There has been a spate of ads and announcements over the last 3-4 weeks by banks in India about the introduction of the new Cheque Truncation System, CTS-2010, from the new year i.e. three weeks from now.

There has been a spate of ads and announcements over the last 3-4 weeks by banks in India about the introduction of the new Cheque Truncation System, CTS-2010, from the new year i.e. three weeks from now.

For the uninitiated, CTS transforms cheque clearing from a paper-intensive process to a digital journey whereby only images of cheques move between the payer bank, payee bank and the clearing house (which, in this case, is India’s central bank, Reserve Bank of India). Before CTS, paper cheques need to move physically between these parties.

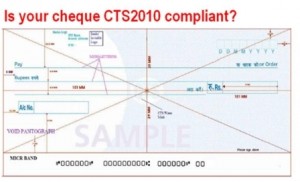

To ensure interoperability of the new system across all participating banks, the central bank has mandated the use of a uniform “CTS2010-compliant” cheque format. This differs from the diverse cheque formats in use at present. In line with this, banks have been asking their customers to contact their nearest branch to collect the new CTS2010-compliant cheque books ASAP since their existing cheques would become invalid after 31 December 2012.

While the need to visit the branch was a minor irritant, I took it as a small price to pay for the nation’s leap to the next generation of payments technology. Incidentally, I find cheques far more convenient than electronic payments and therefore don’t consider CTS to be anachronistic. So much so that I’ll take this opportunity to reiterate my long-held belief that Mobile RDC – the smartphone extension of the cheque truncation system implemented in the USA in 2004 – is the only mobile banking killer-app so far.

But, I digress.

Coming back to CTS-2010, I took the time off to get hold of the new cheque books from all my banks and thought that that was all there was to the imminent cutover to CTS-2010.

Alas, that was not to be.

When I read this news article yesterday, I realized the full import of CTS-2010 and began wondering if CTS would turn into Contract Termination System. Let me explain.

Banks making mortgages and auto loans to their retail customers collect repayments by way of Electronic Clearance Service (or ECS, as direct debit mandates are called in India) or post dated cheques (PDCs). Homeowners letting out their houses take PDCs from their tenants towards monthly rent. Manufacturers in certain industries (e.g. FMCG) ship goods to their stockists against pre-signed cheques held in their custody, with each cheque dated to match the respective date of shipment.

Banks making mortgages and auto loans to their retail customers collect repayments by way of Electronic Clearance Service (or ECS, as direct debit mandates are called in India) or post dated cheques (PDCs). Homeowners letting out their houses take PDCs from their tenants towards monthly rent. Manufacturers in certain industries (e.g. FMCG) ship goods to their stockists against pre-signed cheques held in their custody, with each cheque dated to match the respective date of shipment.

In all cases, the PDCs for the entire contract duration (e.g., 11 or 22 months in the case of a house lease agreement) are collected upfront at the time of entering into the contract. By following this practice, which is common in many countries apart from India, payees (recipients of the cheques) ensure that they’re saved the trouble of having to chase payers (issuers of the cheques) for payments every month.

While this might come as a surprise to readers in Europe and North America, collecting payments in many parts of the world, including India, is not as simple as submitting the invoice when the job is done. Besides, litigating a breach of contract can be extremely time-consuming. As a result, PDCs serve as an implicit promise that the buyer / payee will honor the payment because cheque bouncing is a criminal offence. Ergo, very few parties will go ahead with contracts of these type – however ironclad they are – unless they’re accompanied by PDCs.

Now, CTS will render existing PDCs invalid because they’re not CTS2010-compliant. In effect, the cutover to the new system effectively will annul all existing contracts.

The authorities are trying to suggest that it’s all a simple matter of the payee contacting the payer and exchanging CTS2010-compliant PDCs for the old ones. It’s not as simple as that:

- Payees are unable to follow up with payers to get new cheques before the deadline elapses.

- Payers are unable to collect their new cheque books from their banks because they’re traveling, have relocated or some other reason.

- Payers develop “buyer’s remorse” and procrastinate about issuing new cheques.

There are already talks about conducting a three month “parallel run” during which time the clearing house would accept both old and new cheques. This should provide some relief to payees facing the first two situations – they can simply keep depositing the old cheques during this period and follow up in parallel for the new cheques. Manufacturers facing the third situation can simply suspend supplies to procrastinating stockists. However, since borrowers have already taken possession of their homes or automobiles and tenants have already occupied the houses, banks and landlords don’t have an easy way out of Situation # 3.

With the launch date three weeks away, I don’t hear any alarm bells from banks or landlords about the ‘contract-termination’ ramification of CTS-2010. A few bankers have attempted to make light of the issue by saying that most of their loan repayments are covered by ECS mandates, which remain unaffected by CTS-2010. Even if “most” means 95%, the sheer volumes represented by the residual cases would still warrant massive efforts on the part of banks to contact borrowers and get the new CTS2010-compliant PDCs from them.

It’s going to be interesting to watch this space over the next few weeks.