In a world that’s awash with exuberant projections in 2022 for products that are not yet launched in 2013 – no, I’m not just looking at you, ISIS – GigaOm injected a touch of reality by providing some actual figures for mobile wallet payment volumes: US$ 500M in USA last year (Source: GigaOm / Berg Insight).

Most of these mobile payments happened at Starbucks.

It might be tempting to infer from this that mobile payment is the most popular method of payment at Starbucks.

But that’d be jumping to a wrong conclusion.

Just as it would be to start from the factual statement “The US dominates Indian IT services” and end with the erroneous conclusion, “India dominates US IT services”. (No, it does not. Out of the total IT outsourcing market of $3T in USA, India earns around $150B, which is a measly 5%.)

Before amplifying further, let me first list down the number of ways in which Starbucks accepts mobile payments:

Starbucks Card App

Digitized version of loyalty card to which consumers can upload $$. The money can be spent only at Starbucks. In other words, this is a “closed loop” method of payment (MOP).

Square Wallet

Consumers can pay with the digitized version of their regular network credit or debit card. This is an “open loop” MOP.

Apple Passbook, KeyRing, et al

Apple Passbook, KeyRing, et al

While Starbucks does not make an explicit mention that it supports Apple Passbook and KeyRing, many consumers report using these third-party mobile apps to scan in their Starbucks plastic loyalty cards and pay for their lattes via smartphones (see here and here). In fact, Apple uses Starbucks Card to illustrate the use of Passbook on its website (at least it used to do so until its website underwent a refresh subsequent to the recent iOS7 upgrade).

Starbucks generated a total spend of around US$ 500M from all these mobile payment methods put together.

Contrast this with the company’s revenues of US$ 13.3B in FYE 2012 (Source: Yahoo! Finance).

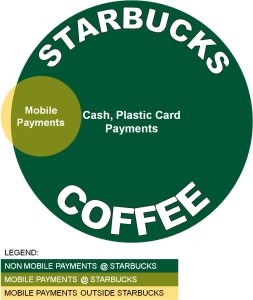

Ergo, mobile payments account for a measly 3.75% of Starbucks’ revenues.

This means the coffee retailer derived over 96% of its revenue from other instruments like cash and plastic cards.

Even going by transaction volume, Starbucks’ recent announcement that 10% of instore payment transactions happened by mobile means that 9 out 10 transactions at Starbucks took place with cash and plastic cards.

Therefore, whether reckoned by spend or volumes, mobile payments is absolutely not the dominant payment method at Starbucks.

It’s true that the company is equipping an increasing number of its stores to accept payments by scannning bar codes displayed on smartphone screens. It also invested US$ 25M for a 0.8% stake – see this Q&A on Quora – in the mobile payments startup Square last year. These initiatives signal the company’s confidence in the rising popularity of mobile payments in the years to come.

However, as of now, mobile payments is not the #1 or even #2 method of payment at Starbucks.

As an aside, the fact that its share by spend (3.75%) lags that by transactions (10%) might suggest that the average ticket size in dollar terms is lower for mobile transactions than cash or card payments. This doesn’t make much sense on first glance but it doesn’t change anything – even ascribing the higher 10% share to mobile payments, cash and plastic cards still reign supreme at Starbucks.

I never thought that mobile wallets had gone mainstream. But, until I did the above math, I never realized that they accounted for such a miniscule portion of the total payments market.

The marginal status of mobile wallets is further reinforced by this article in The Telegraph, which reports that only 1% of all retail payments happen via mobile phone even in Japan, a country that’s widely believed to have a 4-5 year lead on mobile technology over the rest of the world.