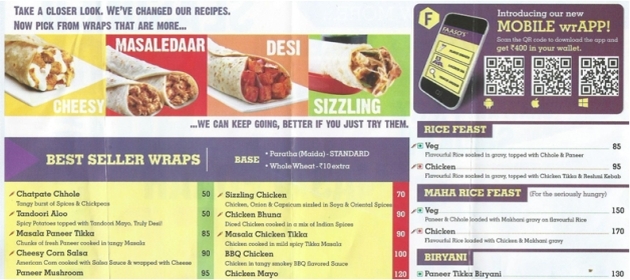

The quick service restaurant chain FAASO’s recently launched MOBILE wrAPP, an ordering, payment cum loyalty app. Available on Android, iOS and Windows, the app lets users locate stores, browse the menu, place delivery or takeaway orders, and make online or cash on delivery payments.

The quick service restaurant chain FAASO’s recently launched MOBILE wrAPP, an ordering, payment cum loyalty app. Available on Android, iOS and Windows, the app lets users locate stores, browse the menu, place delivery or takeaway orders, and make online or cash on delivery payments.

To incent repeat purchase, the company credits INR 400 (~US$ 6.67) to a mobile wallet inside wrAPP. Done as soon as the consumer places the first order via the app, this feature injects the loyalty angle to what’s primarily an ordering-cum-payment app.

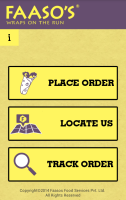

More on that in a bit but here are a few quick observations about the mobile app:

- By using omni QR code technology that automatically recognizes a smartphone’s operating system, the app could replace three different QR codes – one each for Android, iOS and Windows – by a single code. The space this would free up could be used to enlarge the QR code, which would increase its potential scan volume for reasons explained in Making QR Codes Work.

- Driving directions misses the chance to piggyback on turn-by-turn navigation supported by Google Maps for many cities in India, including the ones in which FAASO’s has a presence.

- Surprisingly, post-order transaction messages use off-app SMS messages and not PUSH notifications inside the app.

- The app seems to be well integrated with the billing system – my receipt was clearly marked with “APP ORDER”.

- The item quantity selection button is a bit too small for fat fingers; the INR 400 wallet credit is easy to miss. Apart from these blemishes, the app has a clean layout.

[slideshow_deploy id=’1587′]

Now, moving on to the loyalty part of wrAPP.

As mentioned earlier, the app credits INR 400 at start. In case diners think they can place an order worth INR 400 and get their food free by offsetting the cost against the wallet credit, FAASO’s reminds them that there are literally no free lunches.

The way the wallet works, the reward can be redeemed by way of discounts on orders at the rate of INR 50 discount per INR 250 order. Therefore, an order of INR 400 would be eligible for INR 50 discount (and the diner would still need to pay INR 350).

By requiring multiple orders for redeeming the entire credit of INR 400, the app drives repeat purchase, which is one of the basic goals of a loyalty program. Orders can be placed in any one of the following permutations and combinations:

- 8 orders of at least INR 250, with a discount of INR 50 per order, or

- 4 orders of at least INR 500, with a discount of INR 100 per order

- etc.

No matter which option is chosen by the customer, she’d need to spend a total of INR 2,000 (8 x 250 or 4 x 500 or …) to “burn” the total INR 400 reward. This translates to a Burn Ratio of 2000:400 or 5:1, which is not as attractive as the 4:1 figure that’s in vogue among credit card, PAYBACK and many other loyalty programs.

The app freezes if there’s a loss in Internet connectivity during card payment. Even returning to the applications screen and tapping the app’s icon brings back the same frozen screen. The only way I could get rid of it was to tap the Force Stop button on the Task Manager and fire up the app again. When I did this, my order was lost and I had to start all over again. This gives me – and many other customers, I’m sure – one more reason to opt for Cash on Delivery. Whether by design or default, FAASO’s has backstopped this problem by allowing the wallet credit to be applied to both card and COD orders – unlike many other online businesses that give discounts only for online payments.

The company’s flexibility about mode of payment doesn’t extend to the ordering channel, though. It’s very clear that the company wants to drive traffic to the mobile as against instore channel.

For one, the INR 50 discount is only applicable for orders placed through the mobile app.

For another, there’s no delivery charge for online orders. Therefore, an item listed at INR 250 on the menu would cost INR 200 for mobile orders and INR 250 for instore customers.

This is a rare example of a price discrimination strategy in India. Either it will help accomplish the company’s goal of driving mobile orders on priority or trigger complaints from walk in customers who find out that they’re not eligible for the INR 50 discount.

Only time will tell what happens.