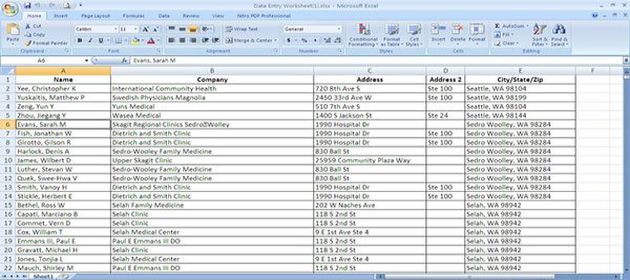

How To Replace Excel For Collecting Master Data For Your SAAS

In Why Overcoming The Tyranny Of Excel Is A Lousy Positioning Theme, we’d cautioned software companies from pitching their software as a replacement for Excel. Since then, we’re happy to…