What the OP is asking for is a “mobile loyalty wallet”, an app that lets consumers scan their plastic loyalty cards into their smartphone. By digitizing physical cards, a mobile loyalty wallet saves consumers the trouble of having to carry all their physical cards in their wallets and ensures that they never lose out on rewards when they shop at a store whose loyalty card they’ve forgotten to carry with them.

What the OP is asking for is a “mobile loyalty wallet”, an app that lets consumers scan their plastic loyalty cards into their smartphone. By digitizing physical cards, a mobile loyalty wallet saves consumers the trouble of having to carry all their physical cards in their wallets and ensures that they never lose out on rewards when they shop at a store whose loyalty card they’ve forgotten to carry with them.

A mobile loyalty wallet shouldn’t be confused with “mobile wallet”, which stores credit and debit cards digitally and is used to make payments with a mobile device.

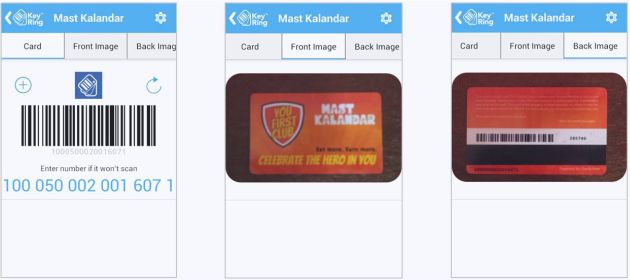

I’m a happy user of KeyRing, a canonical example of a mobile loyalty wallet app. Its maker gives its location as Dallas, TX, in the USA.

Apple Wallet (previously known as Passbook) is another mobile loyalty wallet app. It’s also Made in USA.

From time to time, I’ve come across a couple of Indian mobile loyalty wallets when their founders reached out to me seeking angel investment. I’ve forgotten their names. All I can remember about them is that, their UX uniformly sucked and I deleted them within a week.

When they sought my feedback, I referred their founders to KeyRing and Apple Wallet as a source of inspiration for making their apps more frictionless. Like founders of most Indian startups – barring the ones founded by IITians – they ignored my feedback and tried to teach me how to hold the camera while scanning the card and many other things I now forget.

At this point, I don’t have any Indian mobile loyalty wallets to recommend.

But that shouldn’t matter. Because, regardless of its country of origin, a mobile loyalty wallet app lets you digitize your loyalty cards from any country by simply scanning the barcode on the card or, if the card doesn’t have a barcode, by clicking a picture of the front and back of the card.

Like I’ve onboarded the loyalty card of the Indian QSR chain Mast Kalandar on my American KeyRing app.

From there on, whenever you’re shopping, you reach the checkout, fire up the app, select the said retailer’s card and flash your smartphone screen at the retailer’s POS machine (iOS Passport does all this automatically, probably based on LBS technology).

If the retailer has the technology to scan the digital card off of your smartphone screen, you’d extract the full value from your mobile loyalty wallet.

If not, you’d need to read out the card number manually and the checkout clerk would need to enter it manually into their POS system. Although you wouldn’t use the full capability of your mobile loyalty wallet, you will still have used its core functionality.

In the several years that I’ve been using KeyRing, I haven’t come across a single retailer in India who can scan the card from the smartphone. As a result, I’ve never been able to put my mobile loyalty wallet to full use in India.

Over time, the mobile loyalty wallet product category has lost its shine in India – thank God I didn’t invest in any of those apps!

That’s because retailers have increasingly started using the customer’s mobile phone number as a proxy for the loyalty program member ID. While many retailers continue to issue plastic loyalty cards, that’s largely for branding purposes.

88%, 57%, 84% – three numbers that clearly establish how loyalty programs can boost revenues, profits and C-SAT. http://t.co/Dwcq0NjROh

— GTM360 (@GTM360) April 7, 2014

The way it works at many stores now, customers finish their shopping, reach checkout, and earn points by verbally quoting their mobile phone number to the billing clerk. There’s no need to show the plastic card – hence no need for a mobile loyalty wallet – to earn points.

Many retailers also permit customers to redeem their points by speaking out their mobile number at checkout. So even redemption does not require the plastic card or mobile loyalty wallet. The few security-conscious retailers that insist on the plastic card for redemption won’t anyway be able to accept a mobile loyalty wallet because they can only scan the magstripe on the physical card.

Therefore, the usage frequency of plastic loyalty cards – and the value proposition of a mobile loyalty wallet – have dropped drastically in recent times in India.

People share their mobile phone numbers freely in India. Since the OP’s question pertained to India, I could conveniently assume that a retailer can get the customer’s mobile phone number and substitute it for loyalty program member ID.

In a global context, this assumption is not valid. Consumers don’t disclose their mobile phone numbers that freely in USA, UK and many other countries. Loyalty membership numbers embossed on plastic loyalty cards are still required to earn and redeem reward points – retailers can’t replace them so easily with mobile phone numbers. Ergo, the value proposition of mobile loyalty wallet is still intact in those markets.