With over 100 million users a year ago, PayTM was already ahead of its digital payment competitors before the November 2016 demonetization of high value currency notes in India.

On the back of the push for #CashlessIndia consequent to #CurrencySwitch, the Alibaba-backed mobile wallet has increased its lead over its other mobile wallets (e.g. MobiKwik, PayZapp) and account-to-account money transfer apps (e.g. UPI). Today, PayTM boasts 150M users (Source: Wikipedia).

Based on my personal experience and anecdotal evidence, I advance five reasons to explain why PayTM is miles ahead of its rivals.

#1. Ease of Onboarding Merchants

Merchants can sign up for PayTM without a bank account. They can receive money into their PayTM wallets without a bank account. They can even spend their wallet balance by shopping at other merchants that accept PayTM payments. It’s only when they want to cash out their money from their PayTM account that they need a bank account.

As a result, PayTM was / is able to sign up hundreds of thousands of merchants that don’t have bank accounts. These merchants could sign up for PayTM as soon as they had a compelling need to accept cashless payments i.e. immediately after the demonetization announcement, start accepting payments and visit banks later to open their accounts after their PayTM account balances started growing.

Contrast this with competing e-wallets, which insist that merchants link their bank accounts (or debit cards or credit cards) to their apps right at the time of installing them. As a result, financially-excluded merchants couldn’t sign up for them when they had a compelling need. PayTM’s rivals lost this market to PayTM.

#2. Viral Distribution

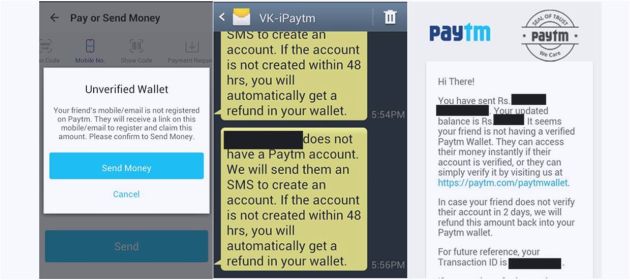

When PayPal launched in the late 1990s, it allowed and incented existing users to send money to non users. When users sent money to their friends and family members (that were not on PayPal), PayPal sent them an email saying “Collect $$ by signing up for PayPal”.

This gave non-users a very compelling reason to join PayPal compared to any direct advertising or PR efforts, and generated massive viral distribution for PayPal.

PayTM has copied this approach. And has probably reaped the rich rewards à la PayPal.

Surprisingly, PayTM’s competitors haven’t followed this approach. They insist that payments can be made only to people that have already signed up to their e-wallets. They probably think sending money to a non-user would be tantamount to putting the cart before the horse. Indeed, it would. But, as I’ve said time and again, Putting Cart Before Horse Does Work. PayTM and PayPal get it. Their competitors don’t. Instead, they put their prospective users at the mercy of their respective banks to gain signups.

To take UPI as an example, to receive payments, you need to have a Virtual Payment Address (VPA) from your bank. Assuming that you’re thorougly sold on UPI and decide to create your VPN, you’ll need to contend with your bank’s systems to actually generate one. This adds a big moving part, which doesn’t always work. Just today, I got an SMS from my bank saying they can’t issue new MMIDs – an integral part of IMPS, the payment rails on which UPI works – for the next five days. There’s no guarantee that you’d still be interested in UPI five days later.

#3. Feet On Street Approach

In the weeks following #CurrencySwitch, PayTM salespersons made daily rounds in retail hotspots asking storekeepers if they wanted PayTM.

I’ve seen this personally in my building storefront that’s dotted with tea shops, fruit stores, cigarette sellers and other micromerchants.

I’ve also heard more about PayTM’s aggressive merchant acquisition drive from a couple of Uber drivers.

I’ve also heard more about PayTM’s aggressive merchant acquisition drive from a couple of Uber drivers.

