Frequent users of credit cards recognize that there’s much more than annual fees and APRs to distinguish one card from another. From their years of usage, they might’ve realized that their overall satisfaction with a credit card – and how strongly they’d recommend it others – depends upon late fees, payment allocation sequence, fees for exceeding credit limits, billing cycle, rewards expiry, and many other clauses buried in the fine print of the cardholder agreements.

With so much riding on them, you’d imagine that cardholders and card shoppers would have ready access to these agreements so that they could consult them at any time.

Unfortunately, you’d be wrong. Cardholders receive these agreements years earlier along with the welcome pack of their cards. Banks keep making changes to the clauses all along. As a result, I doubt if anyone other than the most organized of cardholders has ready access to their cardholder contracts.

The recently launched Federal Reserve Board database now makes it easy to locate all cardholder agreements in one place. You no longer have to search your files going back years to retrieve them. All you’ve to do is enter your credit card issuer’s name and out comes the PDF and TEXT versions of the cardholder agreement.

The recently launched Federal Reserve Board database now makes it easy to locate all cardholder agreements in one place. You no longer have to search your files going back years to retrieve them. All you’ve to do is enter your credit card issuer’s name and out comes the PDF and TEXT versions of the cardholder agreement.

Now that all the information is available, can we expect cardholders to be able to quickly locate a specific clause in the agreement in order to validate a certain charge levied on their monthly statement? Will credit card shoppers be able to select the best card for their needs based not only on annual fees and APRs, but after a thorough evaluation of the fine print?

Unlikely – for two reasons.

For one, credit card agreements contain language that cannot be understood easily by an average credit card holder or shopper.

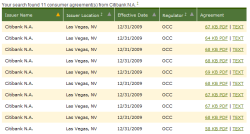

Two, when you search the FED database by credit card issuer, it outputs the agreements for all types of cards issued by that company. For large issuers, that exceeds a dozen agreements. So, the cardholder or shopper has no easy way to tell which one pertains to them. Worse still, an issuer may have more than one entry to search under. For example, Citibank is listed under both “Citibank N.A. Las Vegas NV” and “Citibank (South Dakota) N.A.” How many people know which one to select?

However, the FED database can be used as a good starting point by third-party https://sildenafilhealth.com service providers seeking to help cardholders and shoppers to locate the correct agreement and navigate the fine print before deciding on which credit card to apply for.

Credit card comparison websites like CreditCards.com, Bankrate.com and others could review all agreements in the FED database to arrive at a single, easy-to-understand rating of their user-friendliness. This will save the average shopper the trouble of going through all the legal mumbo-jumbo to figure out what’s best for their needs. Similar ratings are provided by a few comparison shopping websites that list the best consumer product deals not only on price but also on the basis of the online retailer’s reputation. For example, PriceFight has a feature called “People’s Choice” that incorporates non-price attributes valued by the shopping community, which include customer service, return policies, shipping, and security. Credit card comparison shopping services could attempt something similar by using the FED database.

Credit card comparison websites like CreditCards.com, Bankrate.com and others could review all agreements in the FED database to arrive at a single, easy-to-understand rating of their user-friendliness. This will save the average shopper the trouble of going through all the legal mumbo-jumbo to figure out what’s best for their needs. Similar ratings are provided by a few comparison shopping websites that list the best consumer product deals not only on price but also on the basis of the online retailer’s reputation. For example, PriceFight has a feature called “People’s Choice” that incorporates non-price attributes valued by the shopping community, which include customer service, return policies, shipping, and security. Credit card comparison shopping services could attempt something similar by using the FED database.

![]() As to difficulty of identifying the appropriate contract for a given card, third-party service providers could build an overlay on top of the FED database in such a way that the consumer / cardholder merely enters a few digits of their credit card and out comes the applicable agreement. As the website TRUE COST OF CREDIT shows, it is possible to uniquely identify a card issuer and the specific type of card – and hence retrieve the appropriate agreement for any given card – by using just the first six digits of the card number, which is called the Issuer Identification Number, or the “card bin”.

As to difficulty of identifying the appropriate contract for a given card, third-party service providers could build an overlay on top of the FED database in such a way that the consumer / cardholder merely enters a few digits of their credit card and out comes the applicable agreement. As the website TRUE COST OF CREDIT shows, it is possible to uniquely identify a card issuer and the specific type of card – and hence retrieve the appropriate agreement for any given card – by using just the first six digits of the card number, which is called the Issuer Identification Number, or the “card bin”.

Hope one or more of the plethora of credit card comparison shopping sites takes the lead and builds features on top of the FED database so that shoppers find it easy to decide which credit card is best for them. As a matter of fact, I recently came across a little known one called nerdwallet which claims in this press release that it “currently indexes more than 600 of the cards in the Fed’s database, and condenses the pertinent information into a dead-simple interface”. I think nerdwallet has gone a little ahead of itself in its enthusiasm to leverage the buzz around the FED database to differentiate itself from the bigger players – when I visited its website, I couldn’t find any mention of its using the FED database nor any comparison result as intuitive as PriceFight’s People’s Choice.

Google seems to have mined into the FED and other databases available in the public domain to create a comparison ad for US credit cards.

One of these days, I'll post a detailed report. But, for a quick glimpse, check out:

https://www.google.com/comparisonads/uscredit