According to this cabbie who accepts PayTM on his personal name – PayTM is also Uber’s official digital payments partner – PayTM sales reps ride on their motorbikes up and down a street near Pune Airport where hundreds of Uber and Ola taxis are parked, asking drivers if they want to sign up for PayTM.

When a driver says yes, the rep connects the driver’s smartphone on his own 4G network using tethered WiFi hotspot, downloads the app, installs and onboards the driver on PayTM. All this in 5-10 minutes. Without being judgmental about whether the driver is tech savvy or not. And at no data charges to the cabbie. This Uber driver is so conversant with PayTM’s merchant acquisition program that he actually knows the PayTM rep’s sales quota (10 merchants a day)!

In sharp contrast, most competitors of PayTM haven’t harnessed the power of feet-on-street to recruit merchants. Instead, they seem to expect merchants to sign up in self-service mode. An investor in one of these PayTM competitors actually said this in a MEDIUM article:

Merchants should be able to go to an Amazon or Flipkart site or a Croma store and just buy a terminal at their own cost and link their bank account and start accepting payments.

Nice try. Even if they’re tech-savvy, crazy busy merchants simply don’t have the time to shop for terminals and learn how to make them work – especially when they’re getting pampered by the nation’s #1 mobile wallet company!

As a result, most micromerchants I’ve quizzed are not even aware of UPI, BHIM and other competing e-wallets.

#4. Frictionless Payments

By design or default, the Sign Out link in PayTM’s mobile app is buried deep inside the app. As a result, many users have never seen it and stay logged into their app all the time. This means they’re able to make a payment without a password or PIN.

Wish @Paytm replaces the 2-field logIn screen on its mobile app with @payzapp type of frictionless yet secure PIN pad. pic.twitter.com/8UHuOHQPCw

— GTM360 (@GTM360) January 11, 2017

This creates a significant security vulnerability in PayTM. But it also makes PayTM’s CX that much more frictionless, which makes a lot of difference when people use it many times a day.

Security is a hygiene factor. Convenience trumps security. Everytime. Even in India.

PayTM has understood and capitalized on this element of consumer behavior. Its competitors have totally missed it.

#5. Miscellaneous

PayTM is very well funded and is able to spend big bucks on advertising as also absorb losses on virtually every transaction.

PayTM makes every effort to enhance UX. For example, as I’d highlighted in Hiding Your Secret Sauce, PayTM preloads its wallet on the fly without user intervention. As a result, users wary of having to topup prepaid mobile wallets before initiating payments find the PayTM experience superior to that of other mobile wallets, which bump them off with a message asking them to load enough money into their wallets first and then reattempt the payment.

With the reasons for PayTM’s lead over other e-wallets out of the way, let me come to its detractors who’re predicting that PayTM and other prepaid mobile wallets will become extinct on the face of growing competition from BHIM, a government-sponsored m-wallet. While I agree that PayTM’s dominance is a thing of the present, I think stories of PayTM’s demise are grossly exaggerated.

No. Never underestimate inertia, resistance to change & incumbent advantage.

https://t.co/zbiXBBho0b— Ketharaman Swaminathan (@s_ketharaman) January 10, 2017

That said, PayTM does face a few headwinds:

- Sustaining relationships with merchants with daily sales of INR 50K+. This category of merchants includes vegetable vendors and fruit sellers among others who find its cap (INR 20K per month without KYC, INR 100K per month with KYC) too low. I know at least two merchants that have bailed out of PayTM for this reason. (Interestingly, they’ve gone back to cash, which suggests that PayTM’s competitors couldn’t recruit them either)

- Willingness of PayTM’s Chinese backer to fund the company’s cashbacks and mounting losses.

As they say, past performance is no indication of future success. This maxim is as true for PayTM as any other company. Only time will tell how long India’s #1 mobile wallet will hold on to the top spot.

—–Updates after the original post was published—–

UPDATE DATED 25 FEBRUARY 2017:

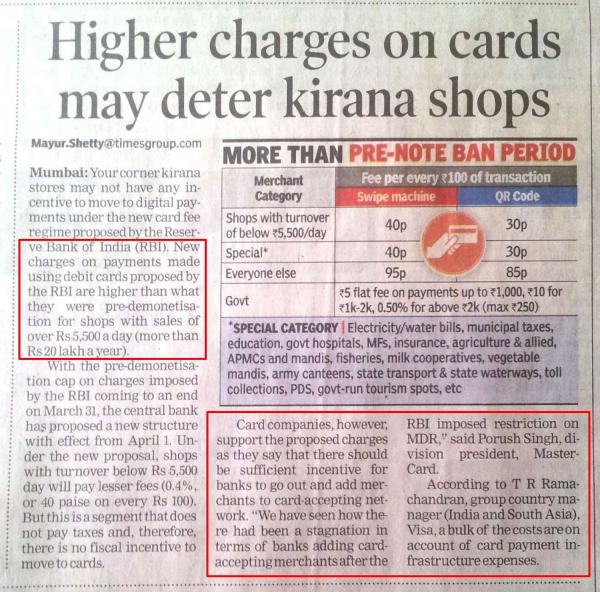

Contrary to popular expectation, banks did not go all out to sign up merchants for card acceptance in the months following #CurrencySwitch. The reason, while well known to industry insiders, has now come out in the public: Merchant acquiring – the business of issuing Merchant Accounts to merchants to let them accept card payments – has traditionally been a loss-leader for banks. It became even less attractive to them after the “RBI imposed restriction on MDR” during the last few months. Yet another reason why mobile wallets like PayTM, which are VC-funded and not under any immediate pressure to post profits, will continue to dominate instore digital payments for the forseeable future – notwithstanding BharatQR or superior CX from bank-owned digital payment products.

UPDATE DATED 27 MARCH 2018:

Paytm corners 3/4th of the (electronic / mobile wallet) market by value and volume, leaving other players – FreeCharge, PhonePe and MobiKwik – far behind. There is not much difference in usage or market share by metro, age or gender.

I know I said PayTM was miles ahead but even I didn’t know it was this far ahead of competition!

UPDATE DATED 17 JULY 2018:

* $50B GTV

* 5B Transactions

* 8M Merchants, 3X of card networks

* 50% user base in Tier-II & III cities (e.g. Durgapur, Madurai, Meerut, Imphal, Surat, Thrissur, Warangal)

* 75% English, 25% Regional Language

UPDATE DATED 19 JUNE 2018:

Money Quote: "Unlike banks, fintechs have access to risk capital and are not under continuous pressure to be profitable." – PayTM Founder @vijayshekharhttps://t.co/ipNPuuHijC

— Ketharaman Swaminathan (@s_ketharaman) June 19, 2018

UPDATE DATED 12 DECEMBER 2018:

“Fast Payments…: No OTP”.

Kudos to PayTM for openly acknowledging that OTP is a major PITA. #Frictionless #CX pic.twitter.com/QBcYkdoFP4

— Ketharaman Swaminathan (@s_ketharaman) December 12, 2018

UPDATE DATED 15 JULY 2019:

PayTM’s latest count of Merchants is 1.2 crores ~ 12 million. That’s up 50% from the 8 million figure reported in my update dated 17 July 2018. I called this in my update dated 25 February 2017 that PayTM will continue to dominate instore digital payments for the forseeable future – notwithstanding BharatQR or superior CX from bank-owned digital payment products.

My prediction has come even more true after the recent Union Budget in which the government outlawed MDR and ordered banks and RBI to absorb the cost of digital payments to merchants. Never a profitable business, the merchant acquiring business has just become even more of a loss-leader for banks. Many Banks and Payment Service Providers have said this diktat will kill incentives for them to propagate digital payments.

On the other hand, PayTM has responded saying it was always offering Zero MDR.

Assuming the company can continue to raise VC funds to fund its losses, PayTM should be able to expand its market share of digital payments even more rapidly than before.